Question: answer all pls! Question 31 What are the dividend yield, capital gains yield, and total required rate of return based on the following. PO =

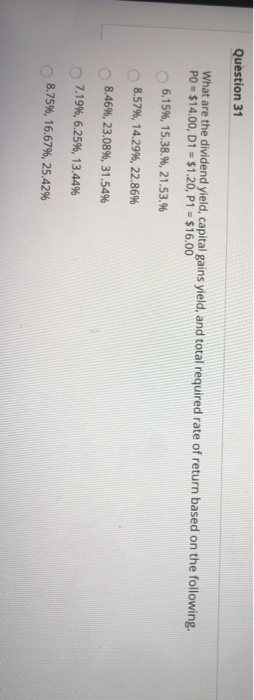

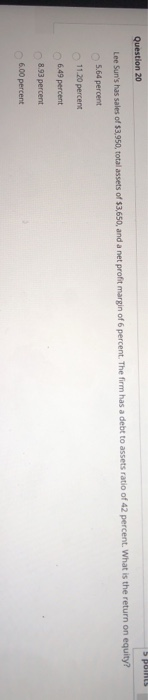

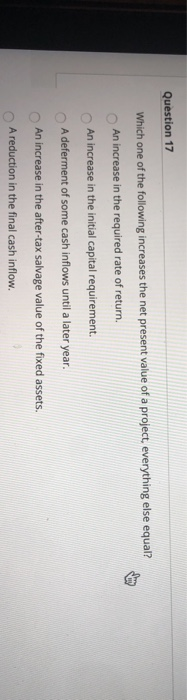

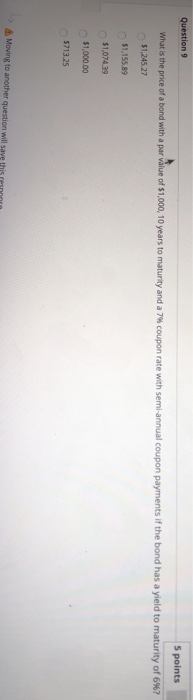

Question 31 What are the dividend yield, capital gains yield, and total required rate of return based on the following. PO = $14.00, D1 = $1.20, P1 = $16.00 6.15%, 15.38.%, 21.53.% 8.57%, 14.29%, 22.86% 8.46%, 23.08%, 31,54% 7.19%, 6.25%, 13.44% 8.75%, 16.67%, 25.42% 5 points Question 20 Lee Sun's has sales of $3.950, total assets of $3,650, and a net profit margin of 6 percent. The firm has a debt to assets ratio of 42 percent. What is the return on equity? 5.64 percent 11.20 percent 6.49 percent 8.93 percent 6.00 percent Question 17 Which one of the following increases the net present value of a project, everything else equal? An increase in the required rate of return. An increase in the initial capital requirement. A deferment of some cash inflows until a later year. An increase in the after-tax salvage value of the fixed assets. A reduction in the final cash inflow. Question 9 5 points What is the price of a bond with a par value of $1,000, 10 years to maturity and a 7% coupon rate with semi-annual coupon payments if the bond has a yield to maturity of 6%? $1,245.27 $1,155.89 $1.07439 $1,000.00 5713.25 Moving to another question will save this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts