answer asap please

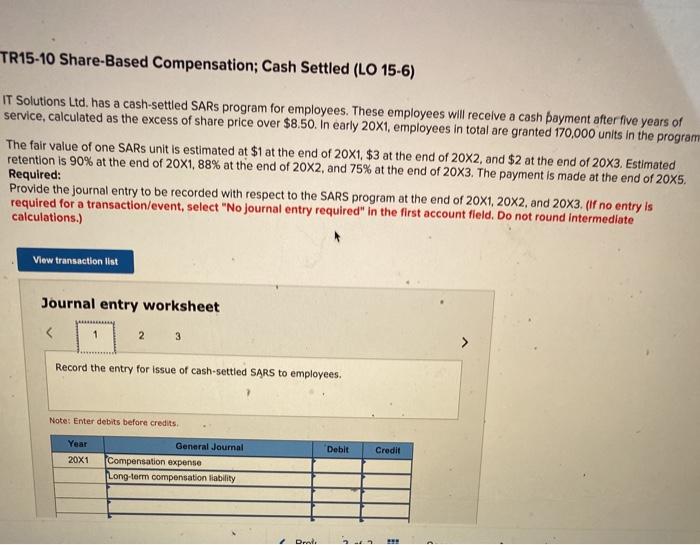

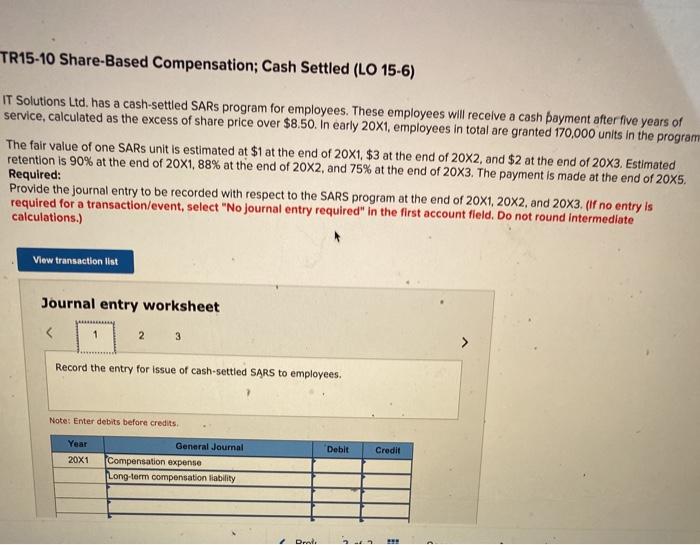

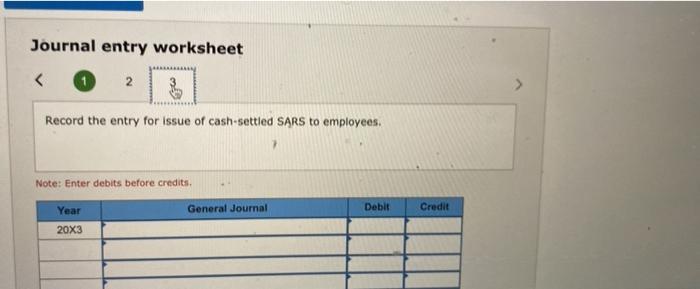

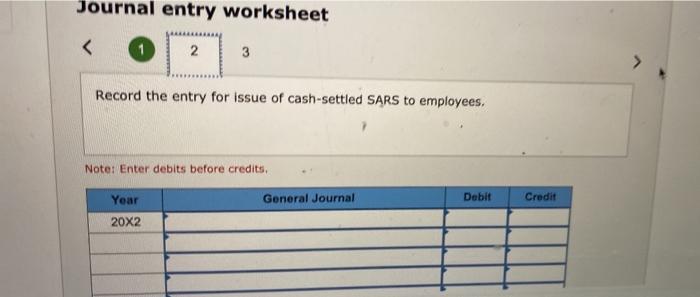

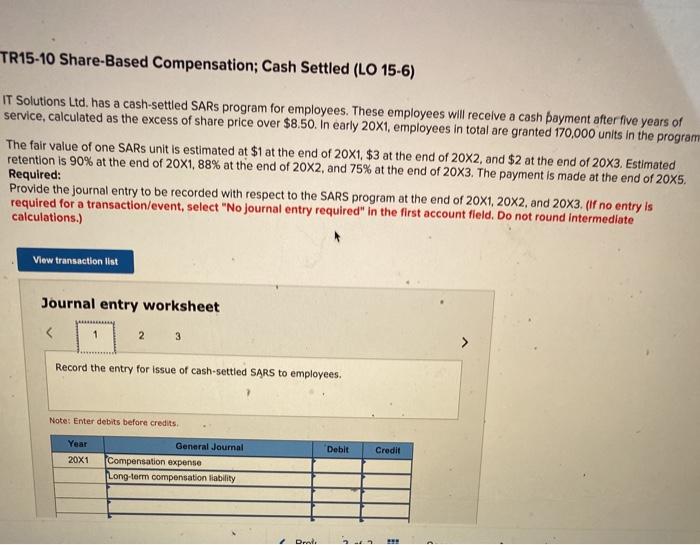

TR15-10 Share-Based Compensation; Cash Settled (LO 15-6) IT Solutions Ltd. has a cash-settled SARS program for employees. These employees will receive a cash payment after five years of service, calculated as the excess of share price over $8.50. in early 20x1, employees in total are granted 170,000 units in the programm The fair value of one SARs unit is estimated at $1 at the end of 20x1, $3 at the end of 20x2, and $2 at the end of 20x3. Estimated retention is 90% at the end of 20X1,88% at the end of 20x2, and 75% at the end of 20X3. The payment is made at the end of 20X5. Required: Provide the journal entry to be recorded with respect to the SARS program at the end of 20X1, 20x2, and 20X3. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round Intermediate calculations.) View transaction list Journal entry worksheet 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits Year Debit Credit 20X1 General Journal Compensation expense Long-term compensation liability Dr. Journal entry worksheet 1 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits Year General Journal Debit Credit 20X3 Journal entry worksheet 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits. Year General Journal Debit Credit 20X2 TR15-10 Share-Based Compensation; Cash Settled (LO 15-6) IT Solutions Ltd. has a cash-settled SARS program for employees. These employees will receive a cash payment after five years of service, calculated as the excess of share price over $8.50. in early 20x1, employees in total are granted 170,000 units in the programm The fair value of one SARs unit is estimated at $1 at the end of 20x1, $3 at the end of 20x2, and $2 at the end of 20x3. Estimated retention is 90% at the end of 20X1,88% at the end of 20x2, and 75% at the end of 20X3. The payment is made at the end of 20X5. Required: Provide the journal entry to be recorded with respect to the SARS program at the end of 20X1, 20x2, and 20X3. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round Intermediate calculations.) View transaction list Journal entry worksheet 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits Year Debit Credit 20X1 General Journal Compensation expense Long-term compensation liability Dr. Journal entry worksheet 1 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits Year General Journal Debit Credit 20X3 Journal entry worksheet 2 3 Record the entry for issue of cash-settled SARS to employees. Note: Enter debits before credits. Year General Journal Debit Credit 20X2