Answer all questions

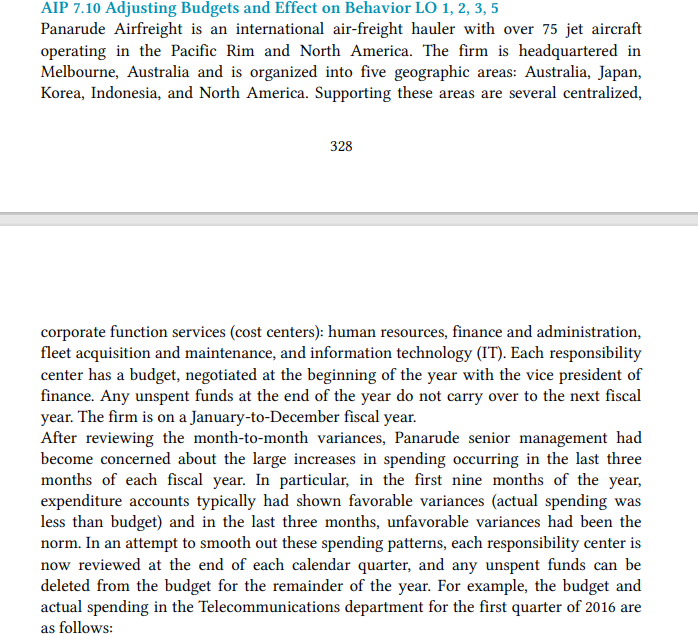

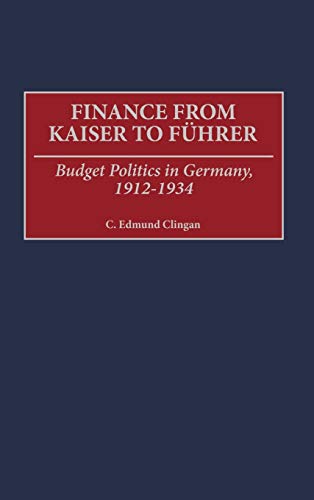

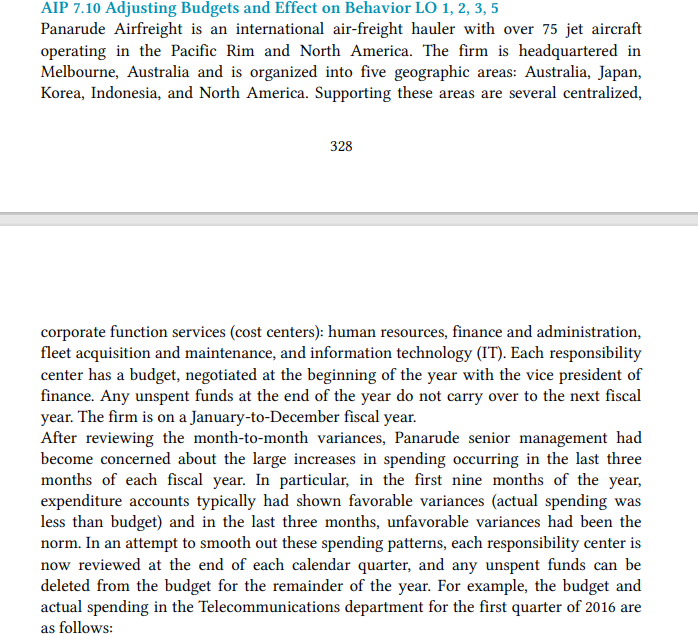

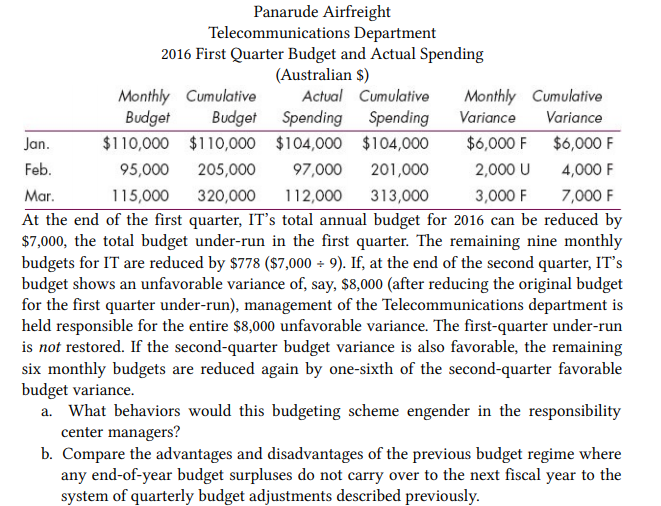

AIP 7.10 Adjusting Budgets and Effect on Behavior LO 1, 2, 3, 5 Panarude Airfreight is an international air-freight hauler with over 75 jet aircraft operating in the Pacific Rim and North America. The firm is headquartered in Melbourne, Australia and is organized into five geographic areas: Australia, Japan, Korea, Indonesia, and North America. Supporting these areas are several centralized, 328 corporate function services (cost centers): human resources, finance and administration, fleet acquisition and maintenance, and information technology (IT). Each responsibility center has a budget, negotiated at the beginning of the year with the vice president of finance. Any unspent funds at the end of the year do not carry over to the next fiscal year. The firm is on a January-to-December fiscal year. After reviewing the month-to-month variances, Panarude senior management had become concerned about the large increases in spending occurring in the last three months of each fiscal year. In particular, in the first nine months of the year, expenditure accounts typically had shown favorable variances (actual spending was less than budget) and in the last three months, unfavorable variances had been the norm. In an attempt to smooth out these spending patterns, each responsibility center is now reviewed at the end of each calendar quarter, and any unspent funds can be deleted from the budget for the remainder of the year. For example, the budget and actual spending in the Telecommunications department for the first quarter of 2016 are as follows: Panarude Airfreight Telecommunications Department 2016 First Quarter Budget and Actual Spending (Australian $) Monthly Cumulative Actual Cumulative Monthly Cumulative Budget Budget Spending Spending Variance Variance Jan. $110,000 $110,000 $104,000 $104,000 $6,000 F $6,000 F Feb. 95,000 205,000 97,000 201,000 2,000 U 4,000 F Mar 115,000 320,000 112,000 313,000 3,000 F 7,000 F At the end of the first quarter, IT's total annual budget for 2016 can be reduced by $7,000, the total budget under-run in the first quarter. The remaining nine monthly budgets for IT are reduced by $778 ($7,000 = 9). If, at the end of the second quarter, IT's budget shows an unfavorable variance of, say, $8,000 (after reducing the original budget for the first quarter under-run), management of the Telecommunications department is held responsible for the entire $8,000 unfavorable variance. The first-quarter under-run is not restored. If the second-quarter budget variance is also favorable, the remaining six monthly budgets are reduced again by one-sixth of the second-quarter favorable budget variance. a. What behaviors would this budgeting scheme engender in the responsibility center managers? b. Compare the advantages and disadvantages of the previous budget regime where any end-of-year budget surpluses do not carry over to the next fiscal year to the system of quarterly budget adjustments described previously. AIP 7.10 Adjusting Budgets and Effect on Behavior LO 1, 2, 3, 5 Panarude Airfreight is an international air-freight hauler with over 75 jet aircraft operating in the Pacific Rim and North America. The firm is headquartered in Melbourne, Australia and is organized into five geographic areas: Australia, Japan, Korea, Indonesia, and North America. Supporting these areas are several centralized, 328 corporate function services (cost centers): human resources, finance and administration, fleet acquisition and maintenance, and information technology (IT). Each responsibility center has a budget, negotiated at the beginning of the year with the vice president of finance. Any unspent funds at the end of the year do not carry over to the next fiscal year. The firm is on a January-to-December fiscal year. After reviewing the month-to-month variances, Panarude senior management had become concerned about the large increases in spending occurring in the last three months of each fiscal year. In particular, in the first nine months of the year, expenditure accounts typically had shown favorable variances (actual spending was less than budget) and in the last three months, unfavorable variances had been the norm. In an attempt to smooth out these spending patterns, each responsibility center is now reviewed at the end of each calendar quarter, and any unspent funds can be deleted from the budget for the remainder of the year. For example, the budget and actual spending in the Telecommunications department for the first quarter of 2016 are as follows: Panarude Airfreight Telecommunications Department 2016 First Quarter Budget and Actual Spending (Australian $) Monthly Cumulative Actual Cumulative Monthly Cumulative Budget Budget Spending Spending Variance Variance Jan. $110,000 $110,000 $104,000 $104,000 $6,000 F $6,000 F Feb. 95,000 205,000 97,000 201,000 2,000 U 4,000 F Mar 115,000 320,000 112,000 313,000 3,000 F 7,000 F At the end of the first quarter, IT's total annual budget for 2016 can be reduced by $7,000, the total budget under-run in the first quarter. The remaining nine monthly budgets for IT are reduced by $778 ($7,000 = 9). If, at the end of the second quarter, IT's budget shows an unfavorable variance of, say, $8,000 (after reducing the original budget for the first quarter under-run), management of the Telecommunications department is held responsible for the entire $8,000 unfavorable variance. The first-quarter under-run is not restored. If the second-quarter budget variance is also favorable, the remaining six monthly budgets are reduced again by one-sixth of the second-quarter favorable budget variance. a. What behaviors would this budgeting scheme engender in the responsibility center managers? b. Compare the advantages and disadvantages of the previous budget regime where any end-of-year budget surpluses do not carry over to the next fiscal year to the system of quarterly budget adjustments described previously