Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer ALL question separately Wood Creations designs, manufactures, and sells modern wood sculptures. Sally Jensen is an artist for the company. Jensen has spent much

Answer ALL question separately

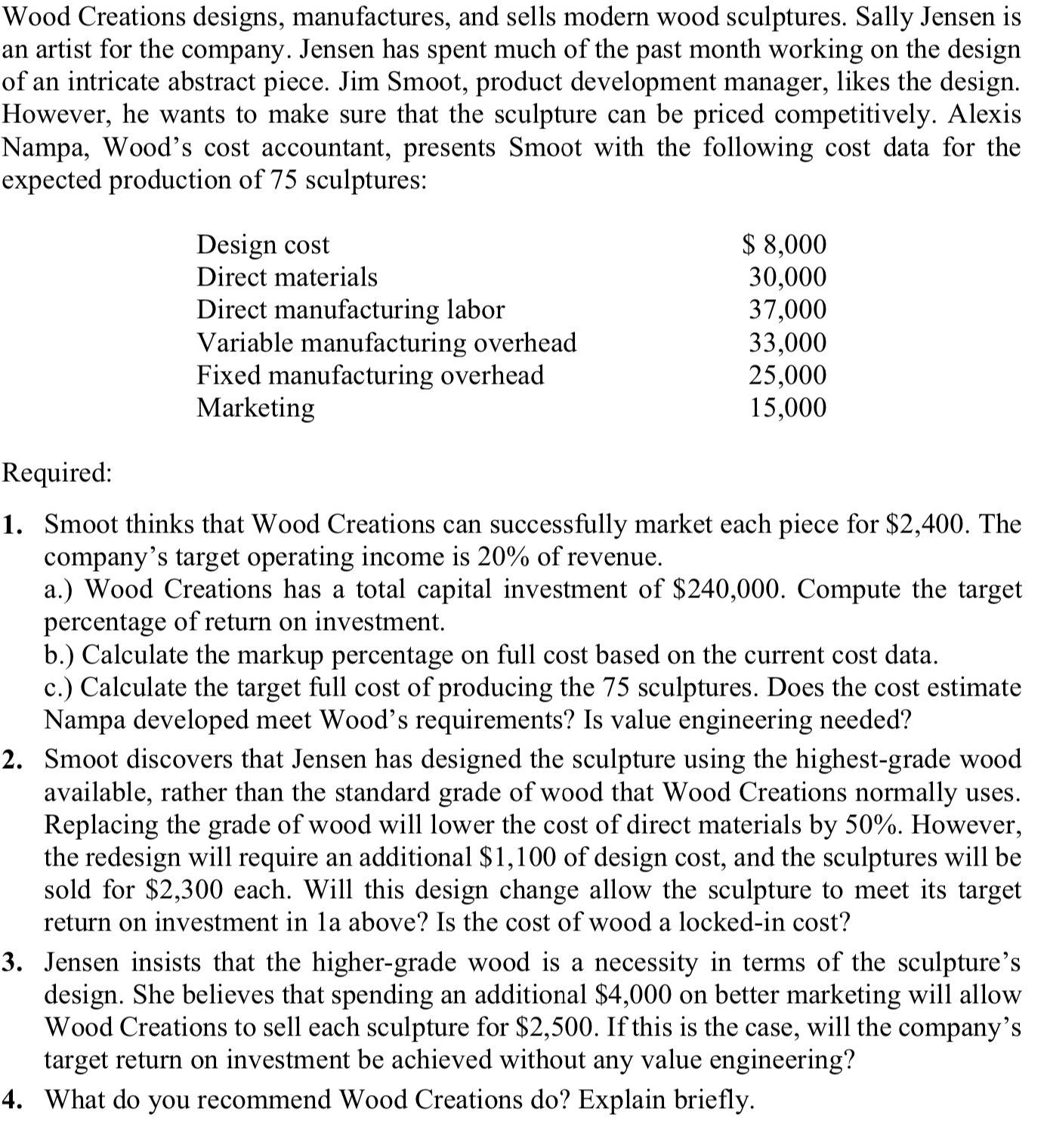

Wood Creations designs, manufactures, and sells modern wood sculptures. Sally Jensen is an artist for the company. Jensen has spent much of the past month working on the design of an intricate abstract piece. Jim Smoot, product development manager, likes the design. However, he wants to make sure that the sculpture can be priced competitively. Alexis Nampa, Wood's cost accountant, presents Smoot with the following cost data for the expected production of 75 sculptures: Design cost Direct materials Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Marketing $ 8,000 30,000 37,000 33,000 25,000 15,000 Required: 1. Smoot thinks that Wood Creations can successfully market each piece for $2,400. The company's target operating income is 20% of revenue. a.) Wood Creations has a total capital investment of $240,000. Compute the target percentage of return on investment. b.) Calculate the markup percentage on full cost based on the current cost data. c.) Calculate the target full cost of producing the 75 sculptures. Does the cost estimate Nampa developed meet Wood's requirements? Is value engineering needed? 2. Smoot discovers that Jensen has designed the sculpture using the highest-grade wood available, rather than the standard grade of wood that Wood Creations normally uses. Replacing the grade of wood will lower the cost of direct materials by 50%. However, the redesign will require an additional $1,100 of design cost, and the sculptures will be sold for $2,300 each. Will this design change allow the sculpture to meet its target return on investment in la above? Is the cost of wood a locked-in cost? 3. Jensen insists that the higher-grade wood is a necessity in terms of the sculpture's design. She believes that spending an additional $4,000 on better marketing will allow Wood Creations to sell each sculpture for $2,500. If this is the case, will the company's target return on investment be achieved without any value engineering? 4. What do you recommend Wood Creations do? Explain brieflyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started