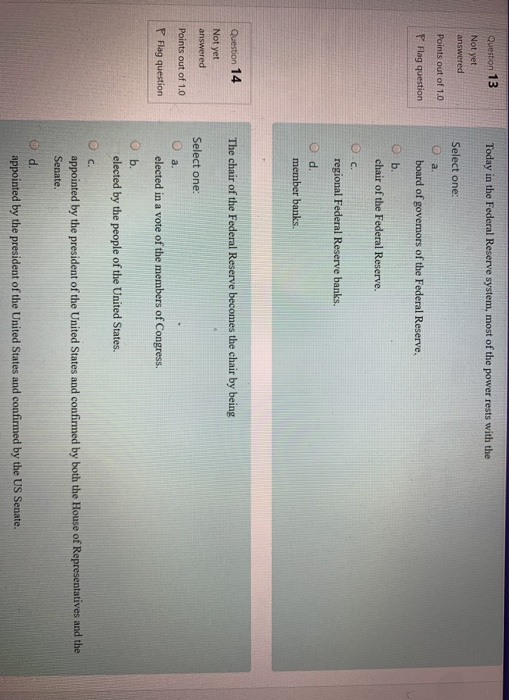

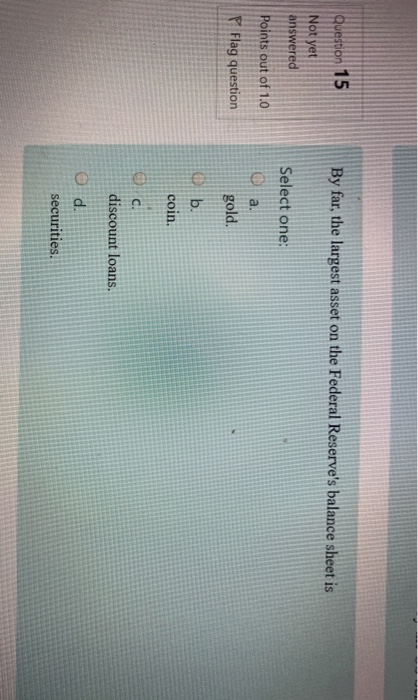

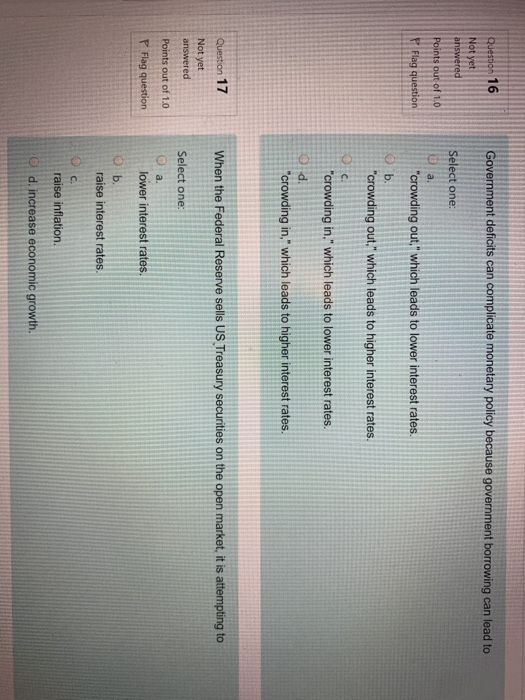

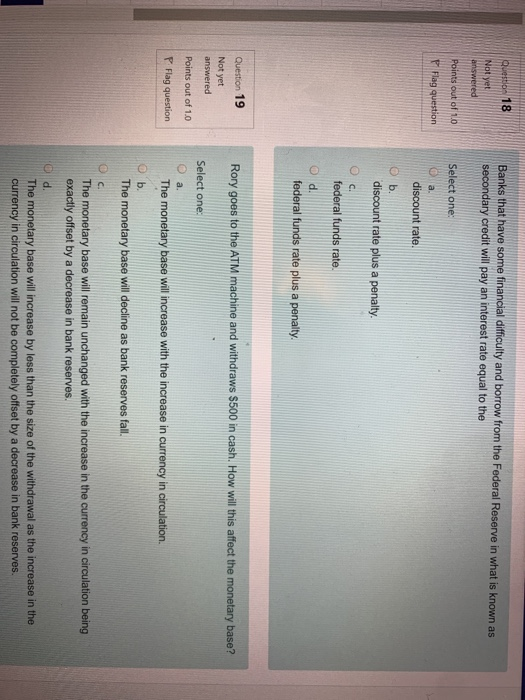

Today in the Federal Reserve system, most of the power rests with the Question 13 Not yet answered Points out of 1.0 Flag question Select one: a. board of governors of the Federal Reserve, b. chair of the Federal Reserve. Oc. regional Federal Reserve banks. d. member banks. The chair of the Federal Reserve becomes the chair by being Question 14 Not yet answered Select one: Points out of 1.0 O a. P Flag question elected in a vote of the members of Congress. b. elected by the people of the United States. appointed by the president of the United States and confirmed by both the House of Representatives and the Senate. O d. appointed by the president of the United States and confirmed by the US Senate. By far, the largest asset on the Federal Reserve's balance sheet is Question 15 Not yet answered Select one: Points out of 1.0 Flag question a. gold b. coin. discount loans. securities. Government deficits can complicate monetary policy because government borrowing can lead to Question 16 Not yet answered Select one: Points out of 1.0 Ua Flag question "crowding out," which leads to lower interest rates. Ob. "crowding out," which leads to higher interest rates. "crowding in." which leads to lower interest rates. "crowding in," which leads to higher interest rates. Question 17 When the Federal Reserve sells US Treasury securities on the open market, it is attempting to Not yet answered Select one: Points out of 1.0 a. P Flag question lower interest rates. b. raise interest rates c. raise inflation O d. increase economic growth. Question 18 Banks that have some financial difficulty and borrow from the Federal Reserve in what is known as secondary credit will pay an interest rate equal to the Not yet answered Points out of 1.0 Select one: Flag question O a. discount rate. b. discount rate plus a penalty. OC. federal funds rate. O d. federal funds rate plus a penalty. Rory goes to the ATM machine and withdraws $500 in cash. How will this affect the monetary base? Question 19 Not yet answered Points out of 1.0 P Flag question Select one: O a The monetary base will increase with the increase in currency in circulation Ob. The monetary base will decline as bank reserves fall. The monetary base will remain unchanged with the increase in the currency in circulation being exactly offset by a decrease in bank reserves. The monetary base will increase by less than the size of the withdrawal as the increase in the currency in circulation will not be completely offset by a decrease in bank reserves