Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all q4 Answer all questions in Q4 that the taste is what is the rate of Relum towym Latest Tweets why capture the compare

Answer all q4

Answer all questions in Q4

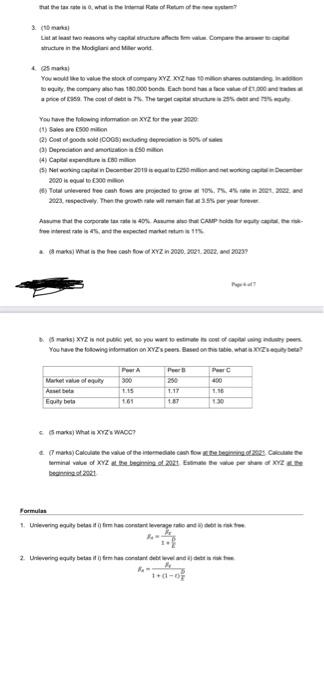

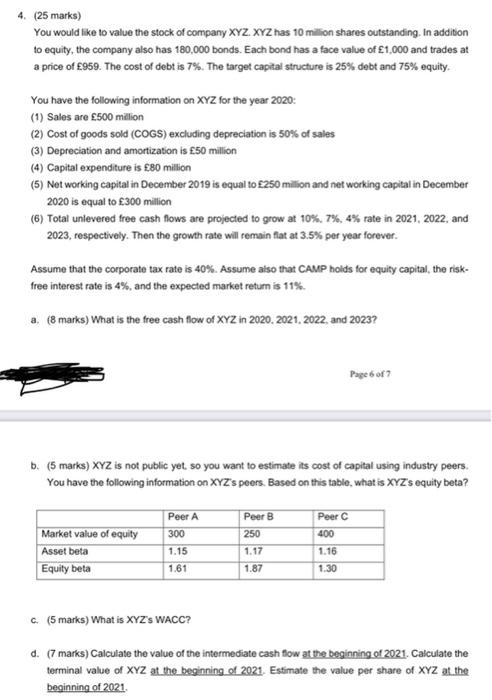

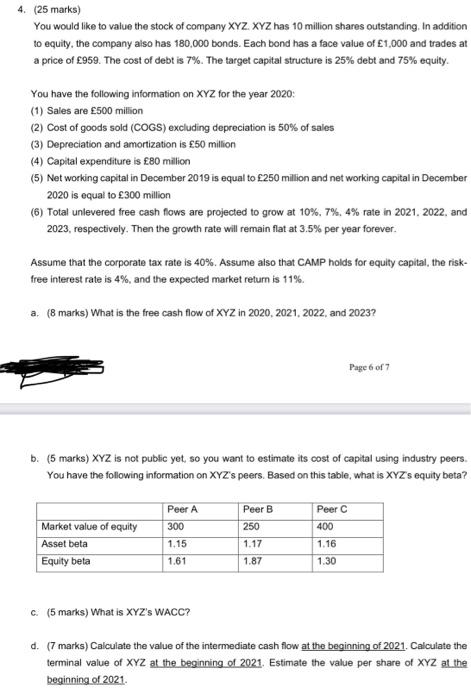

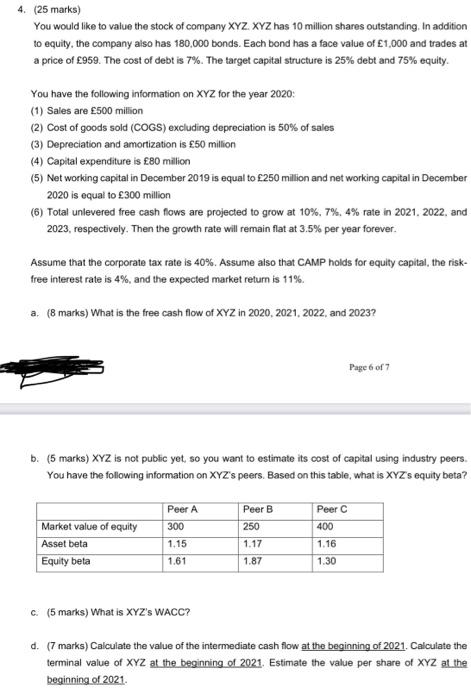

that the taste is what is the rate of Relum towym Latest Tweets why capture the compare structure in the Modern and her word You would like to valore the stock of company XYZ XYZ to shares standing on togally, the company 180.000 Son Each bond to face aprice of the cost of There You have the following omtion XYZ for the year 2010 (1) Sales are 600 min (2) Cost of goods 005) depreciation of Depreciation and anotion 5 million 14) Capitalenditures million Nel woning aan December 2018 is milion de woning 2000 is equal to 300 min Total univered the cash for projected to grow at 10, S. 452222 respectively. Then the growth rate will remain 35 per you Assume that the corporate as tempore fronterest rates, and the expected tu 11 What is the the cash flow of XYZn 2020 2021 2022 2023 mars XYZ is not yet so you warto sitost of capitalnings You have the following information on XYZprostate what? Market value ofely 500 Egutyberte 161 130 mark) What is XY WACC? terminal value of XYZ Lingat2021 Estimate the per she XYZ Formulas 1. Urievening guity betalt form has content leverage ratio anterior 10-08 4. (25 marks) You would like to value the stock of company XYZ XYZ has 10 milion shares outstanding. In addition to equity, the company also has 180,000 bonds. Each bond has a face value of 1,000 and trades at a price of 959. The cost of debt is 7%. The target capital structure is 25% debt and 75% equity. You have the following information on XYZ for the year 2020: (1) Sales are 500 million (2) Cost of goods sold (COGS) excluding depreciation is 50% of sales (3) Depreciation and amortization is 50 million (4) Capital expenditure is 80 million (5) Net working capital in December 2019 is equal to 250 million and networking capital in December 2020 is equal to 300 million (6) Total untevered free cash flows are projected to grow at 10%. 7%, 4% rate in 2021 2022, and 2023, respectively. Then the growth rate will remain flat at 3.5% per year forever. Assume that the corporate tax rate is 40%. Assume also that CAMP holds for equity capital, the risk- free interest rate is 4%, and the expected market return is 11% a. (8 marks) What is the free cash flow of XYZ in 2020. 2021 2022 and 2023? Page 6 of 9 b. (5 marks) XYZ is not public yet so you want to estimate its cost of capital using industry peers. You have the following information on XYZ's peers. Based on this table, what is XYZ's equity beta? Peer A 300 Market value of equity Asset beta Equity beta Peer B 250 1.17 Peer C 400 1.16 1.15 1.61 1.87 1.30 C. (5 marks) What is XYZ WACC? d. (7 marks) Calculate the value of the intermediate cash flow at the beginning of 2021. Calculate the terminal value of XYZ at the beginning of 2021. Estimate the value per share of XYZ at the beginning of 2021 4. (25 marks) You would like to value the stock of company XYZ. XYZ has 10 million shares outstanding. In addition to equity, the company also has 180,000 bonds. Each bond has a face value of 1,000 and trades at a price of 959. The cost of debt is 7%. The target capital structure is 25% debt and 75% equity. You have the following information on XYZ for the year 2020: (1) Sales are 500 million (2) Cost of goods sold (COGS) excluding depreciation is 50% of sales (3) Depreciation and amortization is 50 million (4) Capital expenditure is 80 million (5) Net working capital in December 2019 is equal to 250 million and net working capital in December 2020 is equal to 300 million (6) Total unlevered free cash flows are projected to grow at 10%. 7%, 4% rate in 2021 2022. and 2023, respectively. Then the growth rate will remain flat at 3.5% per year forever. Assume that the corporate tax rate is 40%. Assume also that CAMP holds for equity capital, the risk- free interest rate is 4%, and the expected market return is 11% a. (8 marks) What is the free cash flow of XYZ in 2020, 2021 2022 and 2023? Page 6 of 7 b. (5 marks) XYZ is not public yet, so you want to estimate its cost of capital using industry peers. You have the following information on XYZ's peers. Based on this table, what is XYZ s equity beta? Market value of equity Asset beta Equity beta Peer A 300 1.15 Peer B 250 1.17 Peer C 400 1.16 1.61 1.87 1.30 C. (5 marks) What is XYZ'S WACC? d. (7 marks) Calculate the value of the intermediate cash flow at the beginning of 2021. Calculate the terminal value of XYZ at the beginning of 2021. Estimate the value per share of XYZ at the beginning of 2021 that the taste is what is the rate of Relum towym Latest Tweets why capture the compare structure in the Modern and her word You would like to valore the stock of company XYZ XYZ to shares standing on togally, the company 180.000 Son Each bond to face aprice of the cost of There You have the following omtion XYZ for the year 2010 (1) Sales are 600 min (2) Cost of goods 005) depreciation of Depreciation and anotion 5 million 14) Capitalenditures million Nel woning aan December 2018 is milion de woning 2000 is equal to 300 min Total univered the cash for projected to grow at 10, S. 452222 respectively. Then the growth rate will remain 35 per you Assume that the corporate as tempore fronterest rates, and the expected tu 11 What is the the cash flow of XYZn 2020 2021 2022 2023 mars XYZ is not yet so you warto sitost of capitalnings You have the following information on XYZprostate what? Market value ofely 500 Egutyberte 161 130 mark) What is XY WACC? terminal value of XYZ Lingat2021 Estimate the per she XYZ Formulas 1. Urievening guity betalt form has content leverage ratio anterior 10-08 4. (25 marks) You would like to value the stock of company XYZ XYZ has 10 milion shares outstanding. In addition to equity, the company also has 180,000 bonds. Each bond has a face value of 1,000 and trades at a price of 959. The cost of debt is 7%. The target capital structure is 25% debt and 75% equity. You have the following information on XYZ for the year 2020: (1) Sales are 500 million (2) Cost of goods sold (COGS) excluding depreciation is 50% of sales (3) Depreciation and amortization is 50 million (4) Capital expenditure is 80 million (5) Net working capital in December 2019 is equal to 250 million and networking capital in December 2020 is equal to 300 million (6) Total untevered free cash flows are projected to grow at 10%. 7%, 4% rate in 2021 2022, and 2023, respectively. Then the growth rate will remain flat at 3.5% per year forever. Assume that the corporate tax rate is 40%. Assume also that CAMP holds for equity capital, the risk- free interest rate is 4%, and the expected market return is 11% a. (8 marks) What is the free cash flow of XYZ in 2020. 2021 2022 and 2023? Page 6 of 9 b. (5 marks) XYZ is not public yet so you want to estimate its cost of capital using industry peers. You have the following information on XYZ's peers. Based on this table, what is XYZ's equity beta? Peer A 300 Market value of equity Asset beta Equity beta Peer B 250 1.17 Peer C 400 1.16 1.15 1.61 1.87 1.30 C. (5 marks) What is XYZ WACC? d. (7 marks) Calculate the value of the intermediate cash flow at the beginning of 2021. Calculate the terminal value of XYZ at the beginning of 2021. Estimate the value per share of XYZ at the beginning of 2021 4. (25 marks) You would like to value the stock of company XYZ. XYZ has 10 million shares outstanding. In addition to equity, the company also has 180,000 bonds. Each bond has a face value of 1,000 and trades at a price of 959. The cost of debt is 7%. The target capital structure is 25% debt and 75% equity. You have the following information on XYZ for the year 2020: (1) Sales are 500 million (2) Cost of goods sold (COGS) excluding depreciation is 50% of sales (3) Depreciation and amortization is 50 million (4) Capital expenditure is 80 million (5) Net working capital in December 2019 is equal to 250 million and net working capital in December 2020 is equal to 300 million (6) Total unlevered free cash flows are projected to grow at 10%. 7%, 4% rate in 2021 2022. and 2023, respectively. Then the growth rate will remain flat at 3.5% per year forever. Assume that the corporate tax rate is 40%. Assume also that CAMP holds for equity capital, the risk- free interest rate is 4%, and the expected market return is 11% a. (8 marks) What is the free cash flow of XYZ in 2020, 2021 2022 and 2023? Page 6 of 7 b. (5 marks) XYZ is not public yet, so you want to estimate its cost of capital using industry peers. You have the following information on XYZ's peers. Based on this table, what is XYZ s equity beta? Market value of equity Asset beta Equity beta Peer A 300 1.15 Peer B 250 1.17 Peer C 400 1.16 1.61 1.87 1.30 C. (5 marks) What is XYZ'S WACC? d. (7 marks) Calculate the value of the intermediate cash flow at the beginning of 2021. Calculate the terminal value of XYZ at the beginning of 2021. Estimate the value per share of XYZ at the beginning of 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started