Answered step by step

Verified Expert Solution

Question

1 Approved Answer

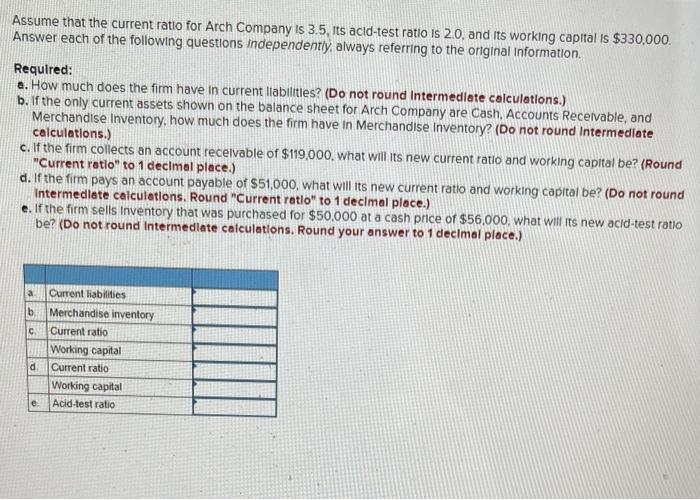

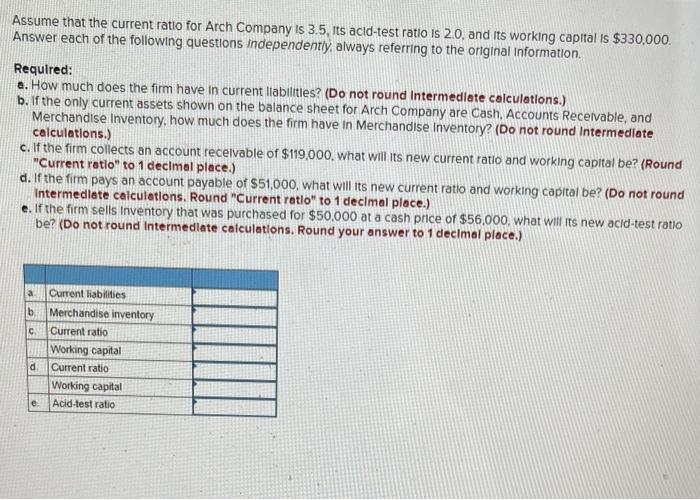

answer all parts of the question. i am requesting all parts to be answered. Assume that the current ratio for Arch Company is 3.5, its

answer all parts of the question. i am requesting all parts to be answered.

Assume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and its working capital is $330.000. Answer each of the following questions independentiy, always referring to the original information. Requlred: a. How much does the firm have in current llabilities? (Do not round Intermedlate calculotions.) b. If the only current assets shown on the balance sheet for Arch Company are Cash. Accounts Recervable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round Intermedlate celculations.) c. If the fitm collects an account recelvable of $119,000, what will its new current ratio and working capital be? (Round "Current ratlo" to 1 decimal place.) d. If the firm pays an account payable of $51,000, what will its new current ratio and working capital be? (Do not round Intermedlate calculations. Round "Current ratio" to 1 decimal place.) e. If the firm sells inventory that was purchased for $50.000 at a cash price of $56.000, what will its new acid-test ratio be? (Do notround Intermedlate calculations. Round your answer to 1 declmal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started