Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap Click Submit to complete this assessment. Question 5 of 5 Save Answer Question 5 16 points A Tampa based contract manufacturer purchased a

answer asap

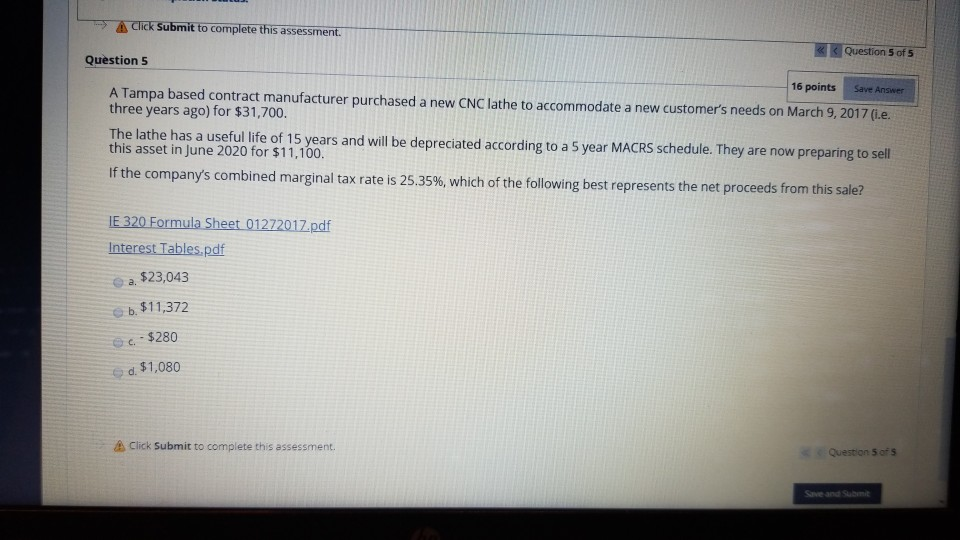

Click Submit to complete this assessment. Question 5 of 5 Save Answer Question 5 16 points A Tampa based contract manufacturer purchased a new CNC lathe to accommodate a new customer's needs on March 9, 2017 (i.e. three years ago) for $31,700. The lathe has a useful life of 15 years and will be depreciated according to a 5 year MACRS schedule. They are now preparing to sell this asset in June 2020 for $11,100. If the company's combined marginal tax rate is 25.35%, which of the following best represents the net proceeds from this sale? IE 320 Formula Sheet 01272017.pdf Interest Tables.pdf 2. $23,043 b. $11,372 c. - $280 d. $1,080 Click Submit to complete this assessment. Question 5 of 5 Save and submit Click Submit to complete this assessment. Question 5 of 5 Save Answer Question 5 16 points A Tampa based contract manufacturer purchased a new CNC lathe to accommodate a new customer's needs on March 9, 2017 (i.e. three years ago) for $31,700. The lathe has a useful life of 15 years and will be depreciated according to a 5 year MACRS schedule. They are now preparing to sell this asset in June 2020 for $11,100. If the company's combined marginal tax rate is 25.35%, which of the following best represents the net proceeds from this sale? IE 320 Formula Sheet 01272017.pdf Interest Tables.pdf 2. $23,043 b. $11,372 c. - $280 d. $1,080 Click Submit to complete this assessment. Question 5 of 5 Save and submitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started