answer all

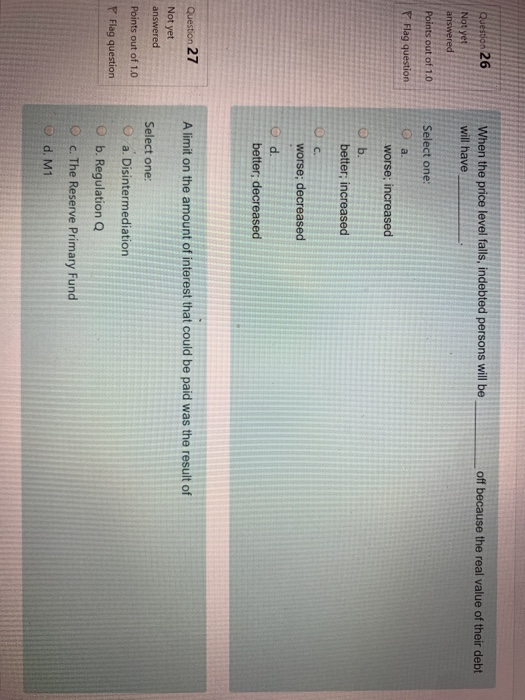

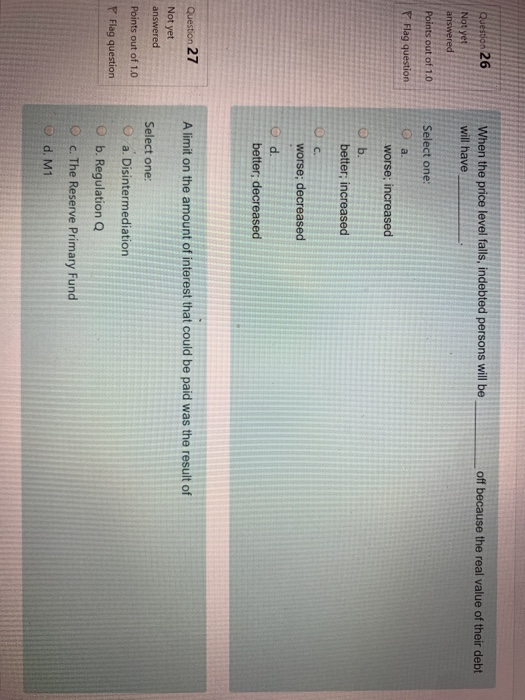

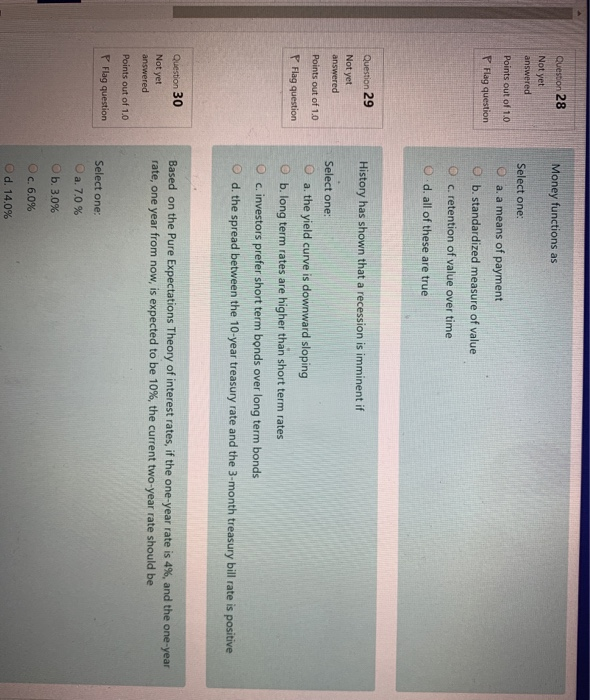

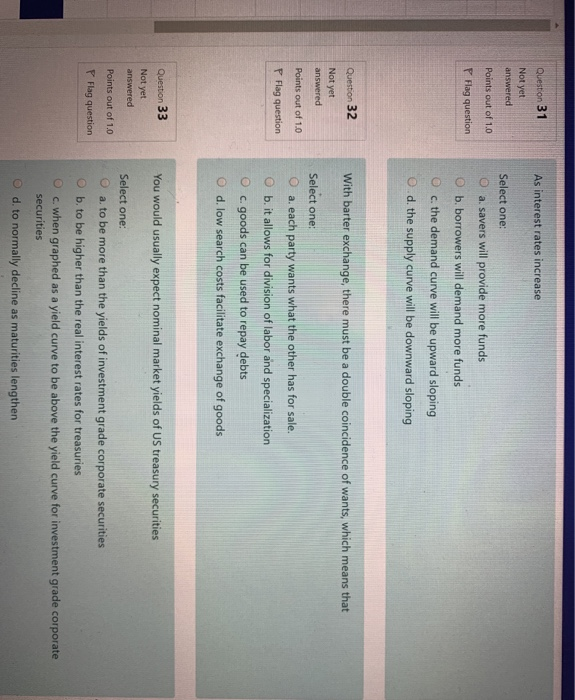

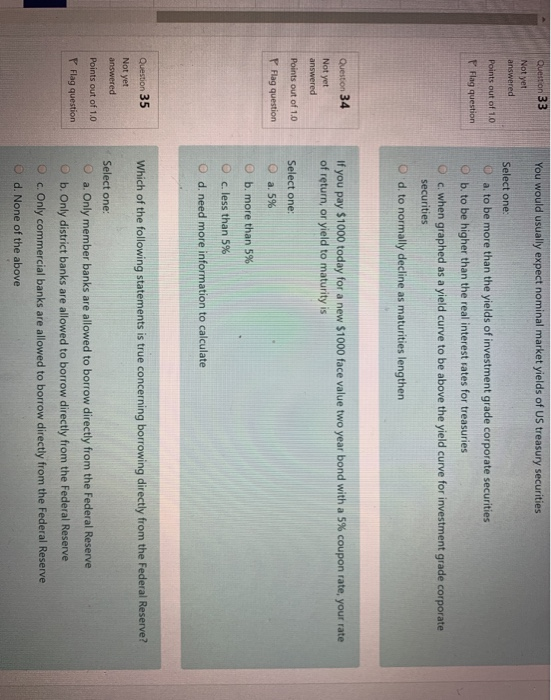

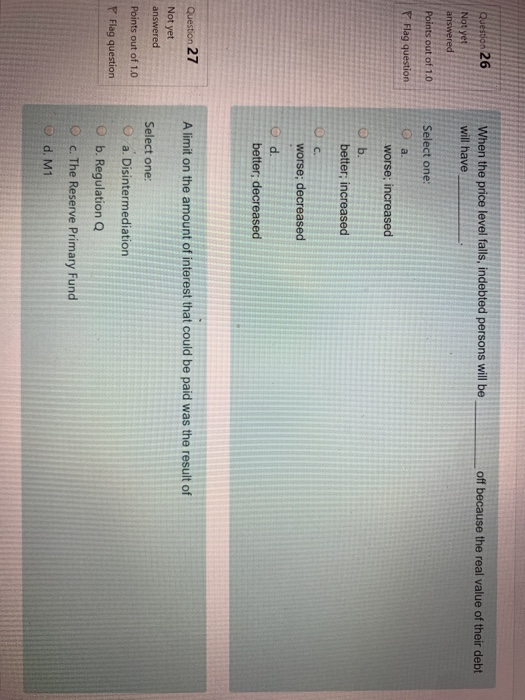

Question 26 Not yet answered When the price level falls, indebted persons will be will have off because the real value of their debt Points out of 1.0 Flag question Select one: a. worse; increased b. better, increased worse; decreased better; decreased Question 27 A limit on the amount of interest that could be paid was the result of Not yet answered Points out of 1.0 Flag question Select one: O a. Disintermediation b. Regulation Q c. The Reserve Primary Fund Od. M1 Money functions as Quesdon 28 Not yet answered Points out of 1.0 Flag question Select one: O a. a means of payment b. standardized measure of value c. retention of value over time d. all of these are true Question 29 History has shown that a recession is imminent if Not yet answered Points out of 1.0 Flag question Select one: O a. the yield curve is downward sloping b. long term rates are higher than short term rates O c. investors prefer short term bonds over long term bonds O d the spread between the 10-year treasury rate and the 3-month treasury bill rate is positive Question 30 Not yet answered Based on the Pure Expectations Theory of interest rates, if the one-year rate is 4%, and the one-year rate, one year from now, is expected to be 10%, the current two-year rate should be Points out of 1.0 Flag question Select one: O a. 7.0 % O b. 3.0% O c. 6.0% Od. 14.0% As interest rates increase Question 31 Not yet answered Points out of 1.0 Select one: O a.savers will provide more funds O b. borrowers will demand more funds P Flag question O c. the demand curve will be upward sloping 0.d. the supply curve will be downward sloping With barter exchange, there must be a double coincidence of wants, which means that Question 32 Not yet answered Points out of 1.0 P Flag question Select one: O a. each party wants what the other has for sale. O b.it allows for division of labor and specialization Oc.goods can be used to repay debts O d. low search costs facilitate exchange of goods You would usually expect nominal market yields of US treasury securities Question 33 Not yet answered Points out of 1.0 Flag question Select one: a. to be more than the yields of investment grade corporate securities O b. to be higher than the real interest rates for treasuries O c. when graphed as a yield curve to be above the yield curve for investment grade corporate securities O d. to normally decline as maturities lengthen You would usually expect nominal market yields of US treasury securities Question 33 Not yet answered Points out of 10 Flag question Select one: a. to be more than the yields of investment grade corporate securities O b. to be higher than the real interest rates for treasures O c. when graphed as a yield curve to be above the yield curve for investment grade corporate securities O d. to normally decline as maturities lengthen Question 34 Not yet answered If you pay $1000 today for a new $1000 face value two year bond with a 5% coupon rate, your rate of return, or yield to maturity is Points out of 1.0 P Flag question Select one: O a. 5% b. more than 5% O c. less than 5% O d. need more information to calculate Which of the following statements is true concerning borrowing directly from the Federal Reserve? Question 35 Not yet answered Points out of 1.0 Flag question Select one: O a. Only member banks are allowed to borrow directly from the Federal Reserve b. Only district banks are allowed to borrow directly from the Federal Reserve O c. Only commercial banks are allowed to borrow directly from the Federal Reserve d. None of the above