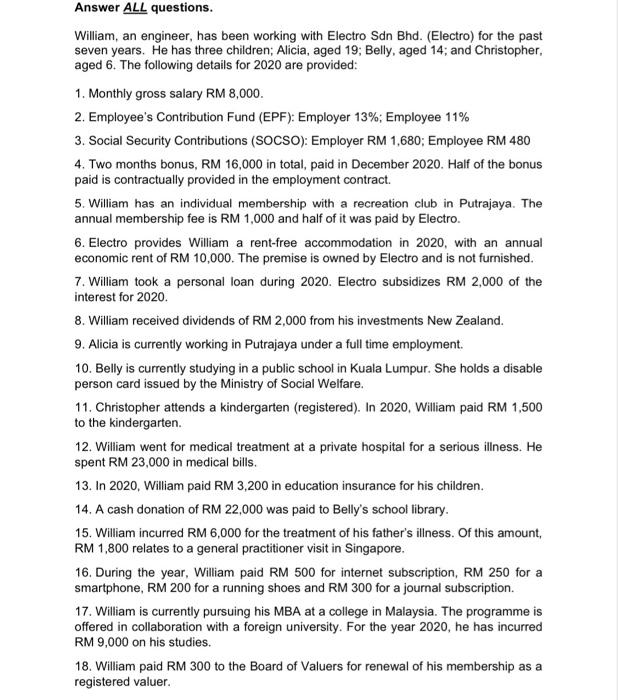

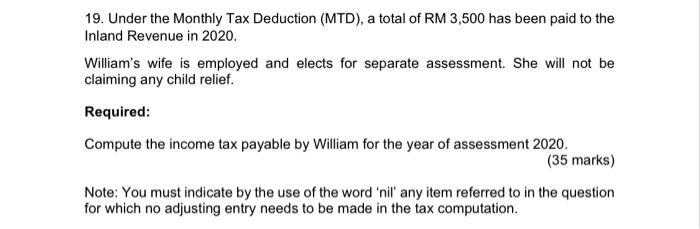

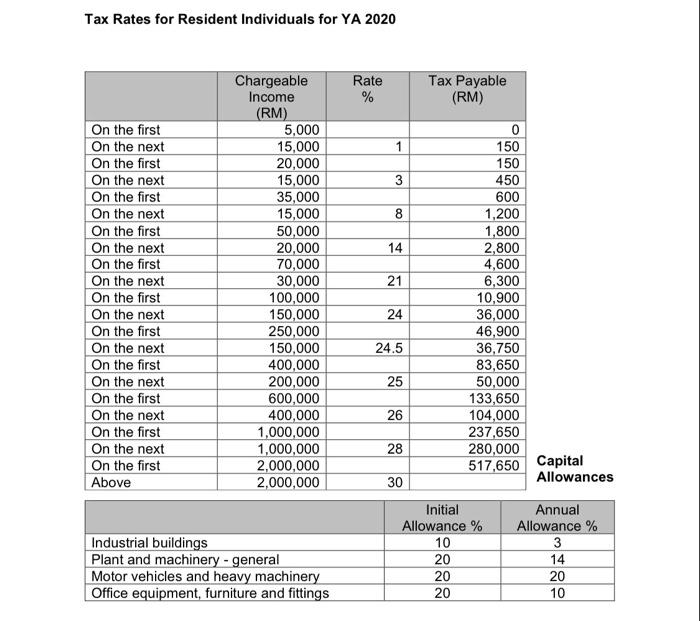

Answer ALL questions. William, an engineer, has been working with Electro Sdn Bhd. (Electro) for the past seven years. He has three children: Alicia, aged 19; Belly, aged 14; and Christopher, aged 6. The following details for 2020 are provided: 1. Monthly gross salary RM 8,000. 2. Employee's Contribution Fund (EPF): Employer 13%; Employee 11% 3. Social Security Contributions (SOCSO): Employer RM 1,680; Employee RM 480 4. Two months bonus, RM 16,000 in total, paid in December 2020. Half of the bonus paid is contractually provided in the employment contract. 5. William has an individual membership with a recreation club in Putrajaya. The annual membership fee is RM 1,000 and half of it was paid by Electro. 6. Electro provides William a rent-free accommodation in 2020, with an annual economic rent of RM 10,000. The premise is owned by Electro and is not furnished. 7. William took a personal loan during 2020. Electro subsidizes RM 2,000 of the interest for 2020 8. William received dividends of RM 2,000 from his investments New Zealand. 9. Alicia is currently working in Putrajaya under a full time employment. 10. Belly is currently studying in a public school in Kuala Lumpur. She holds a disable person card issued by the Ministry of Social Welfare. 11. Christopher attends a kindergarten (registered). In 2020, William paid RM 1,500 to the kindergarten 12. William went for medical treatment at a private hospital for a serious illness. He spent RM 23,000 in medical bills. 13. In 2020, William paid RM 3,200 in education insurance for his children. 14. A cash donation of RM 22,000 was paid to Belly's school library. 15. William incurred RM 6,000 for the treatment of his father's illness. Of this amount RM 1,800 relates to a general practitioner visit in Singapore. 16. During the year, William paid RM 500 for internet subscription, RM 250 for a smartphone, RM 200 for a running shoes and RM 300 for a journal subscription. 17. William is currently pursuing his MBA at a college in Malaysia. The programme is offered in collaboration with a foreign university. For the year 2020, he has incurred RM 9,000 on his studies. 18. William paid RM 300 to the Board of Valuers for renewal of his membership as a registered valuer. 19. Under the Monthly Tax Deduction (MTD), a total of RM 3,500 has been paid to the Inland Revenue in 2020. William's wife is employed and elects for separate assessment. She will not be claiming any child relief. Required: Compute the income tax payable by William for the year of assessment 2020. (35 marks) Note: You must indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation. Tax Rates for Resident Individuals for YA 2020 Rate % Tax Payable (RM) 1 3 8 14 Chargeable Income (RM) 5,000 15,000 20,000 15,000 35,000 15,000 50,000 20,000 70,000 30,000 100,000 150,000 250,000 150,000 400,000 200,000 600,000 400,000 1,000,000 1,000,000 2,000,000 2,000,000 On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first Above 21 0 150 150 450 600 1,200 1,800 2,800 4,600 6,300 10,900 36,000 46,900 36,750 83,650 50,000 133,650 104,000 237,650 280,000 517,650 24 24.5 25 26 28 Capital Allowances 30 Industrial buildings Plant and machinery - general Motor vehicles and heavy machinery Office equipment, furniture and fittings Initial Allowance % 10 20 20 20 Annual Allowance % 3 14 20 10