Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all of the questions Question 8 Answer saved Marked out of 20.00 Flag question Preparing Accounting Adjustments Pownall Photomake Company, a commercial photography studio,

Answer all of the questions

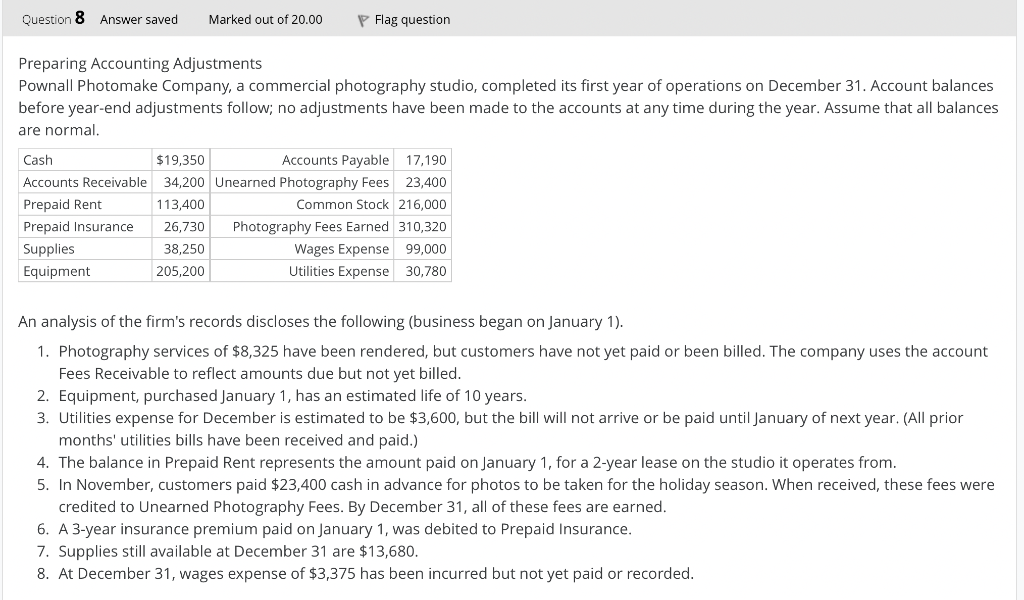

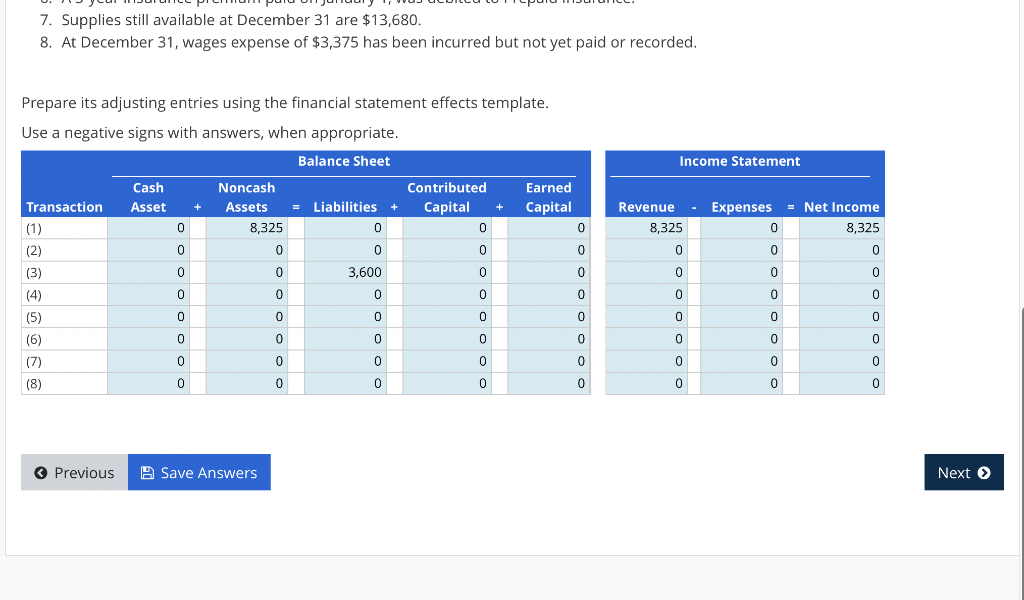

Question 8 Answer saved Marked out of 20.00 Flag question Preparing Accounting Adjustments Pownall Photomake Company, a commercial photography studio, completed its first year of operations on December 31. Account balances before year-end adjustments follow; no adjustments have been made to the accounts at any time during the year. Assume that all balances are normal. Cash $19,350 Accounts Payable 17,190 34,200 Unearned Photography Fees 23,400 Accounts Receivable Prepaid Rent 113,400 Common Stock 216,000 Prepaid Insurance 26,730 Photography Fees Earned 310,320 Supplies 38,250 Wages Expense 99,000 Equipment 205,200 Utilities Expense 30,780 An analysis of the firm's records discloses the following (business began on January 1). 1. Photography services of $8,325 have been rendered, but customers have not yet paid or been billed. The company uses the account Fees Receivable to reflect amounts due but not yet billed. 2. Equipment, purchased January 1, has an estimated life of 10 years. 3. Utilities expense for December is estimated to be $3,600, but the bill will not arrive or be paid until January of next year. (All prior months' utilities bills have been received and paid.) 4. The in Prepaid Rent represents the amount paid on January 1, for a 2-year lease on the stu it operates from. 5. In November, customers paid $23,400 cash in advance for photos to be taken for the holiday season. When received, these fees were credited to Unearned Photography Fees. By December 31, all of these fees are earned. 6. A 3-year insurance premium paid on January 1, was debited to Prepaid Insurance. 7. Supplies still available at December 31 are $13,680. 8. At December 31, wages expense of $3,375 has been incurred but not yet paid or recorded. 7. Supplies still available at December 31 are $13,680. 8. At December 31, wages expense of $3,375 has been incurred but not yet paid or recorded. Prepare its adjusting entries using the financial statement effects template. Use a negative signs with answers, when appropriate. Balance Sheet Cash Noncash Contributed Capital Earned Capital Transaction Asset + Assets Liabilities + 0 0 0 0 0 0 0 3,600 0 0 0 0 0 0 0 0 eaminok (1) (2) (3) (4) (5) (6) (7) (8) Previous 0 8,325 0 0 0 0 0 0 0 0 0 0 Save Answers 0 0 0 0 0 0 0 0 0 0 0 0 Revenue Income Statement 8,325 0 0 0 0 0 0 0 Expenses = Net Income 0 8,325 0 0 0 0 0 0 0 0 0 0 0 0 0 Next >Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started