Answer as much as you can pls

(a) A very successful and profitable firm is currently considering a new, large investment project that could be initiated at the start of 2021. The project involves the acquisition of a plant, which requires an initial outlay of 420 million. Although it is not clear for how long the project will last, there is an expectation that over the first six years of the project its initial capital investment should be fully depreciated. The firms accountants have prepared the following projections on expected sales and cash flows, and information on the cost of capital of the company (ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings.

(ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings.

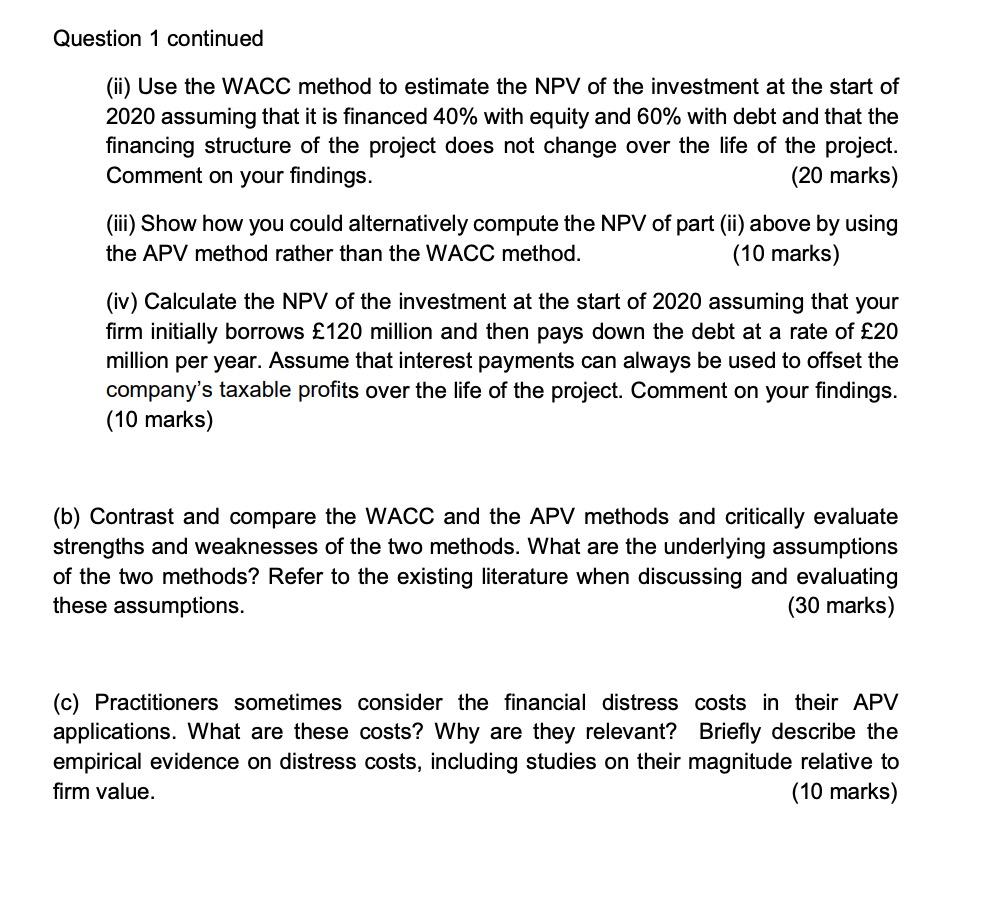

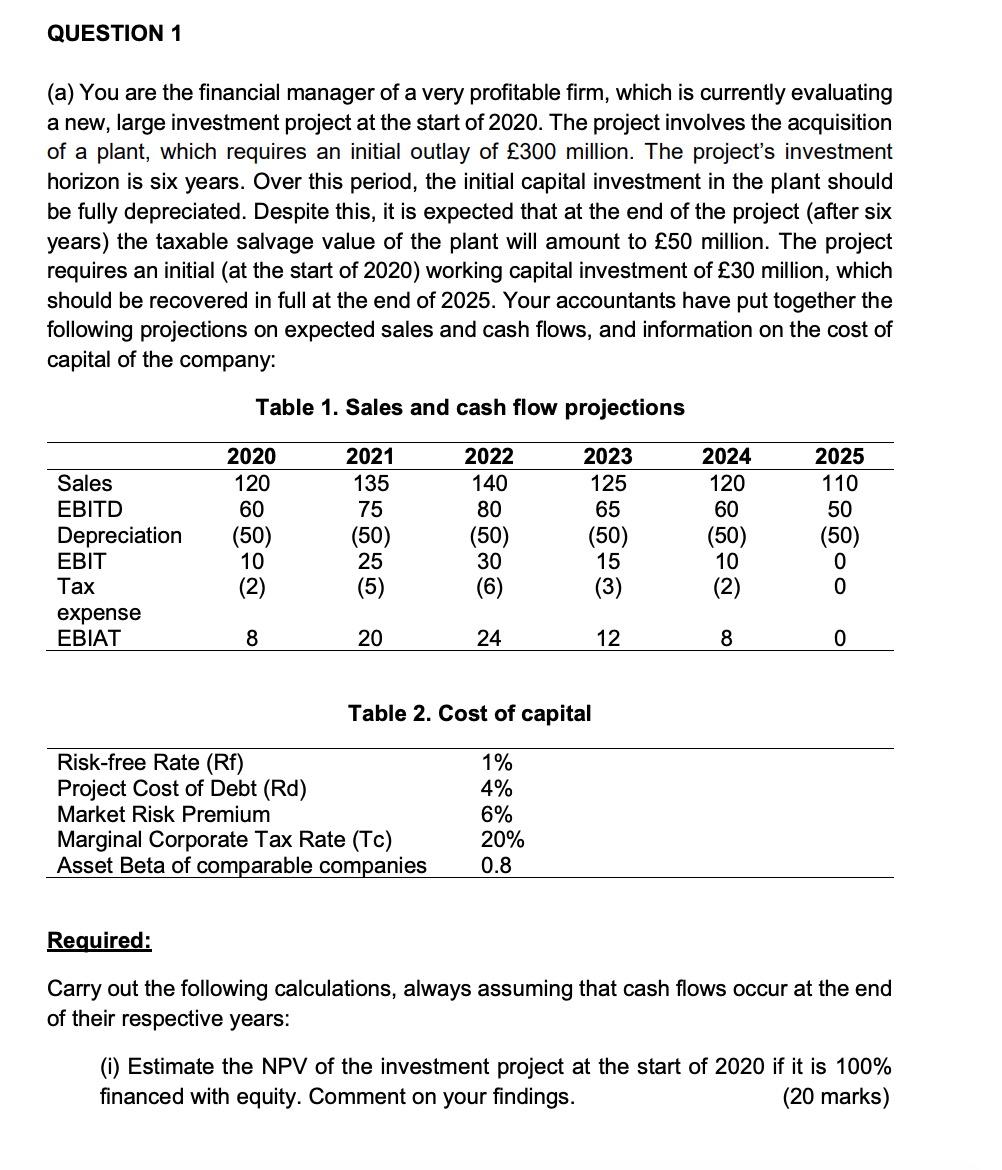

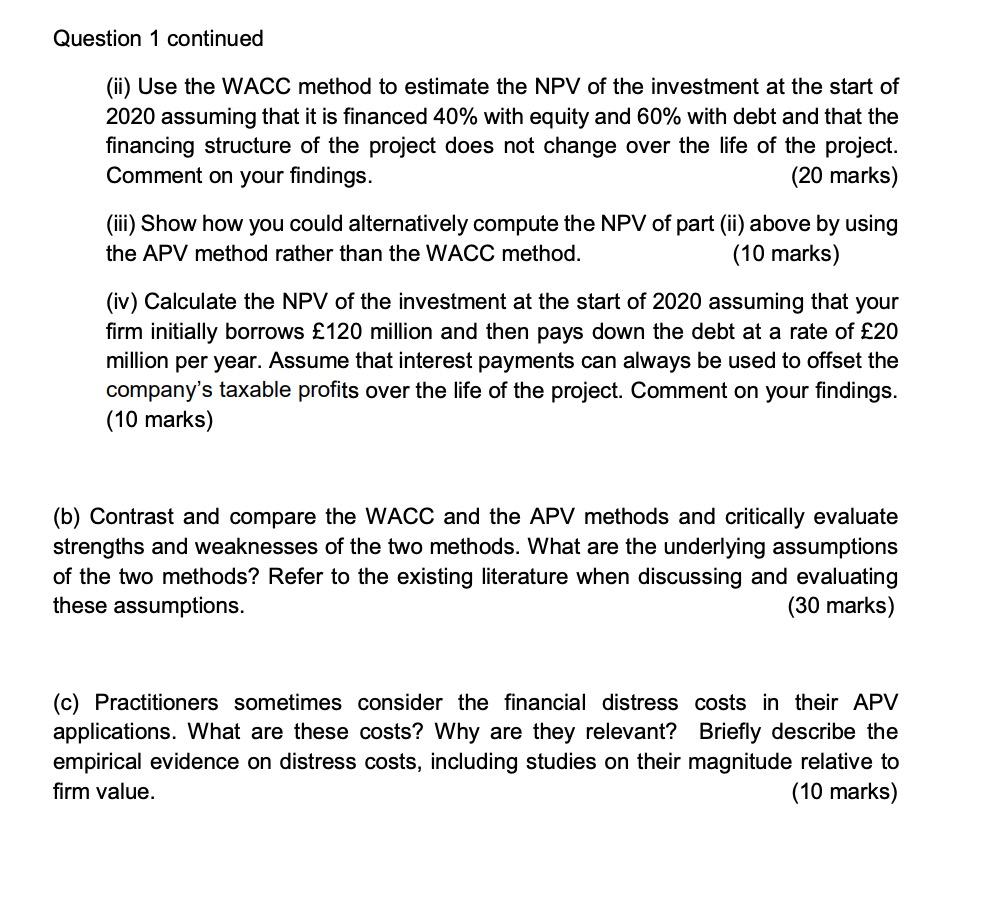

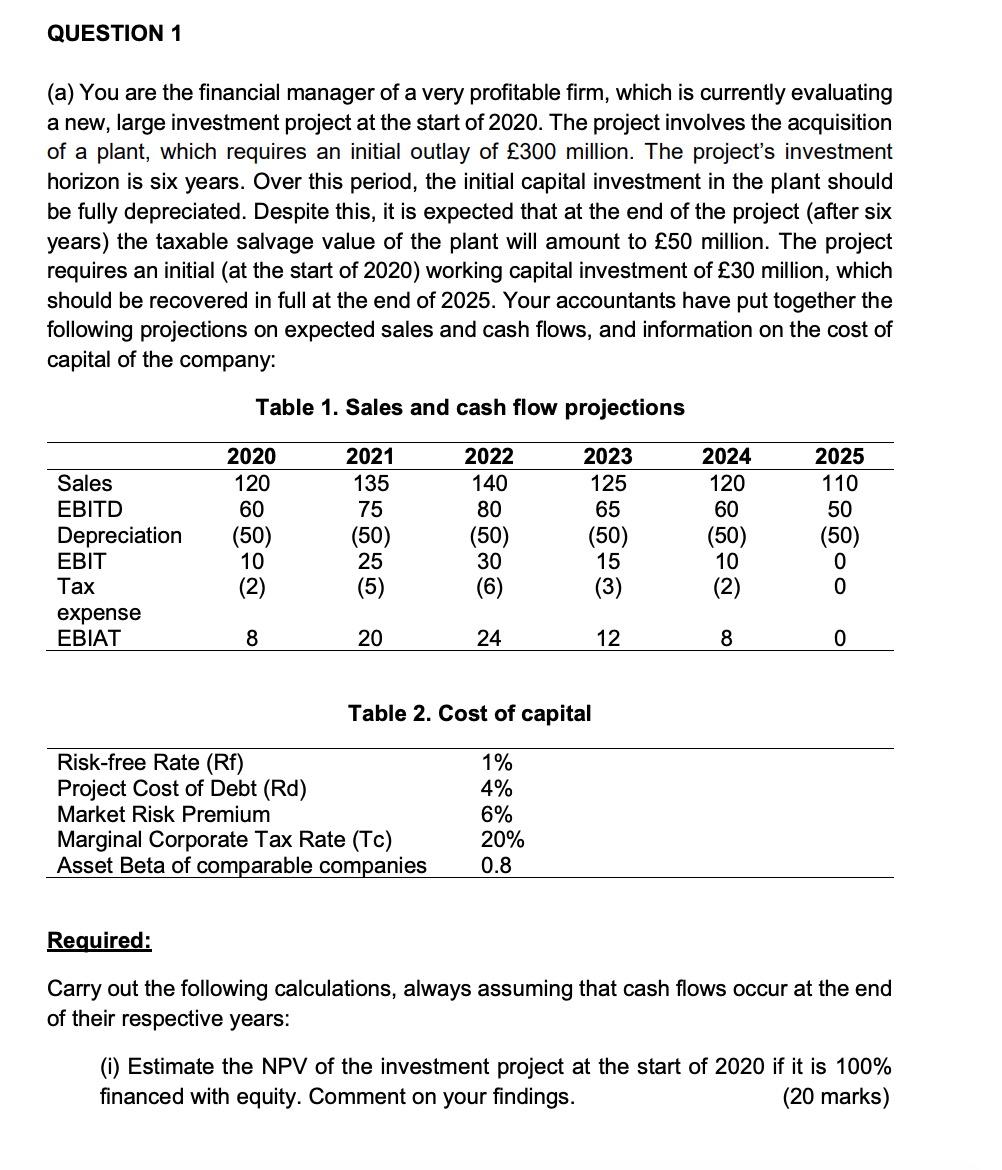

QUESTION 1 (a) You are the financial manager of a very profitable firm, which is currently evaluating a new, large investment project at the start of 2020. The project involves the acquisition of a plant, which requires an initial outlay of 300 million. The project's investment horizon is six years. Over this period, the initial capital investment in the plant should be fully depreciated. Despite this, it is expected that at the end of the project (after six years) the taxable salvage value of the plant will amount to 50 million. The project requires an initial (at the start of 2020) working capital investment of 30 million, which should be recovered in full at the end of 2025. Your accountants have put together the following projections on expected sales and cash flows, and information on the cost of capital of the company: Table 1. Sales and cash flow projections Sales EBITD Depreciation EBIT Tax expense EBIAT 2020 120 60 (50) 10 (2) 2021 135 75 (50) 25 (5) 2022 140 80 (50) 30 (6) 2023 125 65 (50) 15 (3) 2024 120 60 (50) 10 (2) 2025 110 50 (50) 0 0 8 20 24 12 8 0 Table 2. Cost of capital Risk-free Rate (RF) Project Cost of Debt (Rd) Market Risk Premium Marginal Corporate Tax Rate (Tc) Asset Beta of comparable companies 1% 4% 6% 20% 0.8 Required: Carry out the following calculations, always assuming that cash flows occur at the end of their respective years: (i) Estimate the NPV of the investment project at the start of 2020 if it is 100% financed with equity. Comment on your findings. (20 marks) Question 1 continued (ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings. (20 marks) (iii) Show how you could alternatively compute the NPV of part (ii) above by using the APV method rather than the WACC method. (10 marks) (iv) Calculate the NPV of the investment at the start of 2020 assuming that your firm initially borrows 120 million and then pays down the debt at a rate of 20 million per year. Assume that interest payments can always be used to offset the company's taxable profits over the life of the project. Comment on your findings. (10 marks) (b) Contrast and compare the WACC and the APV methods and critically evaluate strengths and weaknesses of the two methods. What are the underlying assumptions of the two methods? Refer to the existing literature when discussing and evaluating these assumptions. (30 marks) (c) Practitioners sometimes consider the financial distress costs in their APV applications. What are these costs? Why are they relevant? Briefly describe the empirical evidence on distress costs, including studies on their magnitude relative to firm value. (10 marks) QUESTION 1 (a) You are the financial manager of a very profitable firm, which is currently evaluating a new, large investment project at the start of 2020. The project involves the acquisition of a plant, which requires an initial outlay of 300 million. The project's investment horizon is six years. Over this period, the initial capital investment in the plant should be fully depreciated. Despite this, it is expected that at the end of the project (after six years) the taxable salvage value of the plant will amount to 50 million. The project requires an initial (at the start of 2020) working capital investment of 30 million, which should be recovered in full at the end of 2025. Your accountants have put together the following projections on expected sales and cash flows, and information on the cost of capital of the company: Table 1. Sales and cash flow projections Sales EBITD Depreciation EBIT Tax expense EBIAT 2020 120 60 (50) 10 (2) 2021 135 75 (50) 25 (5) 2022 140 80 (50) 30 (6) 2023 125 65 (50) 15 (3) 2024 120 60 (50) 10 (2) 2025 110 50 (50) 0 0 8 20 24 12 8 0 Table 2. Cost of capital Risk-free Rate (RF) Project Cost of Debt (Rd) Market Risk Premium Marginal Corporate Tax Rate (Tc) Asset Beta of comparable companies 1% 4% 6% 20% 0.8 Required: Carry out the following calculations, always assuming that cash flows occur at the end of their respective years: (i) Estimate the NPV of the investment project at the start of 2020 if it is 100% financed with equity. Comment on your findings. (20 marks) Question 1 continued (ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings. (20 marks) (iii) Show how you could alternatively compute the NPV of part (ii) above by using the APV method rather than the WACC method. (10 marks) (iv) Calculate the NPV of the investment at the start of 2020 assuming that your firm initially borrows 120 million and then pays down the debt at a rate of 20 million per year. Assume that interest payments can always be used to offset the company's taxable profits over the life of the project. Comment on your findings. (10 marks) (b) Contrast and compare the WACC and the APV methods and critically evaluate strengths and weaknesses of the two methods. What are the underlying assumptions of the two methods? Refer to the existing literature when discussing and evaluating these assumptions. (30 marks) (c) Practitioners sometimes consider the financial distress costs in their APV applications. What are these costs? Why are they relevant? Briefly describe the empirical evidence on distress costs, including studies on their magnitude relative to firm value. (10 marks)

(ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings.

(ii) Use the WACC method to estimate the NPV of the investment at the start of 2020 assuming that it is financed 40% with equity and 60% with debt and that the financing structure of the project does not change over the life of the project. Comment on your findings.