Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all questions 1. A firms' main objective is to maximize profit. True or False 2. Mona quit her job to open her own

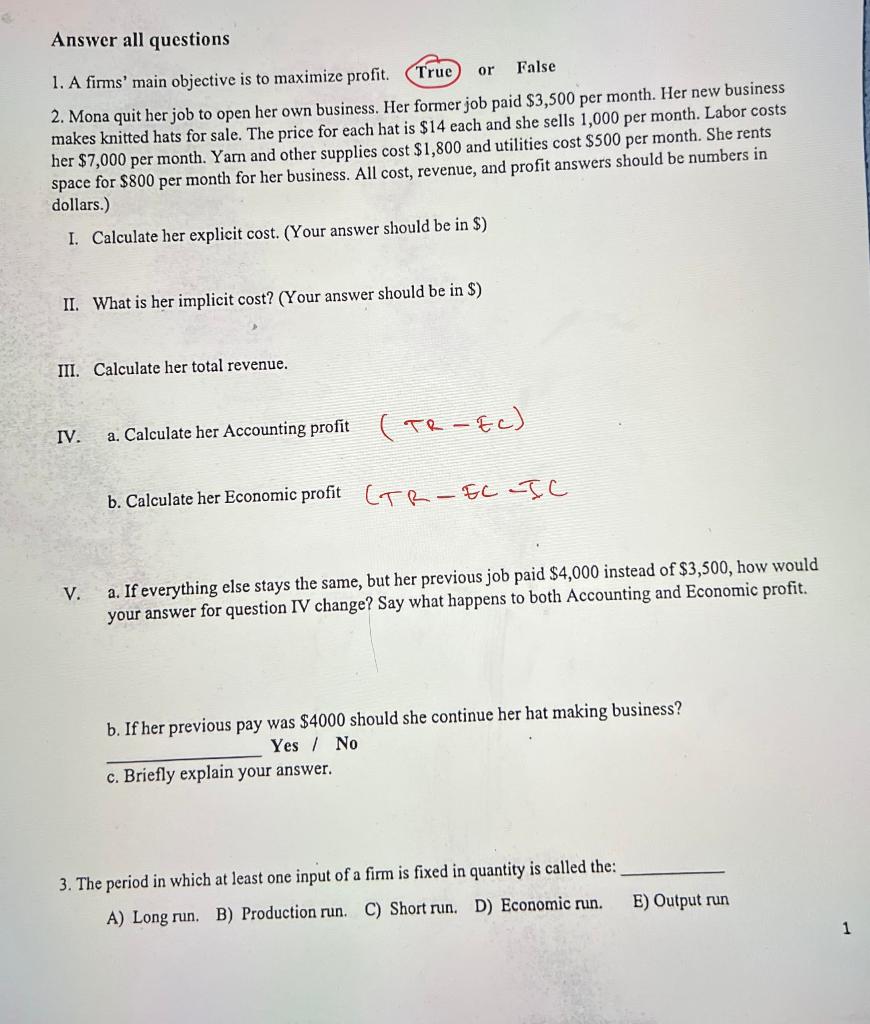

Answer all questions 1. A firms' main objective is to maximize profit. True or False 2. Mona quit her job to open her own business. Her former job paid $3,500 per month. Her new business makes knitted hats for sale. The price for each hat is $14 each and she sells 1,000 per month. Labor costs her $7,000 per month. Yarn and other supplies cost $1,800 and utilities cost $500 per month. She rents space for $800 per month for her business. All cost, revenue, and profit answers should be numbers in dollars.) I. Calculate her explicit cost. (Your answer should be in $) II. What is her implicit cost? (Your answer should be in $) III. Calculate her total revenue. IV. V. (-) T b. Calculate her Economic profit CTR-EC-IC a. Calculate her Accounting profit a. If everything else stays the same, but her previous job paid $4,000 instead of $3,500, how would your answer for question IV change? Say what happens to both Accounting and Economic profit. b. If her previous pay was $4000 should she continue her hat making business? Yes/No c. Briefly explain your answer. 3. The period in which at least one input. A) Long run. B) Production run. firm is fixed in quantity is called the: C) Short run. D) Economic run. E) Output run 1

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Explicit Cost the one which is clear and identifiabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started