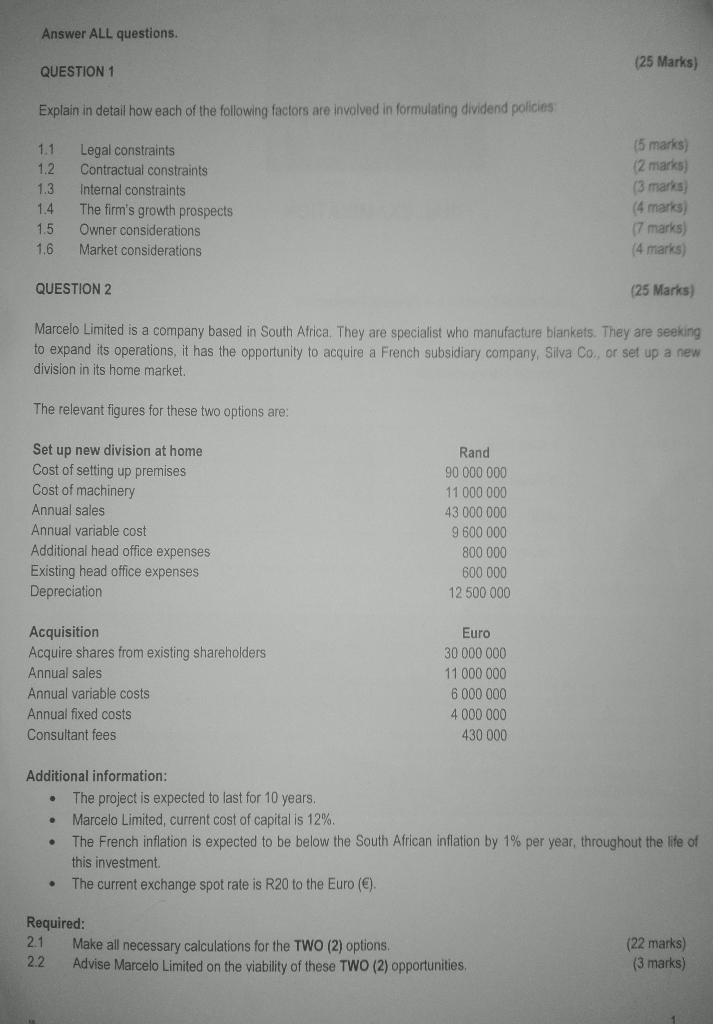

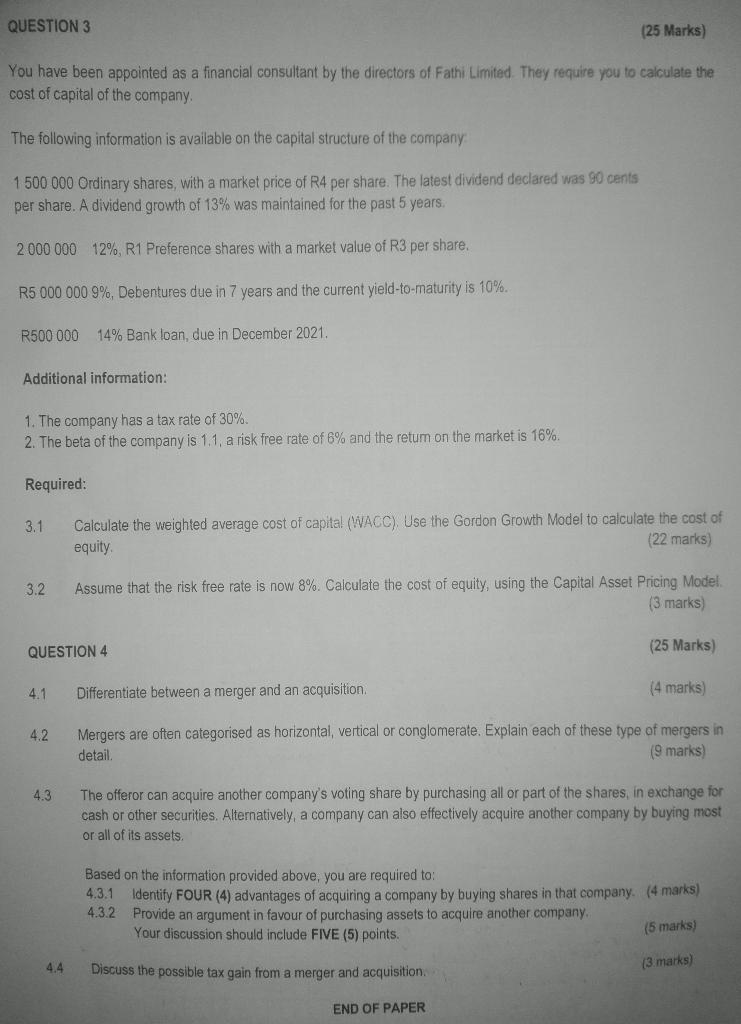

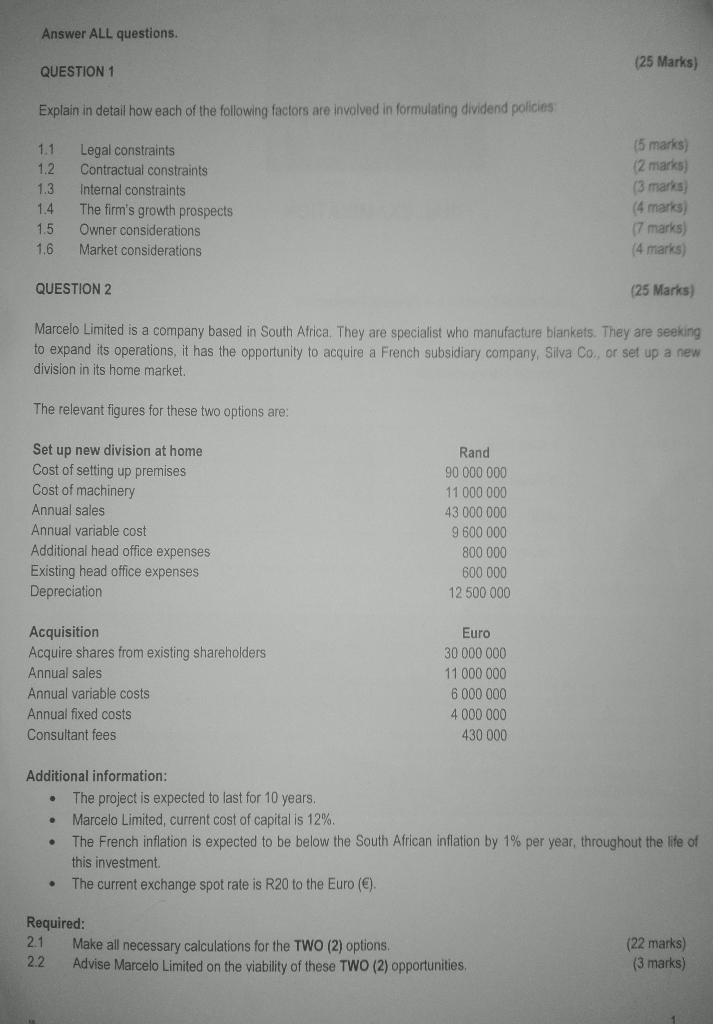

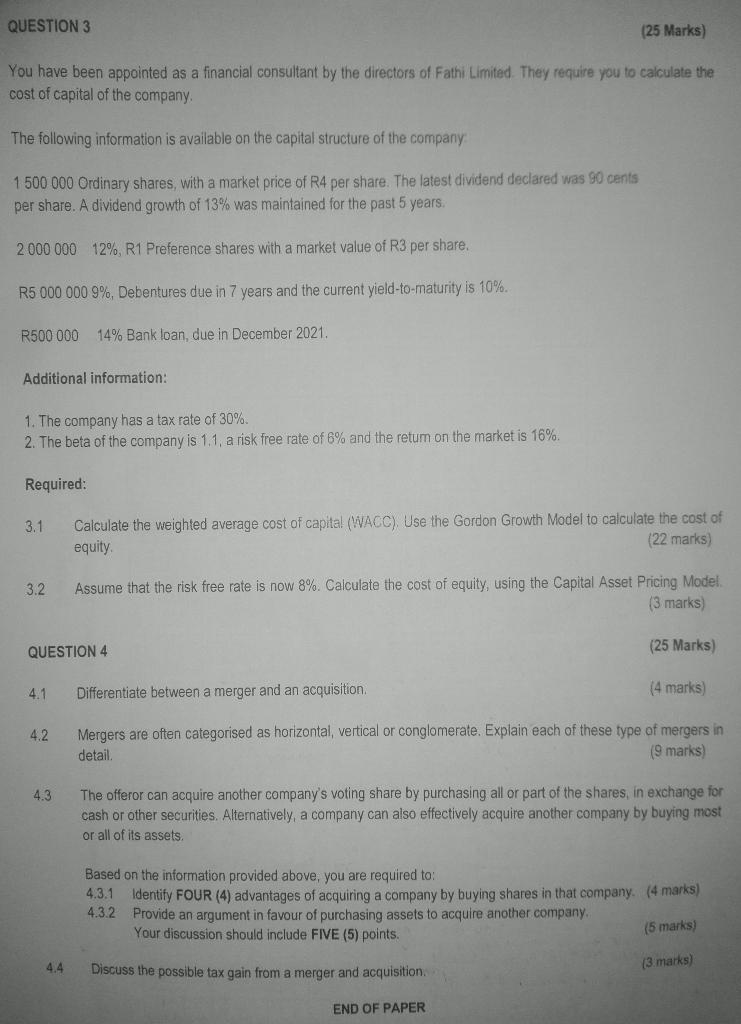

Answer ALL questions. (25 Marks) QUESTION 1 Explain in detail how each of the following factors are involved in formulating dividend policies 1.1 1.2 1.3 1.4 1.5 1.6 Legal constraints Contractual constraints Internal constraints The firm's growth prospects Owner considerations Market considerations 15 marks) (2 marks] (3 marks (4 marks) 17 marks) (4 marks) QUESTION 2 (25 Marks) Marcelo Limited is a company based in South Africa. They are specialist who manufacture blankets. They are seeking to expand its operations, it has the opportunity to acquire a French subsidiary company, Silva Co, or set up a new division in its home market. The relevant figures for these two options are: Set up new division at home Cost of setting up premises Cost of machinery Annual sales Annual variable cost Additional head office expenses Existing head office expenses Depreciation Rand 90 000 000 11 000 000 43 000 000 9 600 000 800 000 600 000 12 500 000 Acquisition Acquire shares from existing shareholders Annual sales Annual variable costs Annual fixed costs Consultant fees Euro 30 000 000 11 000 000 6 000 000 4 000 000 430 000 Additional information: The project is expected to last for 10 years, Marcelo Limited, current cost of capital is 12%. The French inflation is expected to be below the South African inflation by 1% per year, throughout the life of this investment The current exchange spot rate is R20 to the Euro (). Required: 2.1 Make all necessary calculations for the TWO (2) options. 2.2 Advise Marcelo Limited on the viability of these TWO (2) opportunities (22 marks) (3 marks) QUESTION 3 (25 Marks) You have been appointed as a financial consultant by the directors of Fathi Limited. They require you to calculate the cost of capital of the company The following information is available on the capital structure of the company 1 500 000 Ordinary shares with a market price of R4 per share. The latest dividend declared was 90 cents per share. A dividend growth of 13% was maintained for the past 5 years. 2 000 000 12%, R1 Preference shares with a market value of R3 per share. R5 000 000 9%, Debentures due in 7 years and the current yield-to-maturity is 10%. R500 000 14% Bank loan, due in December 2021. Additional information: 1. The company has a tax rate of 30% 2. The beta of the company is 1.1. a risk free rate of 6% and the retum on the market is 16% Required: 3.1 Calculate the weighted average cost of capital (WACC). Use the Gordon Growth Model to calculate the cost of equity (22 marks) 3.2 Assume that the risk free rate is now 8%. Calculate the cost of equity, using the Capital Asset Pricing Model (3 marks QUESTION 4 (25 Marks) 4.1 Differentiate between a merger and an acquisition (4 marks) 4.2 Mergers are often categorised as horizontal, vertical or conglomerate. Explain each of these type of mergers in detail (9 marks 4.3 The offeror can acquire another company's voting share by purchasing all or part of the shares, in exchange for cash or other securities. Alternatively, a company can also effectively acquire another company by buying most or all of its assets. Based on the information provided above, you are required to: 4.3.1 Identify FOUR (4) advantages of acquiring a company by buying shares in that company. (4 marks) 4.3.2 Provide an argument in favour of purchasing assets to acquire another company Your discussion should include FIVE (5) points. (5 marks) 4.4 Discuss the possible tax gain from a merger and acquisition (3 marks) END OF PAPER Answer ALL questions. (25 Marks) QUESTION 1 Explain in detail how each of the following factors are involved in formulating dividend policies 1.1 1.2 1.3 1.4 1.5 1.6 Legal constraints Contractual constraints Internal constraints The firm's growth prospects Owner considerations Market considerations 15 marks) (2 marks] (3 marks (4 marks) 17 marks) (4 marks) QUESTION 2 (25 Marks) Marcelo Limited is a company based in South Africa. They are specialist who manufacture blankets. They are seeking to expand its operations, it has the opportunity to acquire a French subsidiary company, Silva Co, or set up a new division in its home market. The relevant figures for these two options are: Set up new division at home Cost of setting up premises Cost of machinery Annual sales Annual variable cost Additional head office expenses Existing head office expenses Depreciation Rand 90 000 000 11 000 000 43 000 000 9 600 000 800 000 600 000 12 500 000 Acquisition Acquire shares from existing shareholders Annual sales Annual variable costs Annual fixed costs Consultant fees Euro 30 000 000 11 000 000 6 000 000 4 000 000 430 000 Additional information: The project is expected to last for 10 years, Marcelo Limited, current cost of capital is 12%. The French inflation is expected to be below the South African inflation by 1% per year, throughout the life of this investment The current exchange spot rate is R20 to the Euro (). Required: 2.1 Make all necessary calculations for the TWO (2) options. 2.2 Advise Marcelo Limited on the viability of these TWO (2) opportunities (22 marks) (3 marks) QUESTION 3 (25 Marks) You have been appointed as a financial consultant by the directors of Fathi Limited. They require you to calculate the cost of capital of the company The following information is available on the capital structure of the company 1 500 000 Ordinary shares with a market price of R4 per share. The latest dividend declared was 90 cents per share. A dividend growth of 13% was maintained for the past 5 years. 2 000 000 12%, R1 Preference shares with a market value of R3 per share. R5 000 000 9%, Debentures due in 7 years and the current yield-to-maturity is 10%. R500 000 14% Bank loan, due in December 2021. Additional information: 1. The company has a tax rate of 30% 2. The beta of the company is 1.1. a risk free rate of 6% and the retum on the market is 16% Required: 3.1 Calculate the weighted average cost of capital (WACC). Use the Gordon Growth Model to calculate the cost of equity (22 marks) 3.2 Assume that the risk free rate is now 8%. Calculate the cost of equity, using the Capital Asset Pricing Model (3 marks QUESTION 4 (25 Marks) 4.1 Differentiate between a merger and an acquisition (4 marks) 4.2 Mergers are often categorised as horizontal, vertical or conglomerate. Explain each of these type of mergers in detail (9 marks 4.3 The offeror can acquire another company's voting share by purchasing all or part of the shares, in exchange for cash or other securities. Alternatively, a company can also effectively acquire another company by buying most or all of its assets. Based on the information provided above, you are required to: 4.3.1 Identify FOUR (4) advantages of acquiring a company by buying shares in that company. (4 marks) 4.3.2 Provide an argument in favour of purchasing assets to acquire another company Your discussion should include FIVE (5) points. (5 marks) 4.4 Discuss the possible tax gain from a merger and acquisition (3 marks) END OF PAPER