Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all the question and if possible please provide the steps to all the question! Excel file Question 5 (Mandatory) (2 points) Value at Risk

Answer all the question and if possible please provide the steps to all the question!

Excel file

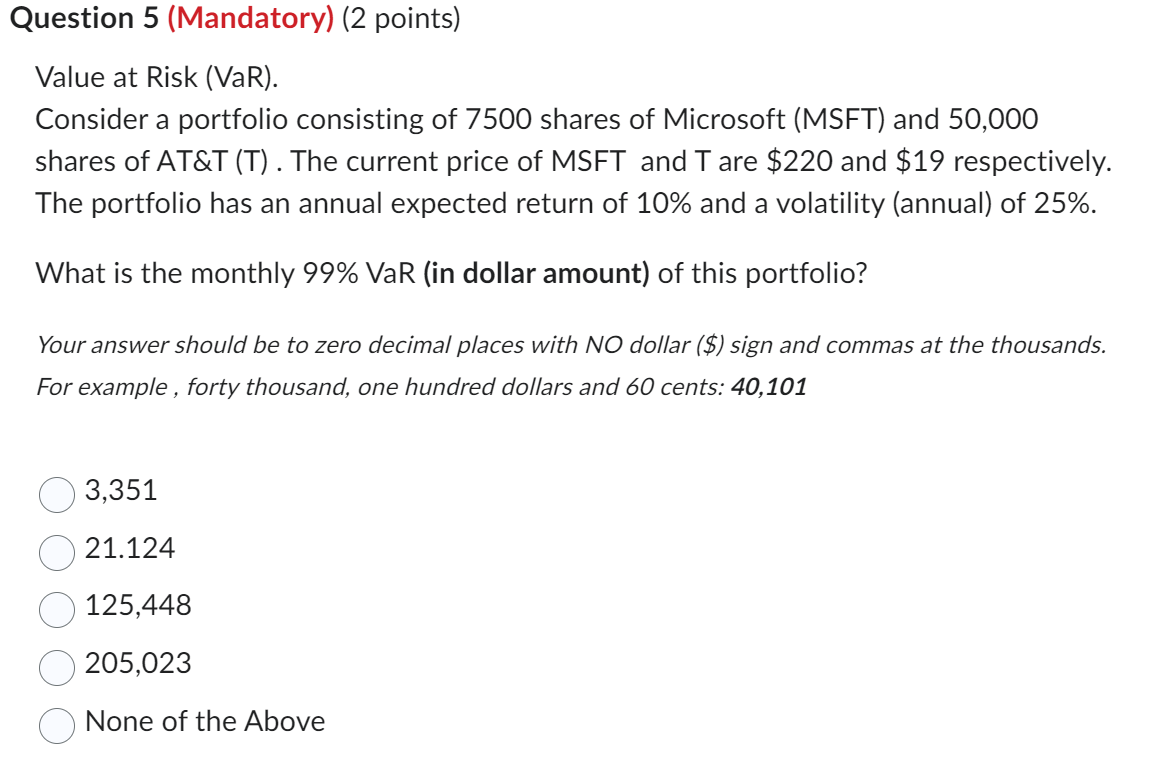

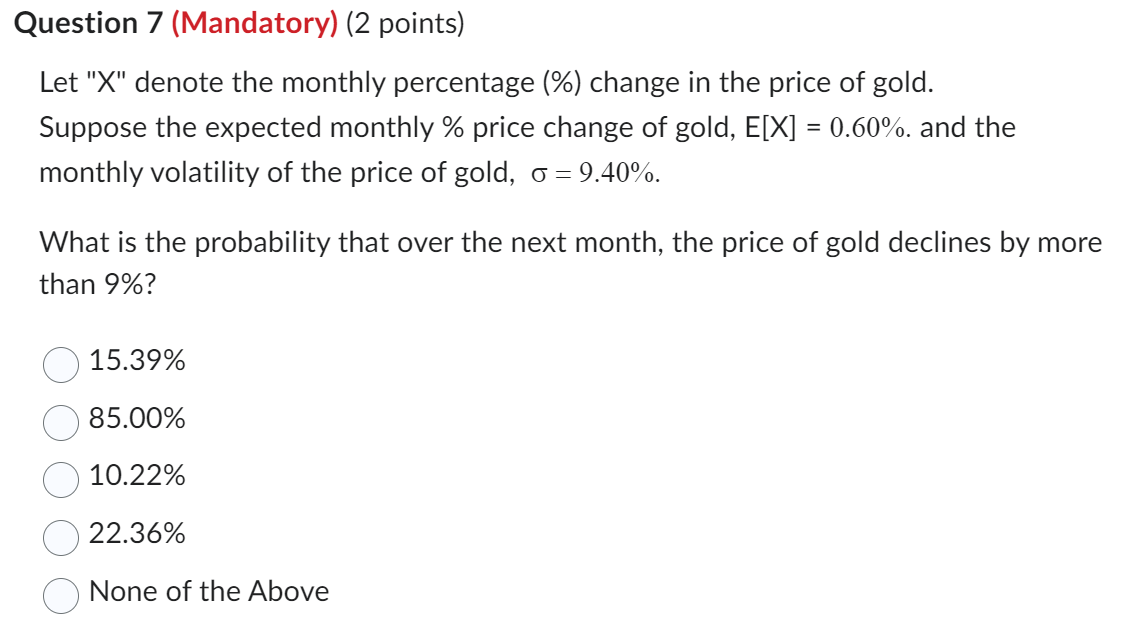

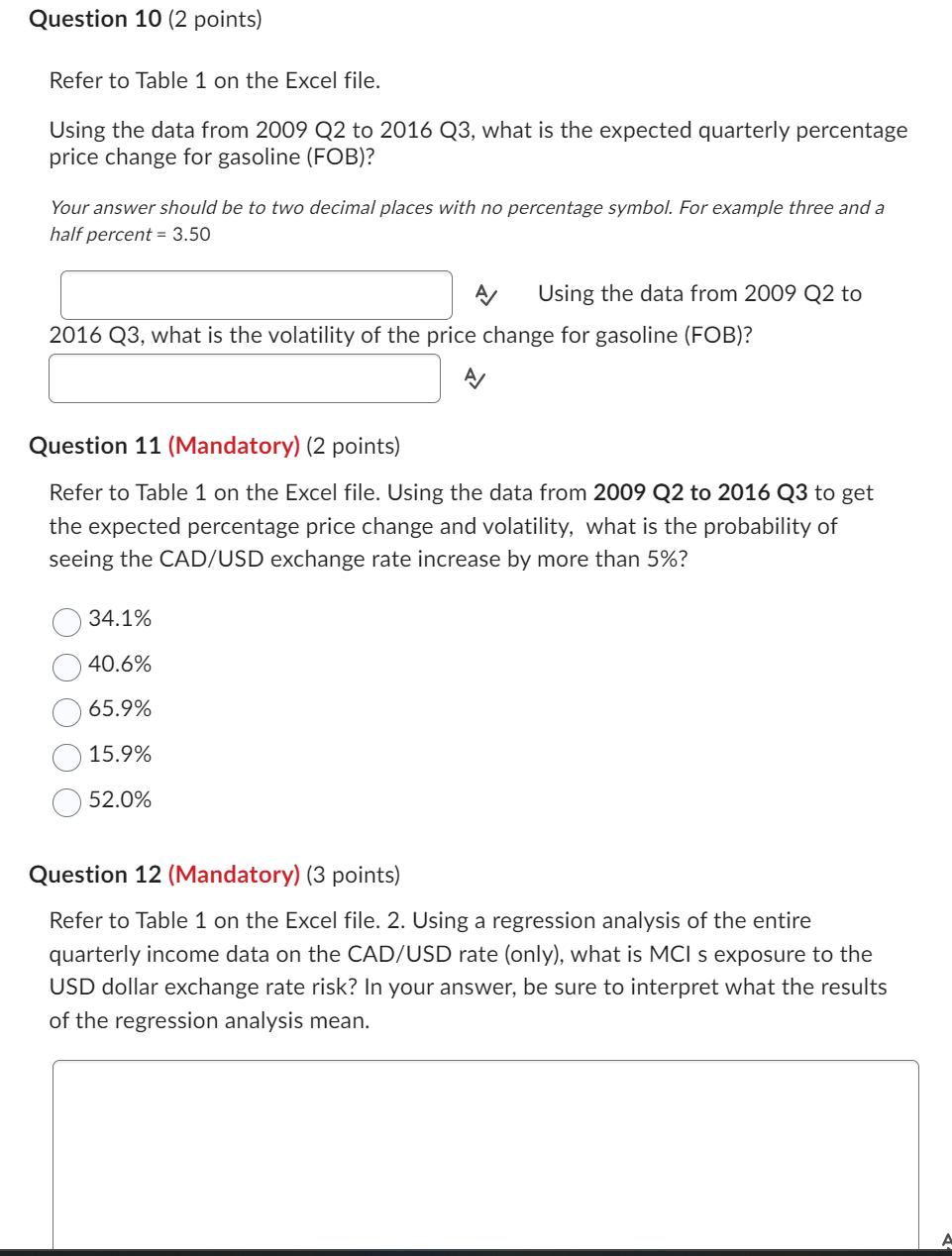

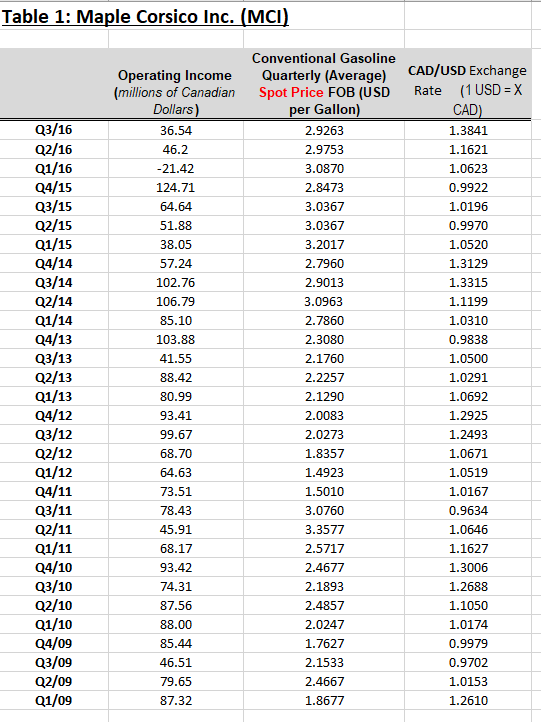

Question 5 (Mandatory) (2 points) Value at Risk (VaR). Consider a portfolio consisting of 7500 shares of Microsoft (MSFT) and 50,000 shares of AT\&T (T). The current price of MSFT and T are $220 and $19 respectively. The portfolio has an annual expected return of 10% and a volatility (annual) of 25%. What is the monthly 99% VaR (in dollar amount) of this portfolio? Your answer should be to zero decimal places with NO dollar (\$) sign and commas at the thousands. For example , forty thousand, one hundred dollars and 60 cents: 40,101 3,35121.124125,448205,023 None of the Above Let "X" denote the monthly percentage (\%) change in the price of gold. Suppose the expected monthly % price change of gold, E[X]=0.60%. and the monthly volatility of the price of gold, =9.40%. What is the probability that over the next month, the price of gold declines by more than 9% ? 15.39% 85.00% 10.22% 22.36% None of the Above Refer to Table 1 on the Excel file. Using the data from 2009 Q2 to 2016 Q3, what is the expected quarterly percentage price change for gasoline (FOB)? Your answer should be to two decimal places with no percentage symbol. For example three and a half percent =3.50 A Using the data from 2009 Q2 to 2016 Q3, what is the volatility of the price change for gasoline (FOB)? A Question 11 (Mandatory) (2 points) Refer to Table 1 on the Excel file. Using the data from 2009 Q2 to 2016 Q3 to get the expected percentage price change and volatility, what is the probability of seeing the CAD/USD exchange rate increase by more than 5% ? 34.1% 40.6% 65.9% 15.9% 52.0% Question 12 (Mandatory) (3 points) Refer to Table 1 on the Excel file. 2. Using a regression analysis of the entire quarterly income data on the CAD/USD rate (only), what is MCl s exposure to the USD dollar exchange rate risk? In your answer, be sure to interpret what the results of the regression analysis mean. Table 1: Maple Corsico Inc. (MCl)

Question 5 (Mandatory) (2 points) Value at Risk (VaR). Consider a portfolio consisting of 7500 shares of Microsoft (MSFT) and 50,000 shares of AT\&T (T). The current price of MSFT and T are $220 and $19 respectively. The portfolio has an annual expected return of 10% and a volatility (annual) of 25%. What is the monthly 99% VaR (in dollar amount) of this portfolio? Your answer should be to zero decimal places with NO dollar (\$) sign and commas at the thousands. For example , forty thousand, one hundred dollars and 60 cents: 40,101 3,35121.124125,448205,023 None of the Above Let "X" denote the monthly percentage (\%) change in the price of gold. Suppose the expected monthly % price change of gold, E[X]=0.60%. and the monthly volatility of the price of gold, =9.40%. What is the probability that over the next month, the price of gold declines by more than 9% ? 15.39% 85.00% 10.22% 22.36% None of the Above Refer to Table 1 on the Excel file. Using the data from 2009 Q2 to 2016 Q3, what is the expected quarterly percentage price change for gasoline (FOB)? Your answer should be to two decimal places with no percentage symbol. For example three and a half percent =3.50 A Using the data from 2009 Q2 to 2016 Q3, what is the volatility of the price change for gasoline (FOB)? A Question 11 (Mandatory) (2 points) Refer to Table 1 on the Excel file. Using the data from 2009 Q2 to 2016 Q3 to get the expected percentage price change and volatility, what is the probability of seeing the CAD/USD exchange rate increase by more than 5% ? 34.1% 40.6% 65.9% 15.9% 52.0% Question 12 (Mandatory) (3 points) Refer to Table 1 on the Excel file. 2. Using a regression analysis of the entire quarterly income data on the CAD/USD rate (only), what is MCl s exposure to the USD dollar exchange rate risk? In your answer, be sure to interpret what the results of the regression analysis mean. Table 1: Maple Corsico Inc. (MCl) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started