Answered step by step

Verified Expert Solution

Question

1 Approved Answer

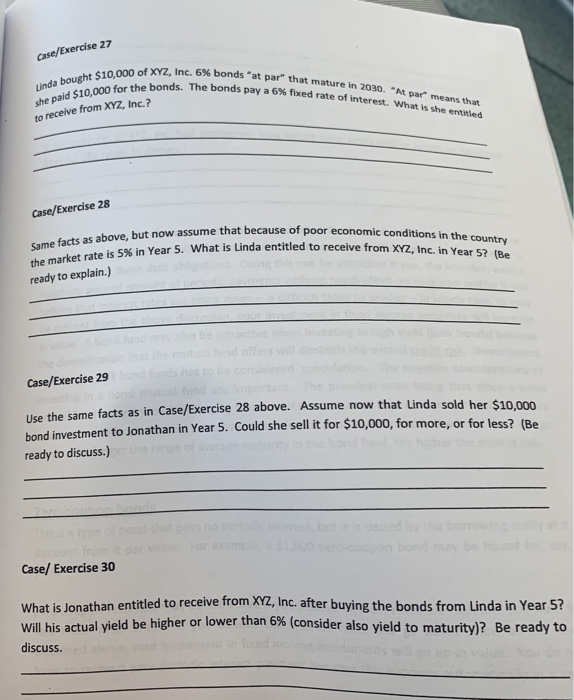

answer all questions below Case/Exercise 27 000 of XYZ, Inc. 6% bonds at par that mature in 2020. for the bonds. The bonds pay a

answer all questions below

Case/Exercise 27 000 of XYZ, Inc. 6% bonds at par that mature in 2020. for the bonds. The bonds pay a 6% fixed rate of intere ds "at par" that mature in 2030. "At par" means that a 6% fixed rate of interest. What is she entitled Linda bought $10,000 of she paid $10,000 for the to receive from XYZ, Inc.? Case/Exercise 28 w assume that because of poor economic conditions in the country da entitled to receive from XYZ, Inc. in Year 5? (Be et rate is 5% in Year 5. What is Linda entitled to receive from XYZ L Same facts as above, but now assume that the market rate is 5% in Year 5 ready to explain.) T L Case/Exercise 29 le the same facts as in Case/Exercise 28 above. Assume now that Linda sold her $100 bond investment to Jonathan in Year 5. Could she sell it for $10,000, for more, or for less? (Be ready to discuss.) or contact p Case/ Exercise 30 What is Jonathan entitled to receive from Xy, Inc. after buying the bonds from Linda in Year 5? all his actual vield be higher or lower than 6% (consider also yield to maturity)? Be ready to discuss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started