Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all the questions expected to grow at 2.7 percent per year, indefinitely. What will the price of this stock be in years if investors

answer all the questions

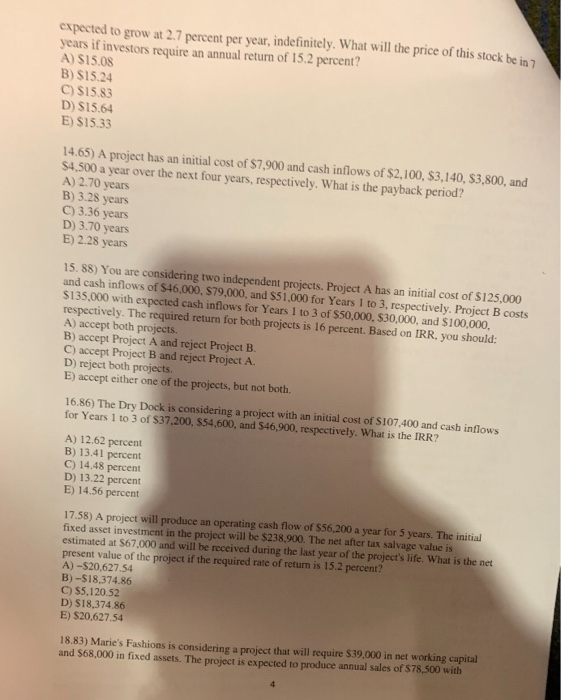

expected to grow at 2.7 percent per year, indefinitely. What will the price of this stock be in years if investors require an annual return of 15.2 percent? A) SI5.08 B) $15.24 C) $15.83 D) S15.64 E) $15.33 14.65) A project has an initial cost of $7,900 and cash inflows of $2,100, $3,140, $3,800, and $4,500 a year over the next four years, respectively. What is the payback period? A) 2.70 years B) 3.28 years C) 3.36 years D) 3.70 years E) 2.28 years 15. 88) You are considering two independent projects. Project A has an initial cost of $125,000 and cash inflows of S46,000, 579,000, and $51.000 for Years 1 to 3. respectively. Project B costs $135,000 with expected cash inflows for Years 1 to 3 of $50,000, $30,000, and $100,000, respectively. The required return for both projects is 16 percent. Based on IRR. you should: A) accept both projects B) accept Project A and reject Project B. C) accept Project B and reject Project A. D) reject both projects. E) accept either one of the projects, but not both 16.86) The Dry Dock is considering a project with an initial cost of S107,400 and cash inflows for Years 1 to 3 of 537.200, S54,600, and 546,900, respectively. What is the IRR2 A) 12.62 percent B) 13.41 percent C) 14.48 percent D) 13.22 percent E) 14.56 percent 17.58) A project will produce an operating cash now of $36,200 a year for 5 years. The initial fixed asset investment in the project will be $238,900. The net after tax salvage value is estimated at $67.000 and will be received during the last year of the project's life. What is the net present value of the project if the required rate of return is 15.2 percent A) -$20,627.54 B)-S18,374.86 C) S5.120.52 D) $18,374.86 E) $20.627.54 18.83) Marie's Fashions is considering a project that will require 539,000 in net working capital and 568,000 in fixed assets. The project is expected to produce annual sales of $78,500 with Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started