Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all questions Peter received the bank statement for the month of December 2019 on 5th January 2020. As at 31st December 2019 the

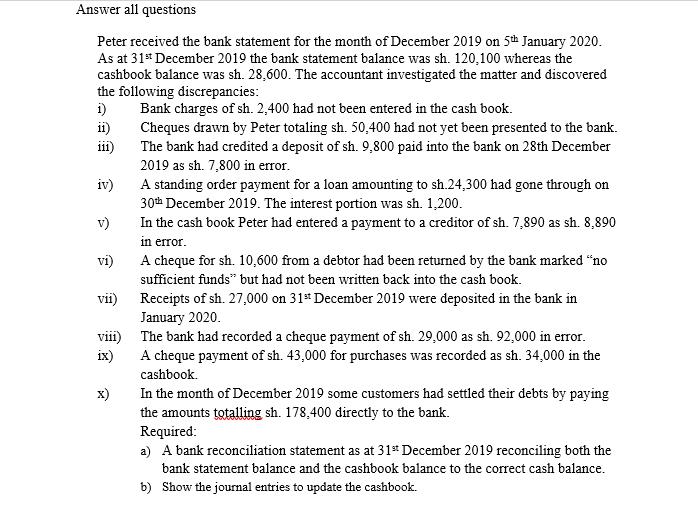

Answer all questions Peter received the bank statement for the month of December 2019 on 5th January 2020. As at 31st December 2019 the bank statement balance was sh. 120,100 whereas the cashbook balance was sh. 28,600. The accountant investigated the matter and discovered the following discrepancies: 1) Bank charges of sh. 2,400 had not been entered in the cash book. 11) 111) iv) v) Cheques drawn by Peter totaling sh. 50,400 had not yet been presented to the bank. The bank had credited a deposit of sh. 9,800 paid into the bank on 28th December 2019 as sh. 7,800 in error. X) A standing order payment for a loan amounting to sh.24,300 had gone through on 30th December 2019. The interest portion was sh. 1,200. In the cash book Peter had entered a payment to a creditor of sh. 7,890 as sh. 8,890 in error. vi) A cheque for sh. 10,600 from a debtor had been returned by the bank marked "no sufficient funds" but had not been written back into the cash book. vii) viii) ix) Receipts of sh. 27,000 on 31st December 2019 were deposited in the bank in January 2020. The bank had recorded a cheque payment of sh. 29,000 as sh. 92,000 in error. A cheque payment of sh. 43,000 for purchases was recorded as sh. 34,000 in the cashbook. In the month of December 2019 some customers had settled their debts by paying the amounts totalling sh. 178,400 directly to the bank. Required: a) A bank reconciliation statement as at 31st December 2019 reconciling both the bank statement balance and the cashbook balance to the correct cash balance. b) Show the journal entries to update the cashbook.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A a Bank reconciliation statement as at 31st December 2019 CASH BALANCE ACCORDING TO CASHBOOK 28600 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started