answer all the question

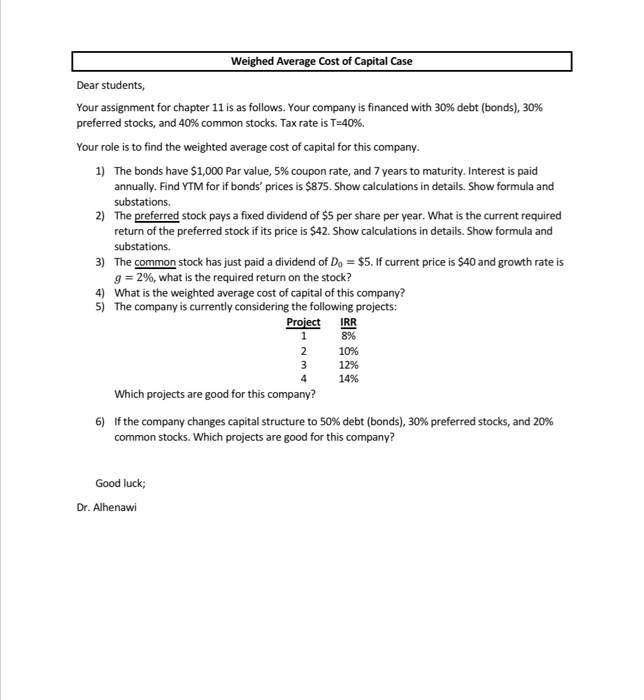

growth rate 2%

Weighed Average Cost of Capital Case Dear students, Your assignment for chapter 11 is as follows. Your company is financed with 30% debt (bonds), 30% preferred stocks, and 40% common stocks. Tax rate is T=40%. Your role is to find the weighted average cost of capital for this company. 1) The bonds have $1,000 Par value, 5% coupon rate, and 7 years to maturity. Interest is paid annually. Find YTM for if bonds prices is $875. Show calculations in details. Show formula and substations. 2) The preferred stock pays a fixed dividend of $5 per share per year. What is the current required return of the preferred stock if its price is $42. Show calculations in details. Show formula and substations. 3) The common stock has just paid a dividend of. If current price is $40 and growth rate is , what is the required return on the stock? 4) What is the weighted average cost of capital of this company? 5) The company is currently considering the following projects: Project IRR 18% 2 10% 3 12% 4 14% Which projects are good for this company? 6) If the company changes capital structure to 50% debt (bonds). 30% preferred stocks, and 20% common stocks. Which projects are good for this company? Weighed Average Cost of Capital Case Dear students, Your assignment for chapter 11 is as follows. Your company is financed with 30% debt (bonds), 30% preferred stocks, and 40% common stocks. Tax rate is T=40%. Your role is to find the weighted average cost of capital for this company. 1) The bonds have $1,000 Par value, 5% coupon rate, and 7 years to maturity. Interest is paid annually. Find YTM for if bonds' prices is $875. Show calculations in details. Show formula and substations. 2) The preferred stock pays a fixed dividend of $5 per share per year. What is the current required return of the preferred stock if its price is $42. Show calculations in details. Show formula and substations. 3) The common stock has just paid a dividend of Do = $5. If current price is $40 and growth rate is g=2%, what is the required return on the stock? 4) What is the weighted average cost of capital of this company? 5) The company is currently considering the following projects: Project IRR 8% 10% 12% 14% Which projects are good for this company? 3 6) If the company changes capital structure to 50% debt (bonds), 30% preferred stocks, and 20% common stocks. Which projects are good for this company? Good luck; Dr. Alhenawi