Answer all of these, please

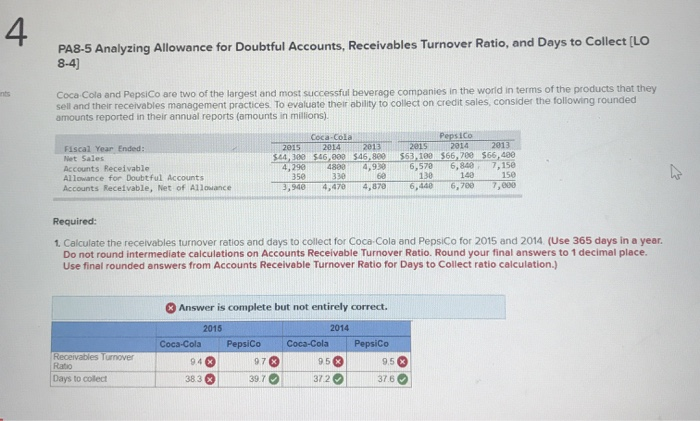

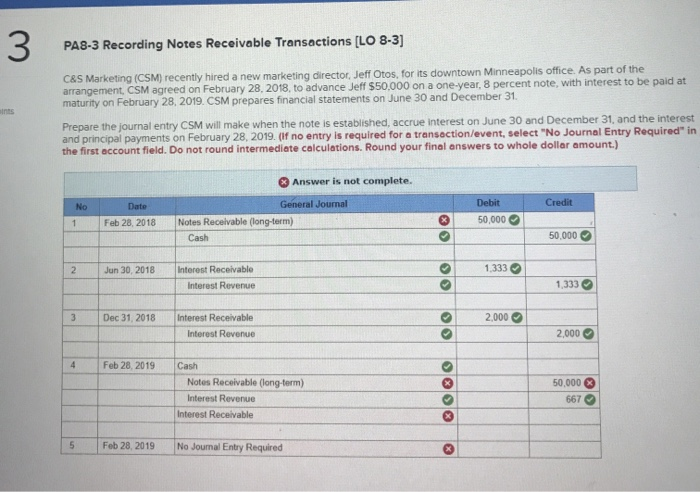

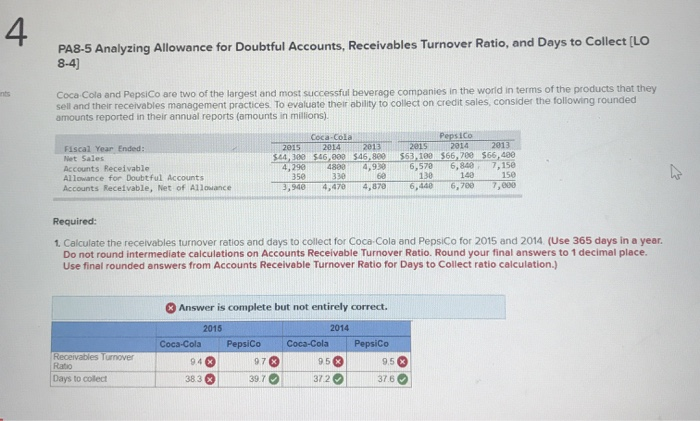

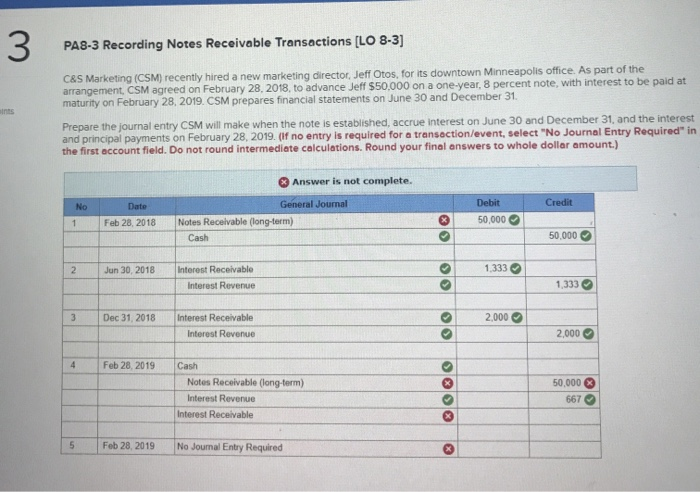

4 PA8-5 Analyzing Allowance for Doubtful Accounts, Receivables Turnover Ratio, and Days 8-4) to Collect [LO Coca Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). nts PepsiCo 2014 Coca-Cola 2014 $44, 300 $46,000 $46,800 4808 330 4,478 2013 2015 2013 Fiscal Year Ended: Net Sales 2015 $63,100 $66, 700 $66,480 6,840 140 4,290 350 3,940 4,930 7,158 150 6,578 130 6,440 Accounts Receivable Allowance for Doubtful Accounts 60 6,700 7,000 4,870 Accounts Receivable, Net of Allouance Required: 1, Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2015 and 2014 (Use 365 days in a year Do not round intermediate calculetions on Accounts Receivable Turnover Ratio. Round your final answers to 1 decimal place. Use final rounded answers from Accounts Receivable Turnover Ratio for Days to Collect ratio calculation.) Answer is complete but not entirely correct. 2014 2015 PepsiCo Coca-Cola Coca-Cola PepsiCo Receivables Turnover Ratio 95x 9.5x 94 97 Days to collect 39.7 37 2 37.6 38 3 3 PA8-3 Recording Notes Receivable Transactions [LO 8-3] C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28, 2018, to advance Jeff $50,000 on a one-year, 8 percent note, with interest to be paid at maturity on February 28, 2019. CSM prepares financial statements on June 30 and December 31 tnts Prepare the journal entry CSM will make when the note is established, accrue interest on June 30 and December 31, and the interest and principal payments on February 28, 2019. (If no entry is required for a transoction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to whole dollar amount.) Answer is not complete. General Journal Credit Debit No Date Notes Receivable (long-term) 50,000 Feb 28, 2018 50,000 Cash 1,333 Jun 30, 2018 Interest Receivable 2 1,333 Interest Revenue 2.000 Interest Receivable 3 Dec 31, 2018 2,000 Interest Revenue 4 Feb 28, 2019 Cash 50,000 Notes Receivable (long-term) Interest Revenue 667 Interest Receivable No Jounal Entry Required 5 Feb 28, 2019