Answer all please will rate quick

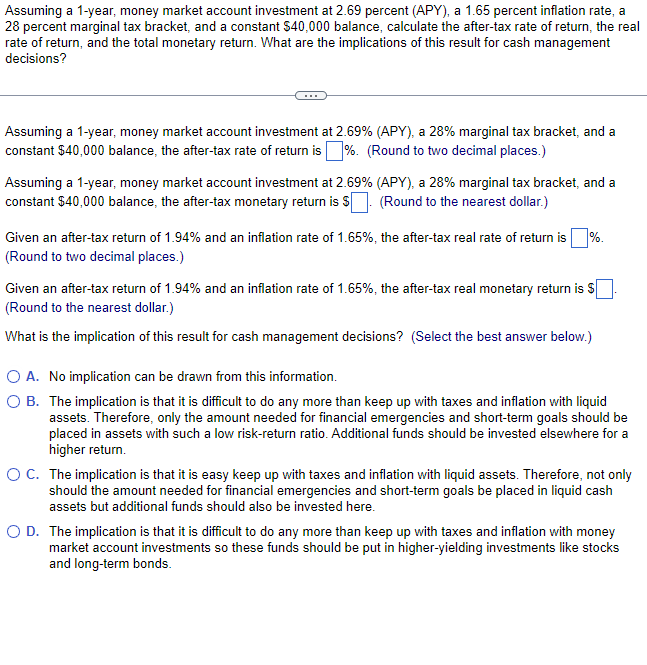

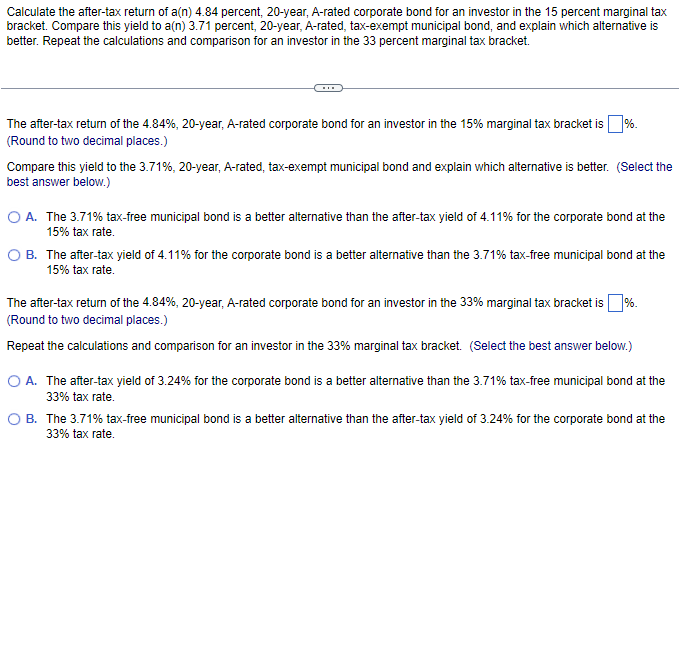

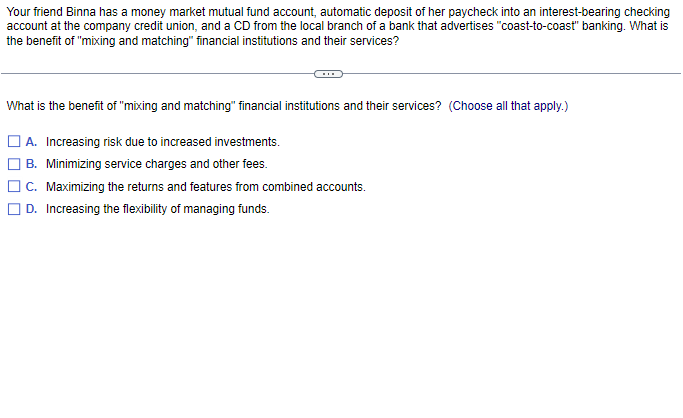

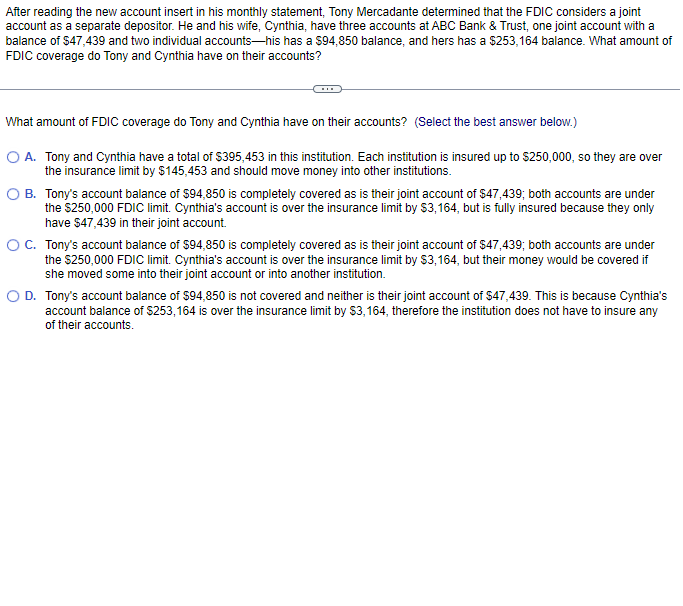

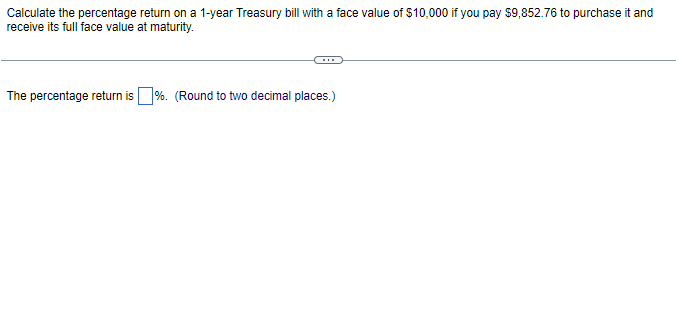

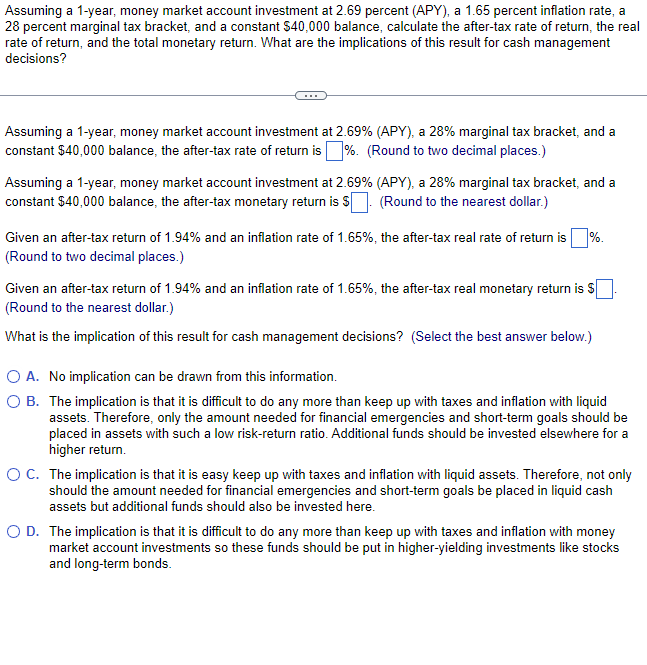

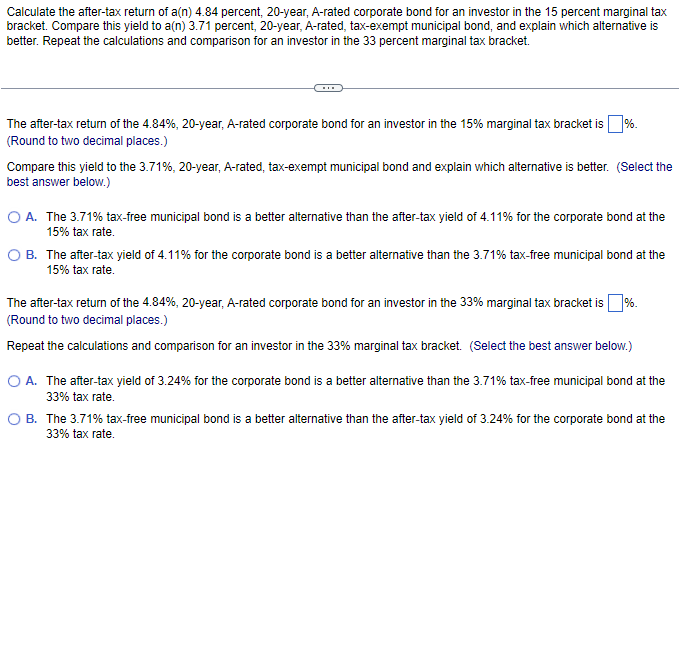

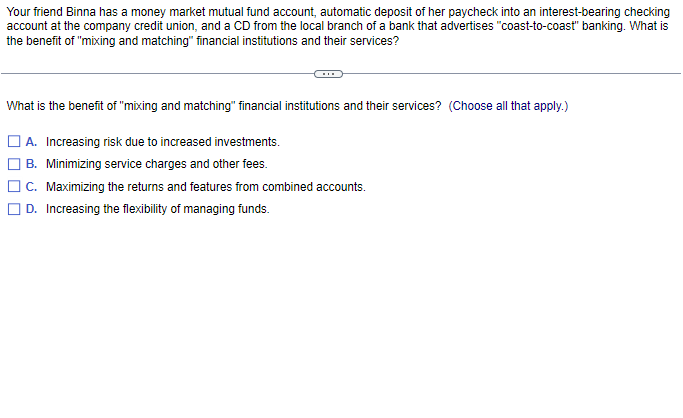

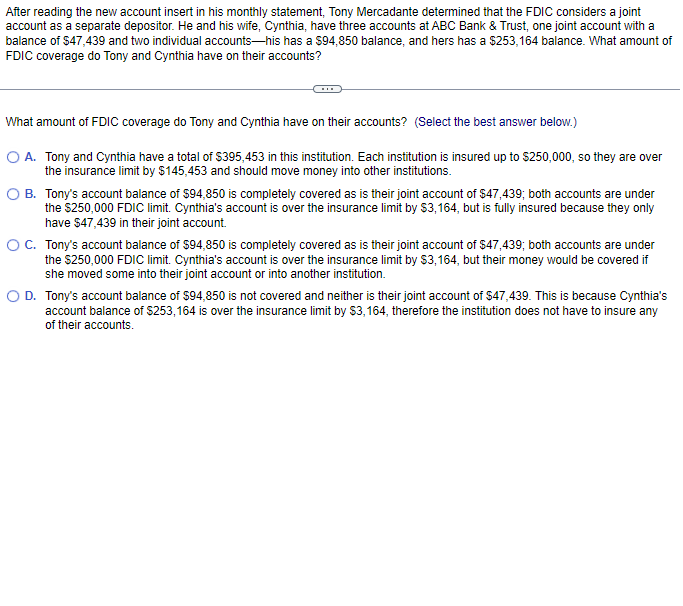

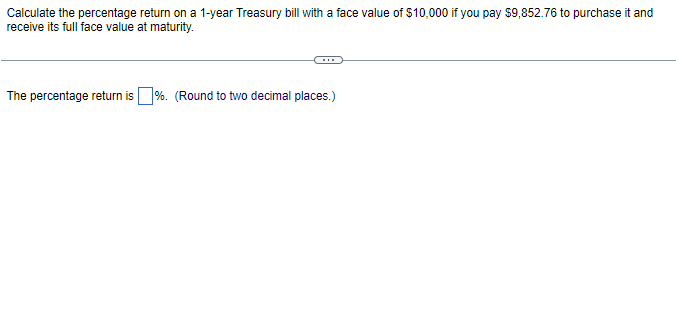

Assuming a 1-year, money market account investment at 2.69 percent (APY), a 1.65 percent inflation rate, a 28 percent marginal tax bracket, and a constant $40,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Assuming a 1-year, money market account investment at 2.69\% (APY), a 28\% marginal tax bracket, and a constant $40,000 balance, the after-tax rate of return is %. (Round to two decimal places.) Assuming a 1-year, money market account investment at 2.69% (APY), a 28% marginal tax bracket, and a constant $40,000 balance, the after-tax monetary return is $. (Round to the nearest dollar.) Given an after-tax return of 1.94% and an inflation rate of 1.65%, the after-tax real rate of return is %. (Round to two decimal places.) Given an after-tax return of 1.94% and an inflation rate of 1.65%, the after-tax real monetary return is $ (Round to the nearest dollar.) What is the implication of this result for cash management decisions? (Select the best answer below.) A. No implication can be drawn from this information. B. The implication is that it is difficult to do any more than keep up with taxes and inflation with liquid assets. Therefore, only the amount needed for financial emergencies and short-term goals should be placed in assets with such a low risk-return ratio. Additional funds should be invested elsewhere for a higher return. C. The implication is that it is easy keep up with taxes and inflation with liquid assets. Therefore, not only should the amount needed for financial emergencies and short-term goals be placed in liquid cash assets but additional funds should also be invested here. D. The implication is that it is difficult to do any more than keep up with taxes and inflation with money market account investments so these funds should be put in higher-yielding investments like stocks and long-term bonds. Calculate the after-tax return of a(n)4.84 percent, 20 -year, A-rated corporate bond for an investor in the 15 percent marginal tax bracket. Compare this yield to a(n) 3.71 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 33 percent marginal tax bracket. The after-tax return of the 4.84%,20-year, A-rated corporate bond for an investor in the 15% marginal tax bracket is %. (Round to two decimal places.) Compare this yield to the 3.71%,20-year, A-rated, tax-exempt municipal bond and explain which alternative is better. (Select the best answer below.) A. The 3.71% tax-free municipal bond is a better alternative than the after-tax yield of 4.11% for the corporate bond at the 15% tax rate. B. The after-tax yield of 4.11% for the corporate bond is a better alternative than the 3.71% tax-free municipal bond at the 15% tax rate. The after-tax return of the 4.84%,20-year, A-rated corporate bond for an investor in the 33% marginal tax bracket is %. (Round to two decimal places.) Repeat the calculations and comparison for an investor in the 33% marginal tax bracket. (Select the best answer below.) A. The after-tax yield of 3.24% for the corporate bond is a better alternative than the 3.71% tax-free municipal bond at the 33% tax rate. B. The 3.71% tax-free municipal bond is a better alternative than the after-tax yield of 3.24% for the corporate bond at the 33% tax rate. Your friend Binna has a money market mutual fund account, automatic deposit of her paycheck into an interest-bearing checking account at the company credit union, and a CD from the local branch of a bank that advertises "coast-to-coast" banking. What is the benefit of "mixing and matching" financial institutions and their services? What is the benefit of "mixing and matching" financial institutions and their services? (Choose all that apply.) A. Increasing risk due to increased investments. B. Minimizing service charges and other fees. C. Maximizing the returns and features from combined accounts. D. Increasing the flexibility of managing funds. After reading the new account insert in his monthly statement, Tony Mercadante determined that the FDIC considers a joint account as a separate depositor. He and his wife, Cynthia, have three accounts at ABC Bank \& Trust, one joint account with a balance of $47,439 and two individual accounts-his has a $94,850 balance, and hers has a $253,164 balance. What amount of FDIC coverage do Tony and Cynthia have on their accounts? What amount of FDIC coverage do Tony and Cynthia have on their accounts? (Select the best answer below.) A. Tony and Cynthia have a total of $395,453 in this institution. Each institution is insured up to $250,000, so they are over the insurance limit by $145,453 and should move money into other institutions. B. Tony's account balance of $94,850 is completely covered as is their joint account of $47,439; both accounts are under the $250,000FDIC limit. Cynthia's account is over the insurance limit by $3,164, but is fully insured because they only have $47,439 in their joint account. C. Tony's account balance of $94,850 is completely covered as is their joint account of $47,439; both accounts are under the $250,000 FDIC limit. Cynthia's account is over the insurance limit by $3,164, but their money would be covered if she moved some into their joint account or into another institution. D. Tony's account balance of $94,850 is not covered and neither is their joint account of $47,439. This is because Cynthia's account balance of $253,164 is over the insurance limit by $3,164, therefore the institution does not have to insure any of their accounts. Calculate the percentage return on a 1-year Treasury bill with a face value of $10,000 if you pay $9,852.76 to purchase it and receive its full face value at maturity. The percentage return is %. (Round to two decimal places.) Assuming a 1-year, money market account investment at 2.69 percent (APY), a 1.65 percent inflation rate, a 28 percent marginal tax bracket, and a constant $40,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Assuming a 1-year, money market account investment at 2.69\% (APY), a 28\% marginal tax bracket, and a constant $40,000 balance, the after-tax rate of return is %. (Round to two decimal places.) Assuming a 1-year, money market account investment at 2.69% (APY), a 28% marginal tax bracket, and a constant $40,000 balance, the after-tax monetary return is $. (Round to the nearest dollar.) Given an after-tax return of 1.94% and an inflation rate of 1.65%, the after-tax real rate of return is %. (Round to two decimal places.) Given an after-tax return of 1.94% and an inflation rate of 1.65%, the after-tax real monetary return is $ (Round to the nearest dollar.) What is the implication of this result for cash management decisions? (Select the best answer below.) A. No implication can be drawn from this information. B. The implication is that it is difficult to do any more than keep up with taxes and inflation with liquid assets. Therefore, only the amount needed for financial emergencies and short-term goals should be placed in assets with such a low risk-return ratio. Additional funds should be invested elsewhere for a higher return. C. The implication is that it is easy keep up with taxes and inflation with liquid assets. Therefore, not only should the amount needed for financial emergencies and short-term goals be placed in liquid cash assets but additional funds should also be invested here. D. The implication is that it is difficult to do any more than keep up with taxes and inflation with money market account investments so these funds should be put in higher-yielding investments like stocks and long-term bonds. Calculate the after-tax return of a(n)4.84 percent, 20 -year, A-rated corporate bond for an investor in the 15 percent marginal tax bracket. Compare this yield to a(n) 3.71 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 33 percent marginal tax bracket. The after-tax return of the 4.84%,20-year, A-rated corporate bond for an investor in the 15% marginal tax bracket is %. (Round to two decimal places.) Compare this yield to the 3.71%,20-year, A-rated, tax-exempt municipal bond and explain which alternative is better. (Select the best answer below.) A. The 3.71% tax-free municipal bond is a better alternative than the after-tax yield of 4.11% for the corporate bond at the 15% tax rate. B. The after-tax yield of 4.11% for the corporate bond is a better alternative than the 3.71% tax-free municipal bond at the 15% tax rate. The after-tax return of the 4.84%,20-year, A-rated corporate bond for an investor in the 33% marginal tax bracket is %. (Round to two decimal places.) Repeat the calculations and comparison for an investor in the 33% marginal tax bracket. (Select the best answer below.) A. The after-tax yield of 3.24% for the corporate bond is a better alternative than the 3.71% tax-free municipal bond at the 33% tax rate. B. The 3.71% tax-free municipal bond is a better alternative than the after-tax yield of 3.24% for the corporate bond at the 33% tax rate. Your friend Binna has a money market mutual fund account, automatic deposit of her paycheck into an interest-bearing checking account at the company credit union, and a CD from the local branch of a bank that advertises "coast-to-coast" banking. What is the benefit of "mixing and matching" financial institutions and their services? What is the benefit of "mixing and matching" financial institutions and their services? (Choose all that apply.) A. Increasing risk due to increased investments. B. Minimizing service charges and other fees. C. Maximizing the returns and features from combined accounts. D. Increasing the flexibility of managing funds. After reading the new account insert in his monthly statement, Tony Mercadante determined that the FDIC considers a joint account as a separate depositor. He and his wife, Cynthia, have three accounts at ABC Bank \& Trust, one joint account with a balance of $47,439 and two individual accounts-his has a $94,850 balance, and hers has a $253,164 balance. What amount of FDIC coverage do Tony and Cynthia have on their accounts? What amount of FDIC coverage do Tony and Cynthia have on their accounts? (Select the best answer below.) A. Tony and Cynthia have a total of $395,453 in this institution. Each institution is insured up to $250,000, so they are over the insurance limit by $145,453 and should move money into other institutions. B. Tony's account balance of $94,850 is completely covered as is their joint account of $47,439; both accounts are under the $250,000FDIC limit. Cynthia's account is over the insurance limit by $3,164, but is fully insured because they only have $47,439 in their joint account. C. Tony's account balance of $94,850 is completely covered as is their joint account of $47,439; both accounts are under the $250,000 FDIC limit. Cynthia's account is over the insurance limit by $3,164, but their money would be covered if she moved some into their joint account or into another institution. D. Tony's account balance of $94,850 is not covered and neither is their joint account of $47,439. This is because Cynthia's account balance of $253,164 is over the insurance limit by $3,164, therefore the institution does not have to insure any of their accounts. Calculate the percentage return on a 1-year Treasury bill with a face value of $10,000 if you pay $9,852.76 to purchase it and receive its full face value at maturity. The percentage return is %. (Round to two decimal places.)