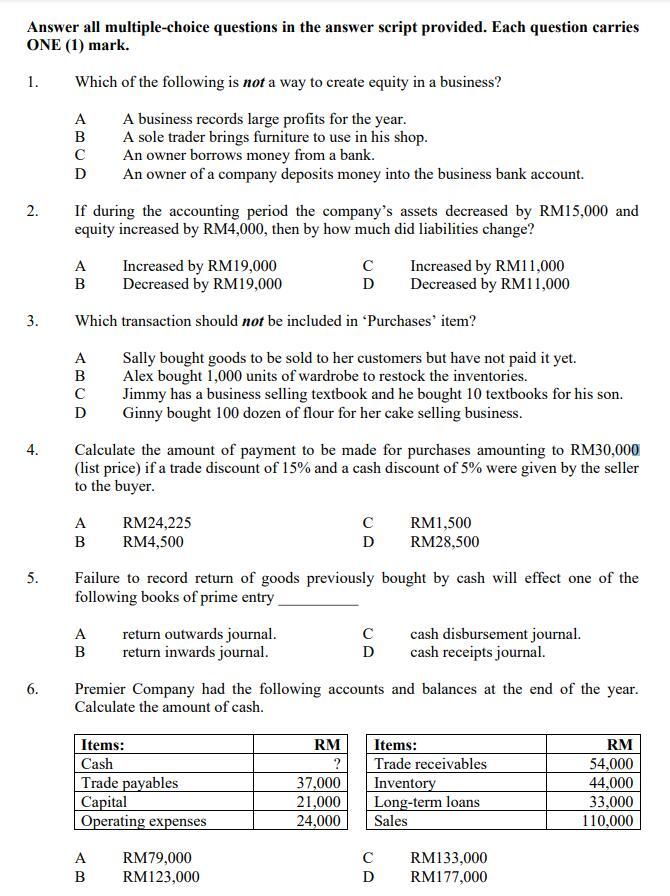

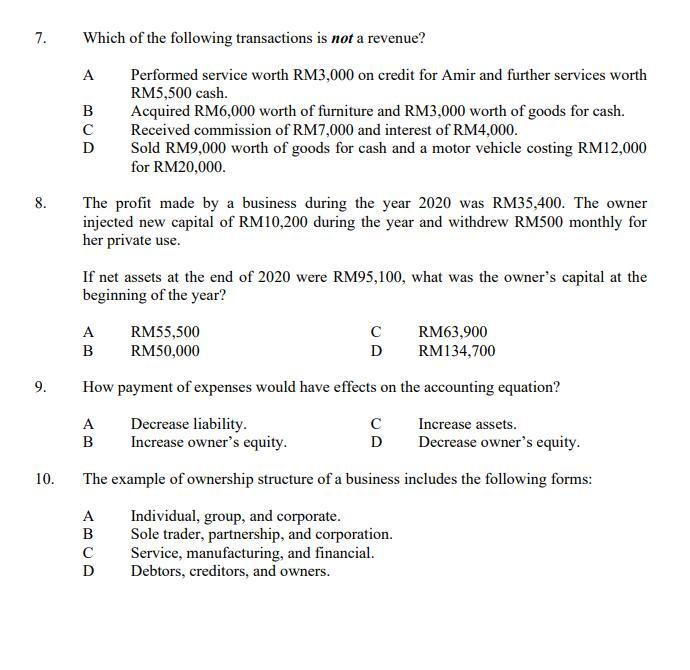

Answer all multiple-choice questions in the answer script provided. Each question carries ONE (1) mark. 1. 2. Which of the following is not a way to create equity in a business? A A business records large profits for the year. B A sole trader brings furniture to use in his shop. An owner borrows money from a bank. D An owner of a company deposits money into the business bank account. If during the accounting period the company's assets decreased by RM15,000 and equity increased by RM4,000, then by how much did liabilities change? Increased by RM19,000 Increased by RM11,000 B Decreased by RM19,000 D Decreased by RM11,000 Which transaction should not be included in Purchases' item? A Sally bought goods to be sold to her customers but have not paid it yet. B Alex bought 1,000 units of wardrobe to restock the inventories. Jimmy has a business selling textbook and he bought 10 textbooks for his son. D Ginny bought 100 dozen of flour for her cake selling business. Calculate the amount of payment to be made for purchases amounting to RM30,000 (list price) if a trade discount of 15% and a cash discount of 5% were given by the seller to the buyer. A RM24,225 RM1,500 B RM4,500 D RM28,500 3. 4. 5. Failure to record return of goods previously bought by cash will effect one of the following books of prime entry A B return outwards journal. return inwards journal. D cash disbursement journal. cash receipts journal. 6. Premier Company had the following accounts and balances at the end of the year. Calculate the amount of cash. Items: Cash Trade payables Capital Operating expenses RM ? 37,000 21,000 24,000 Items: Trade receivables Inventory Long-term loans Sales RM 54,000 44,000 33,000 110,000 A B RM79,000 RM123,000 D RM133,000 RM177,000 7. 8. Which of the following transactions is not a revenue? A Performed service worth RM3,000 on credit for Amir and further services worth RM5,500 cash. B Acquired RM6,000 worth of furniture and RM3,000 worth of goods for cash. Received commission of RM7,000 and interest of RM4,000. D Sold RM9,000 worth of goods for cash and a motor vehicle costing RM12,000 for RM20,000. The profit made by a business during the year 2020 was RM35,400. The owner injected new capital of RM10,200 during the year and withdrew RM500 monthly for her private use. If net assets at the end of 2020 were RM95,100, what was the owner's capital at the beginning of the year? A RM55,500 RM63,900 B RM50,000 D RM134,700 9. How payment of expenses would have effects on the accounting equation? A B Decrease liability. Increase owner's equity. D Increase assets. Decrease owner's equity. 10. The example of ownership structure of a business includes the following forms: A B D Individual, group, and corporate. Sole trader, partnership, and corporation. Service, manufacturing, and financial. Debtors, creditors, and owners