answer all the question/sections

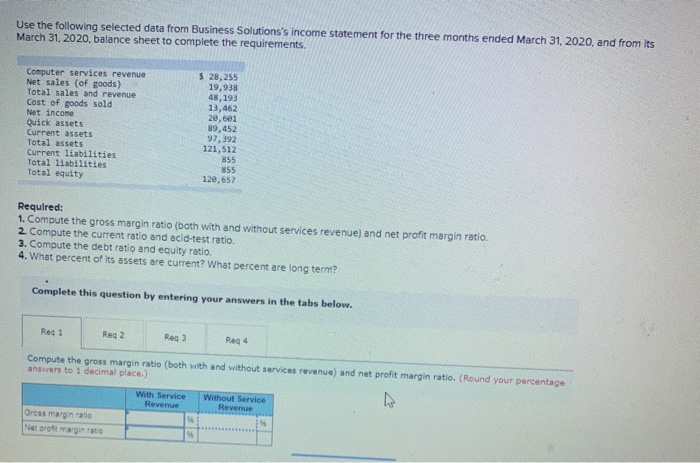

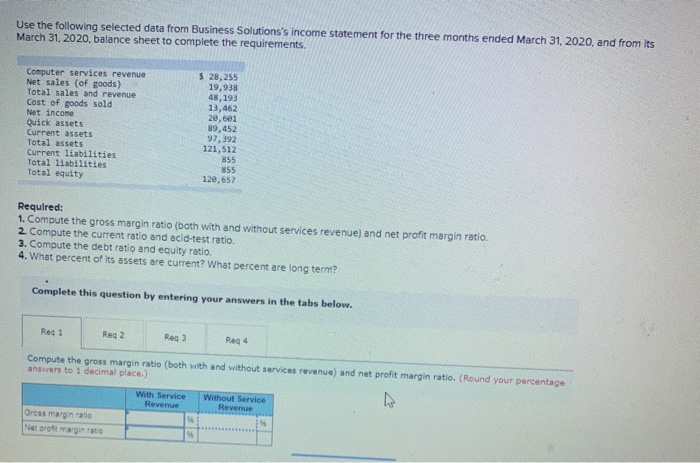

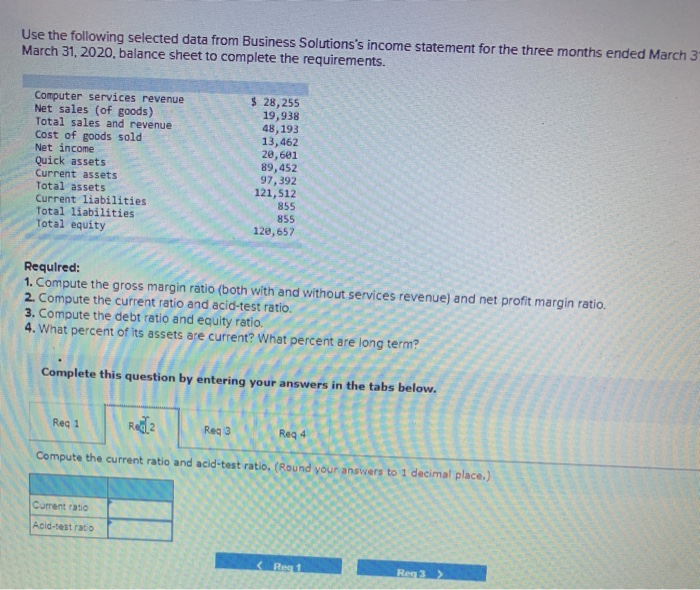

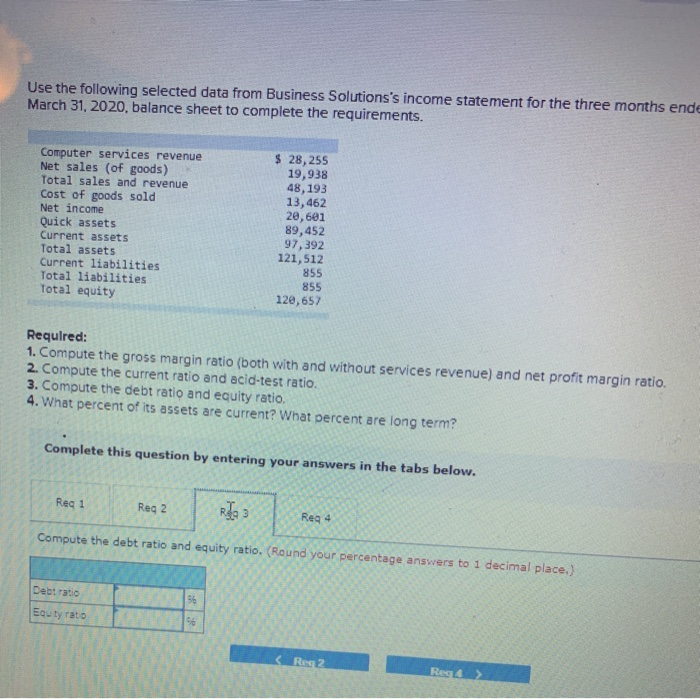

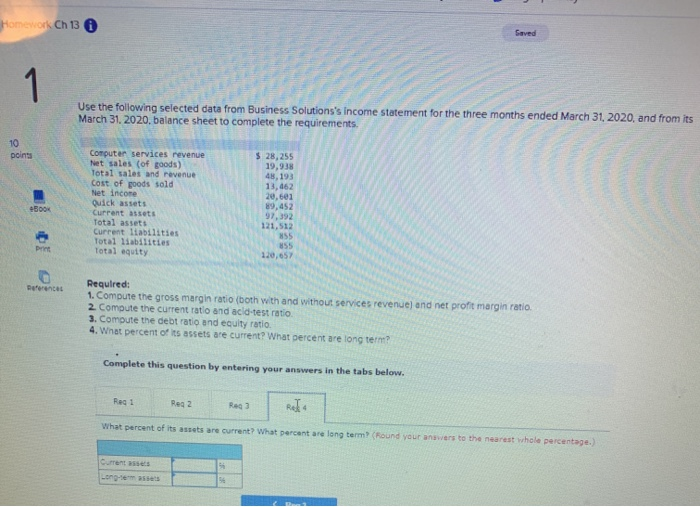

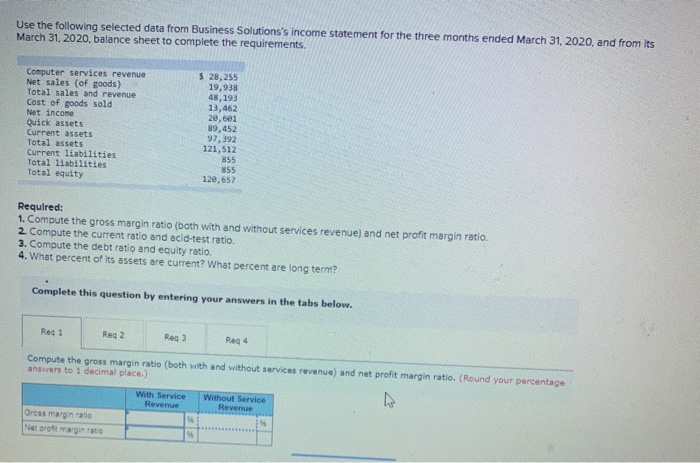

Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2020, and from its March 31, 2020, balance sheet to complete the requirements Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,255 19,938 48,193 13,462 20,601 89,452 97,392 121,512 855 855 120,657 Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Rec 1 Reg 2 Reg 3 Reg 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. (Round your percentage answers to 1 decimal place.) With Service Revenue Without Service Revenue ross margina Netgroft margin to $ 54 Use the following selected data from Business Solutions's income statement for the three months ended March 3 March 31, 2020. balance sheet to complete the requirements. Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,255 19,938 48,193 13,462 20,601 89,452 97,392 121,512 855 855 128,657 Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Reg 1 Reg 3 Reg 4 Compute the current ratio and acid-test ratio, (Round your answers to 1 decimal place.) Current Acid-testato Res 3 > Use the following selected data from Business Solutions's income statement for the three months ende March 31, 2020, balance sheet to complete the requirements. Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,255 19,938 48,193 13,462 20,601 89,452 97,392 121,512 855 855 128,657 Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 4 Compute the debt ratio and equity ratio. (Round your percentage answers to 1 decimal place.) Debao 56 sou tyto 96 Homework Ch 13 Saved 1 Use the following selected data from Business Solutions's Income statement for the three months ended March 31, 2020, and from its March 31, 2020. balance sheet to complete the requirements 10 poins Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,255 19,938 48,193 13,462 20,601 89,452 97,392 121,512 855 855 500x Reference Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio 3. Compute the debt ratio and equity ratio 4. What percent of its assets are current? What percentare long term? Complete this question by entering your answers in the tabs below. Reci Rea 2 Red What percent of its assets are current? What percentare long term (Round your answers to the nearest whole percentage.) Current Longemasse 34