answer all

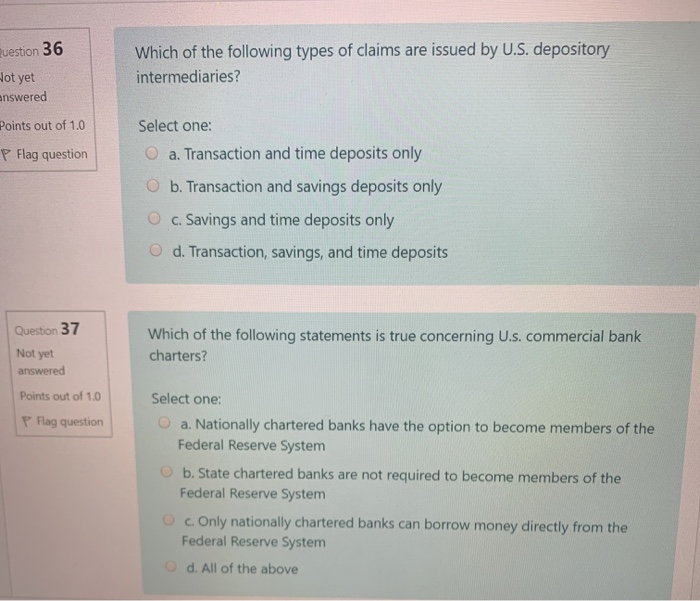

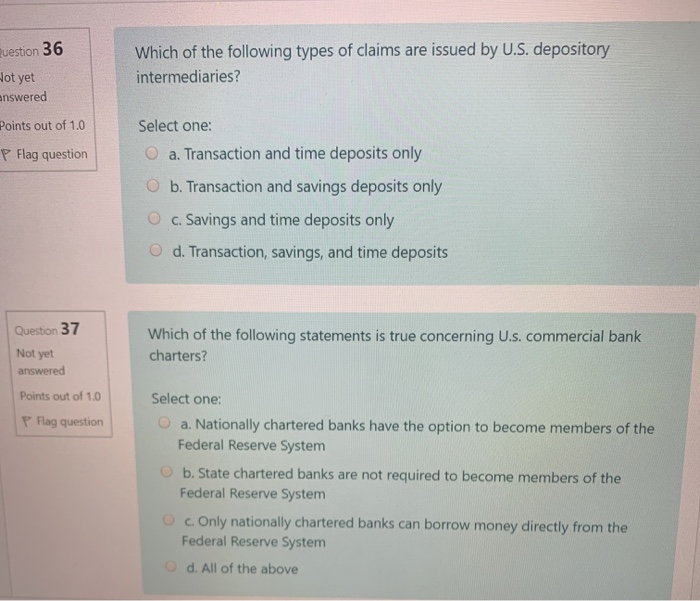

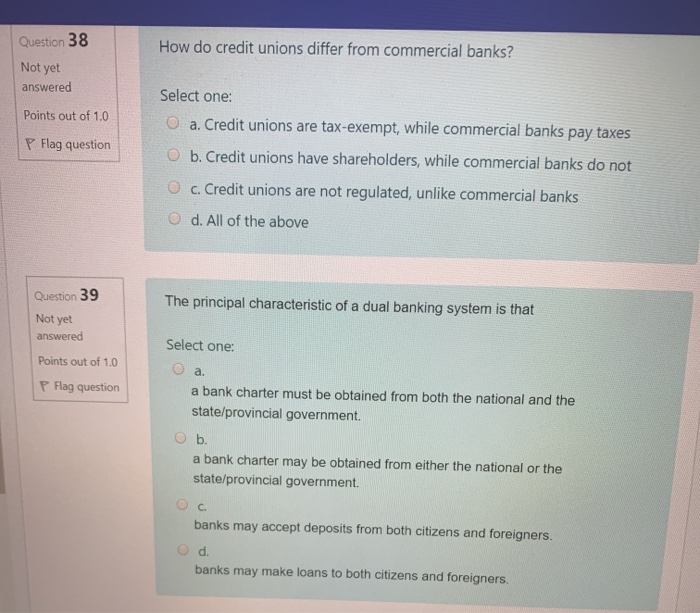

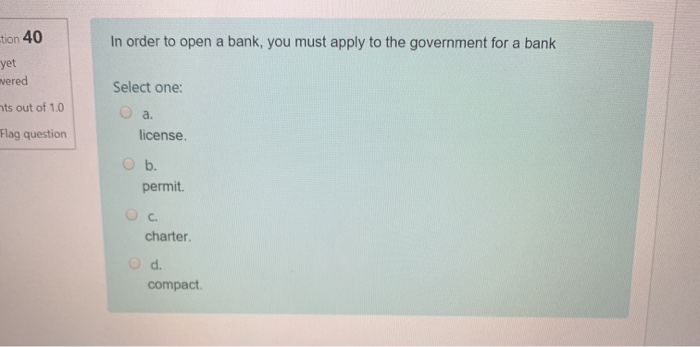

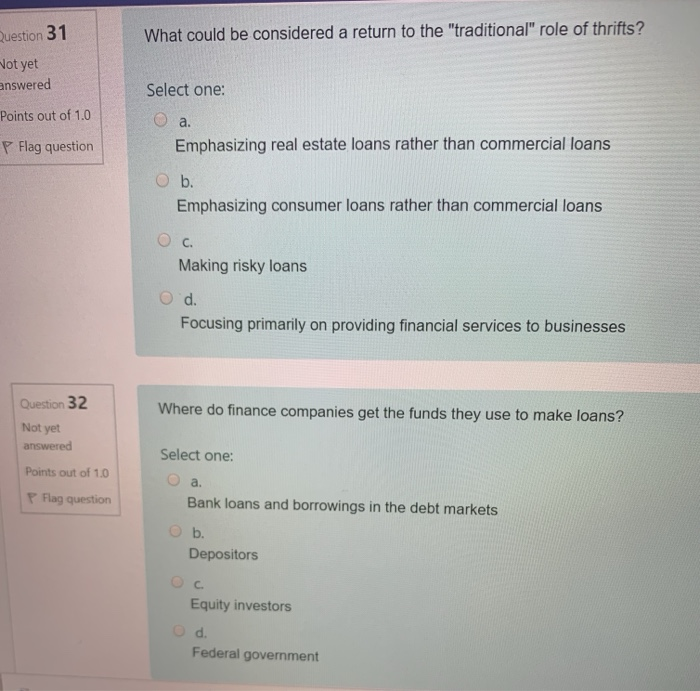

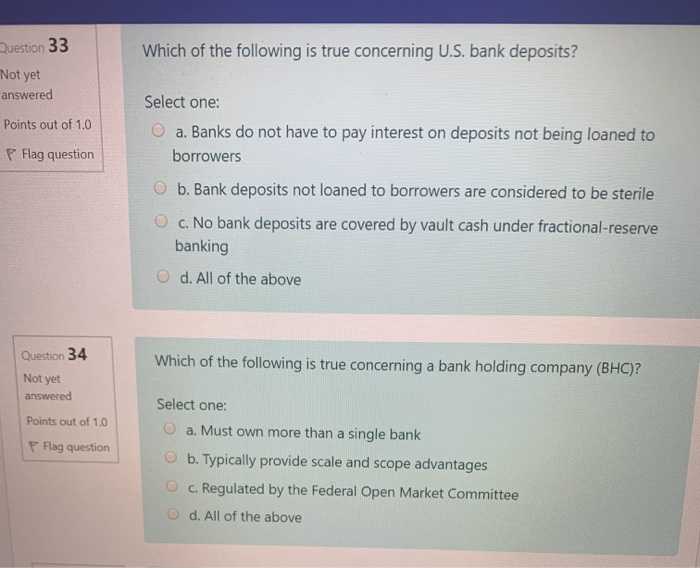

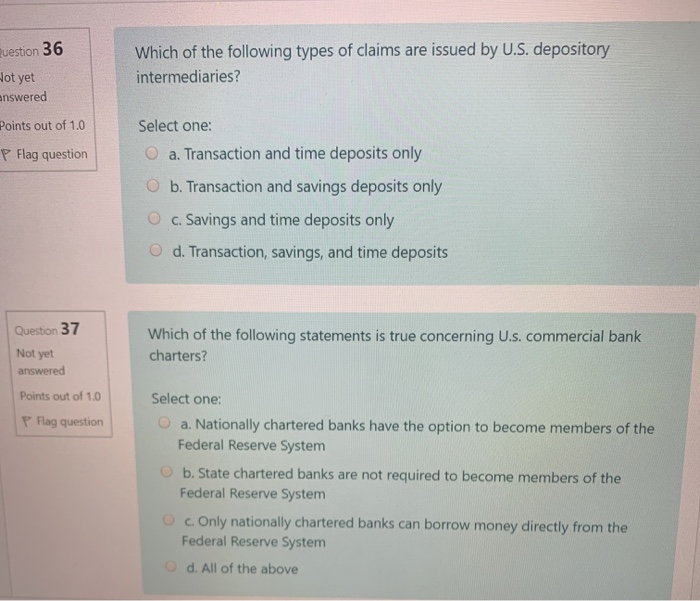

Question 36 Hot yet answered Which of the following types of claims are issued by U.S. depository intermediaries? Points out of 1.0 P Flag question Select one: O a. Transaction and time deposits only b. Transaction and savings deposits only O c. Savings and time deposits only O d. Transaction, savings, and time deposits Question 37 Which of the following statements is true concerning U.s. commercial bank charters? Not yet answered Points out of 1.0 P Flag question Select one: O a Nationally chartered banks have the option to become members of the Federal Reserve System O b. State chartered banks are not required to become members of the Federal Reserve System c. Only nationally chartered banks can borrow money directly from the Federal Reserve System d. All of the above How do credit unions differ from commercial banks? Question 38 Not yet answered Points out of 1.0 Flag question Select one: O a. Credit unions are tax-exempt, while commercial banks pay taxes b. Credit unions have shareholders, while commercial banks do not O c. Credit unions are not regulated, unlike commercial banks d. All of the above The principal characteristic of a dual banking system is that Question 39 Not yet answered Points out of 1.0 P Flag question Select one: O a. a bank charter must be obtained from both the national and the state/provincial government. O b. a bank charter may be obtained from either the national or the state/Provincial government. O banks may accept deposits from both citizens and foreigners. d. banks may make loans to both citizens and foreigners. In order to open a bank, you must apply to the government for a bank tion 40 yet wered nts out of 1.0 Flag question Select one: O a license. b. permit charter d. compact What could be considered a return to the "traditional role of thrifts? Question 31 Not yet answered Points out of 1.0 P Flag question Select one: O a Emphasizing real estate loans rather than commercial loans O b. Emphasizing consumer loans rather than commercial loans Making risky loans O d. Focusing primarily on providing financial services to businesses Where do finance companies get the funds they use to make loans? Question 32 Not yet answered Points out of 1.0 P Flag question Select one: a. Bank loans and borrowings in the debt markets b. Depositors . Equity investors d. Federal government Which of the following is true concerning U.S. bank deposits? Question 33 Not yet answered Points out of 1.0 P Flag question Select one: O a. Banks do not have to pay interest on deposits not being loaned to borrowers b. Bank deposits not loaned to borrowers are considered to be sterile! O c. No bank deposits are covered by vault cash under fractional-reserve banking d. All of the above Which of the following is true concerning a bank holding company (BHC)? Question 34 Not yet answered Points out of 1.0 P Flag question Select one: a. Must own more than a single bank b. Typically provide scale and scope advantages c. Regulated by the Federal Open Market Committee d. All of the above