Answered step by step

Verified Expert Solution

Question

1 Approved Answer

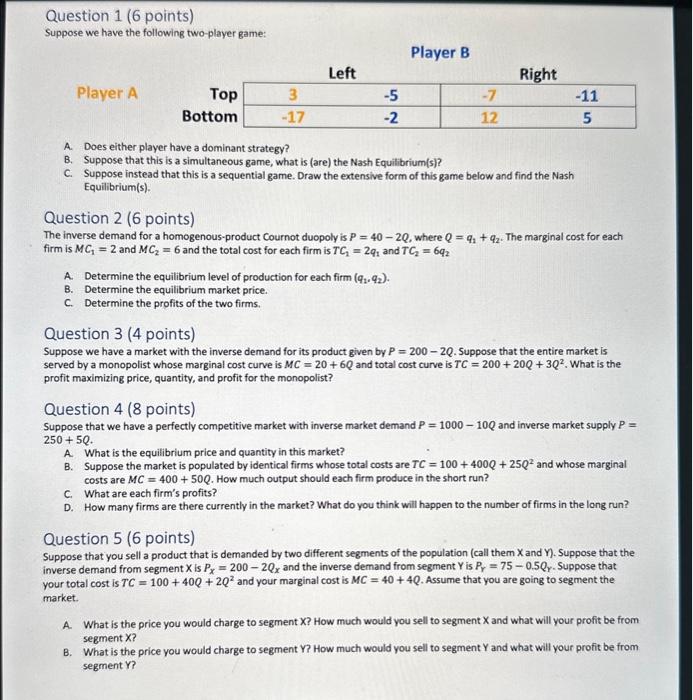

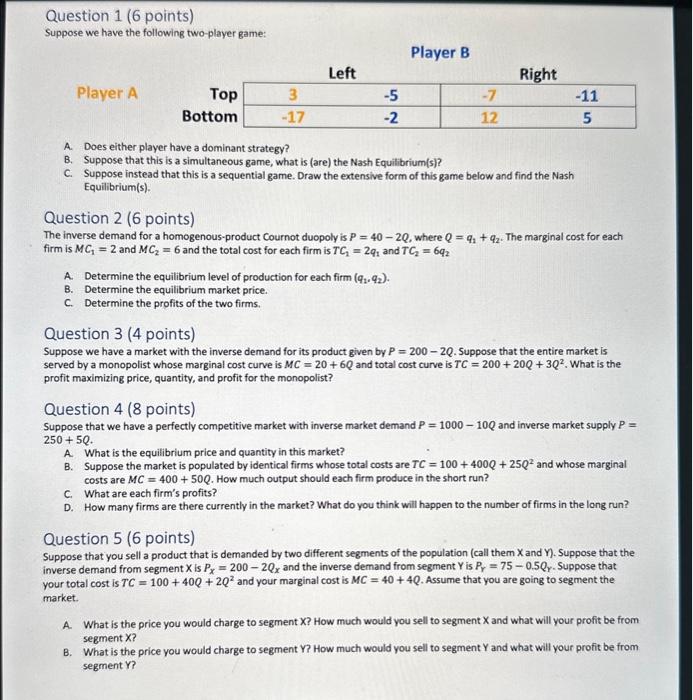

answer as many as possible please Question 1 (6 points) Suppose we have the following two-player game: Player B Player A Bottc A. Does either

answer as many as possible please

Question 1 (6 points) Suppose we have the following two-player game: Player B Player A Bottc A. Does either player have a dominant strategy? B. Suppose that this is a simultaneous game, what is (are) the Nash Equilibrium(s)? C. Suppose instead that this is a sequential game. Draw the extensive form of this game below and find the Nash Equilibrium(s). Question 2 ( 6 points) The inverse demand for a homogenous-product Cournot duopoly is \\( P=40-2 Q \\), where \\( Q=q_{1}+q_{2} \\). The marginal cost for each firm is \\( M C_{1}=2 \\) and \\( M C_{2}=6 \\) and the total cost for each firm is \\( T C_{1}=2 q_{1} \\) and \\( T C_{2}=6 q_{2} \\) A. Determine the equilibrium level of production for each firm \\( \\left(q_{1}, q_{2}\ ight) \\). B. Determine the equilibrium market price. C. Determine the profits of the two firms. Question 3 (4 points) Suppose we have a market with the inverse demand for its product given by \\( P=200-2 Q \\). Suppose that the entire market is served by a monopolist whose marginal cost curve is \\( M C=20+6 Q \\) and total cost curve is \\( T C=200+20 Q+3 Q^{2} \\). What is the profit maximizing price, quantity, and profit for the monopolist? Question 4 (8 points) Suppose that we have a perfectly competitive market with inverse market demand \\( P=1000-10 Q \\) and inverse market supply \\( P= \\) \\( 250+5 Q \\) A. What is the equilibrium price and quantity in this market? B. Suppose the market is populated by identical firms whose total costs are \\( T C=100+400 Q+25 Q^{2} \\) and whose marginal costs are \\( M C=400+50 Q \\). How much output should each firm produce in the short run? C. What are each firm's profits? D. How many firms are there currently in the market? What do you think will happen to the number of firms in the long run? Question 5 (6 points) Suppose that you sell a product that is demanded by two different segments of the population (call them \\( X \\) and \\( Y \\) ). Suppose that the inverse demand from segment \\( \\mathrm{X} \\) is \\( P_{X}=200-2 Q_{X} \\) and the inverse demand from segment \\( Y \\) is \\( P_{Y}=75-0.5 Q_{Y} \\). Suppose that your total cost is \\( T C=100+40 Q+2 Q^{2} \\) and your marginal cost is \\( M C=40+4 Q \\). Assume that you are going to segment the market. A. What is the price you would charge to segment \\( X \\) ? How much would you sell to segment \\( X \\) and what will your profit be from segment \\( X \\) ? B. What is the price you would charge to segment \\( Y \\) ? How much would you sell to segment \\( Y \\) and what will your profit be from segment Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started