answer asap pls

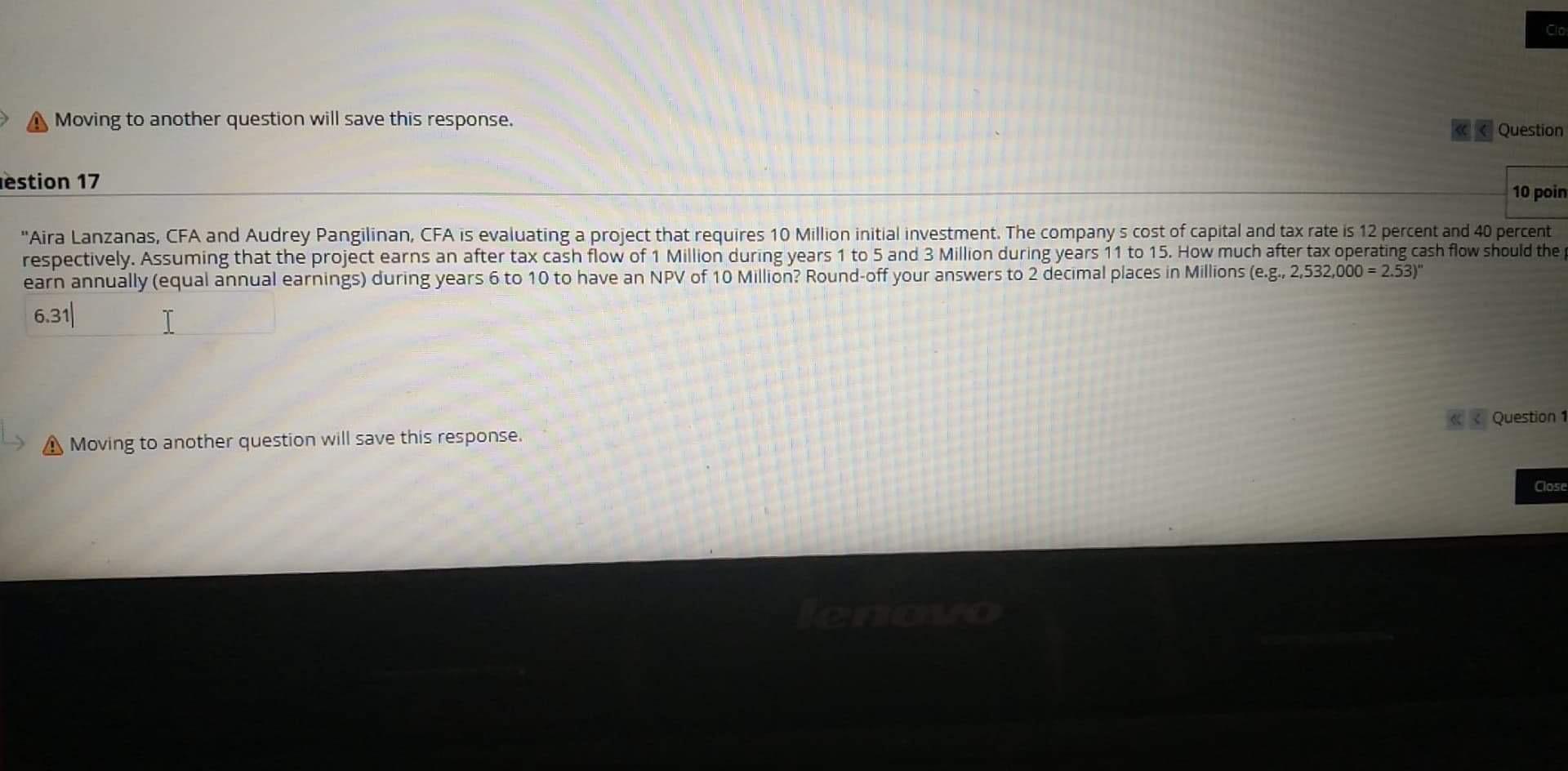

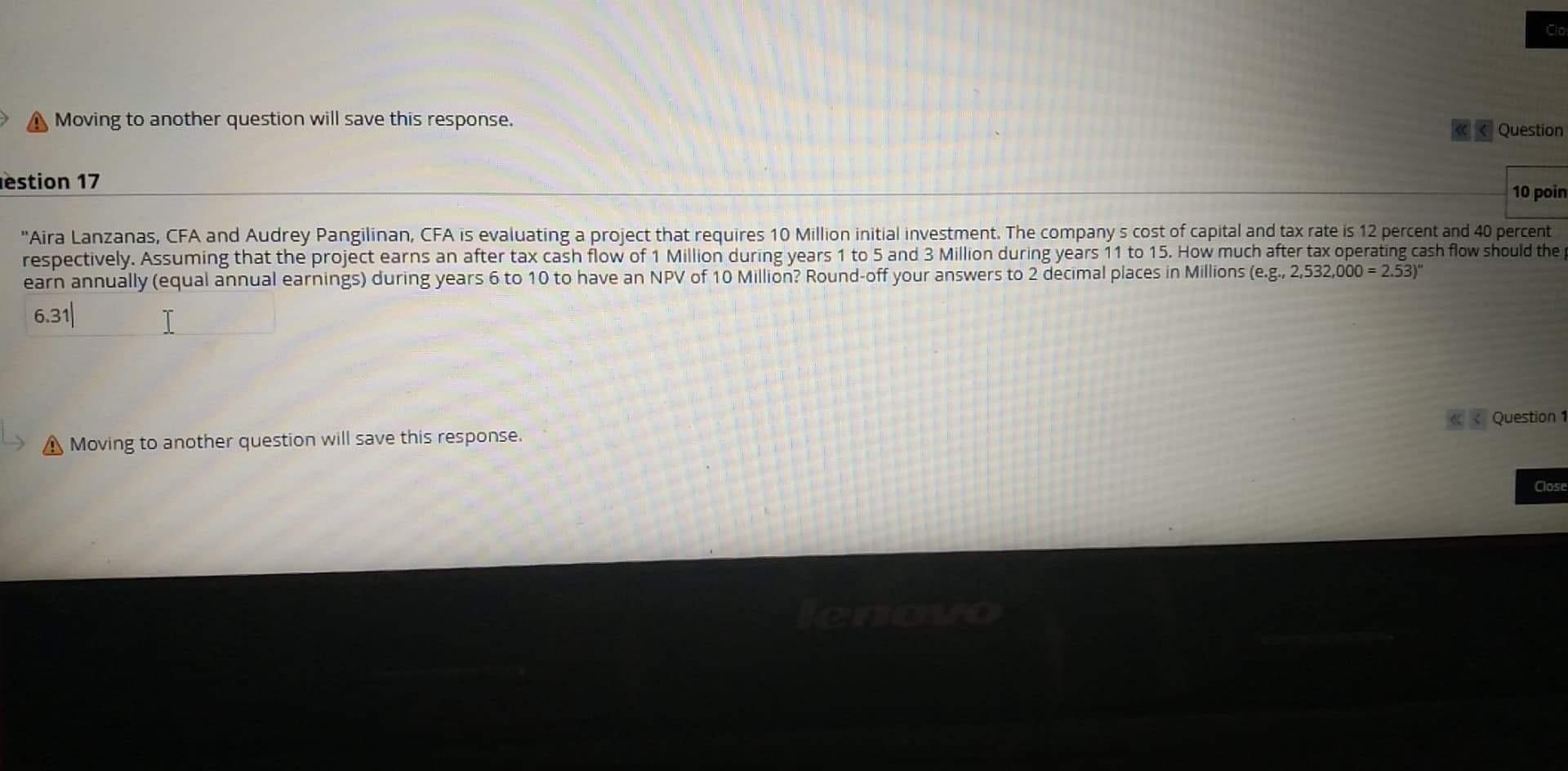

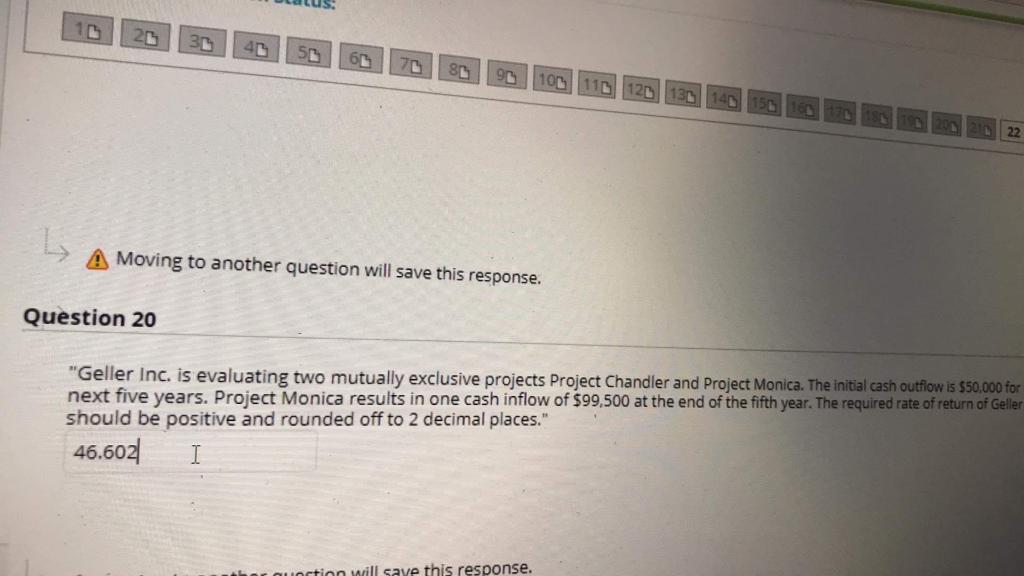

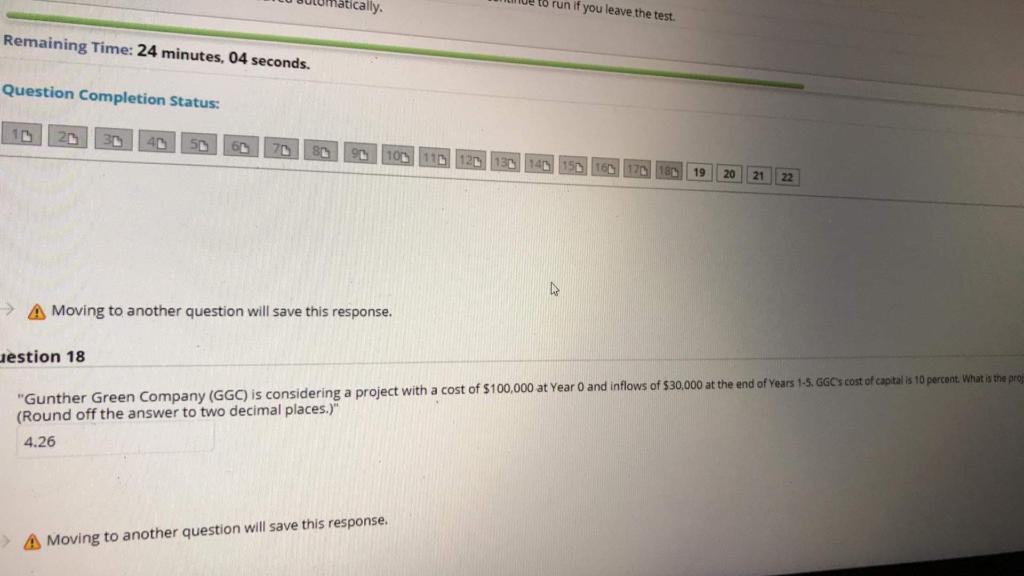

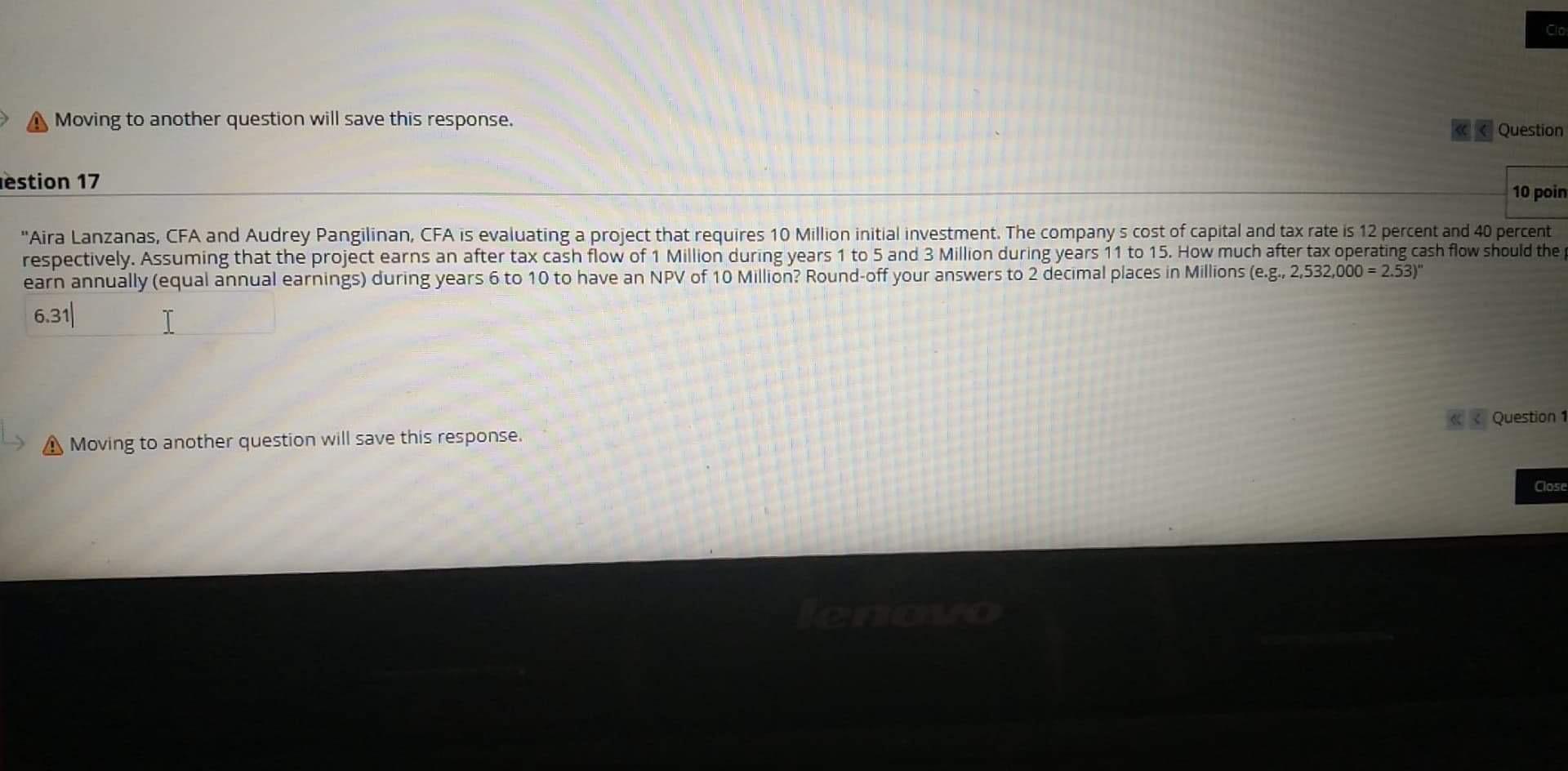

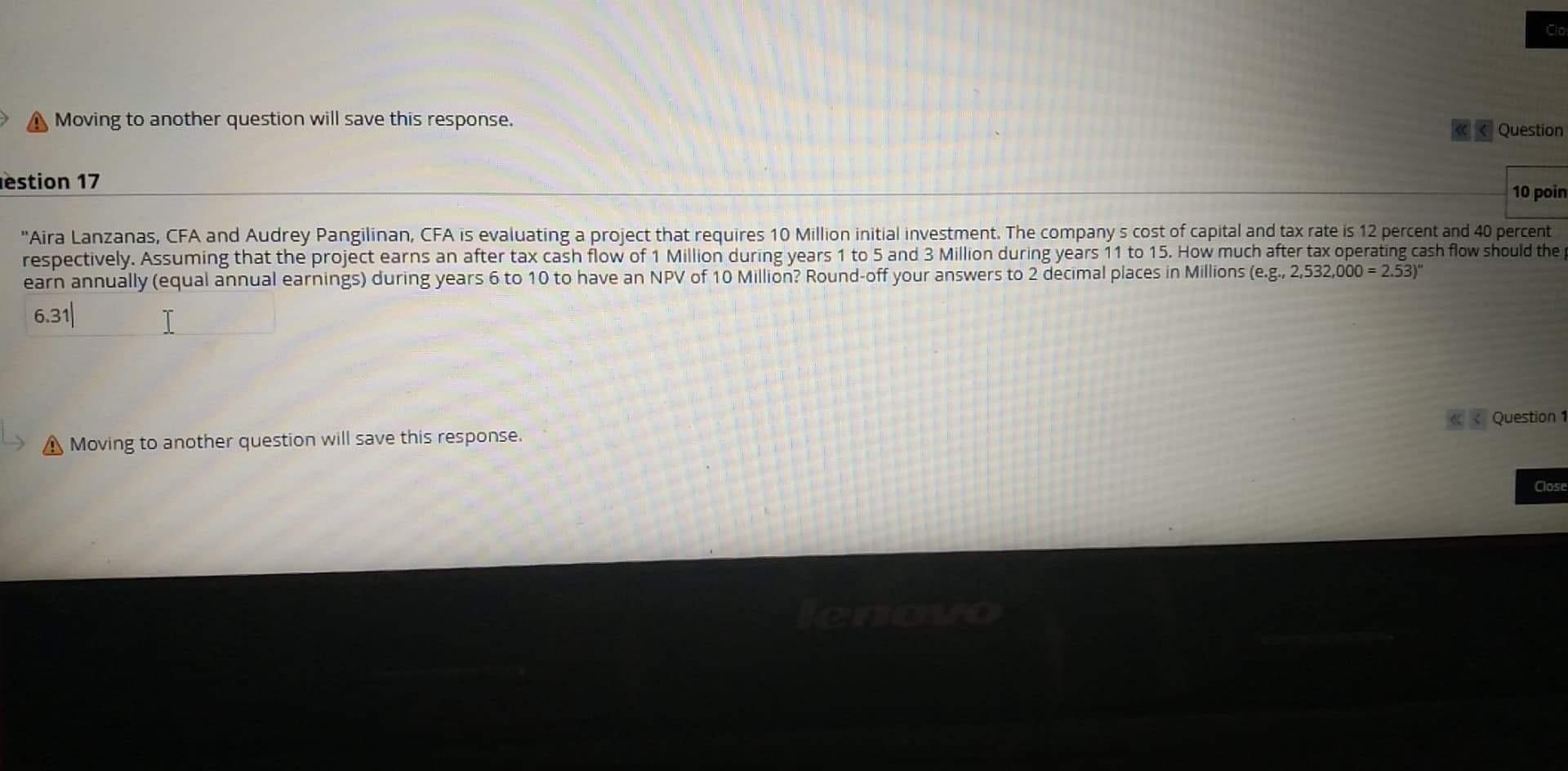

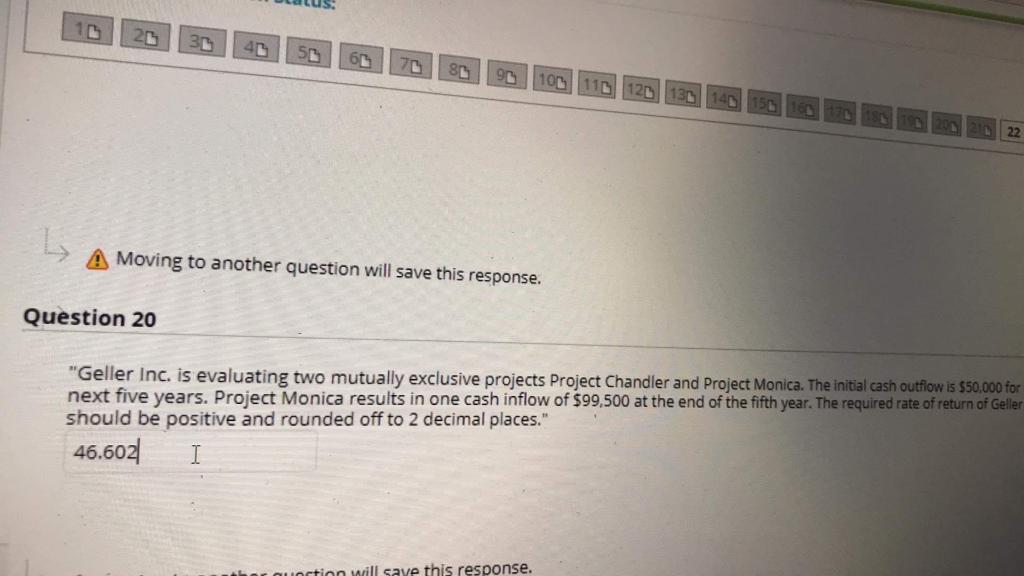

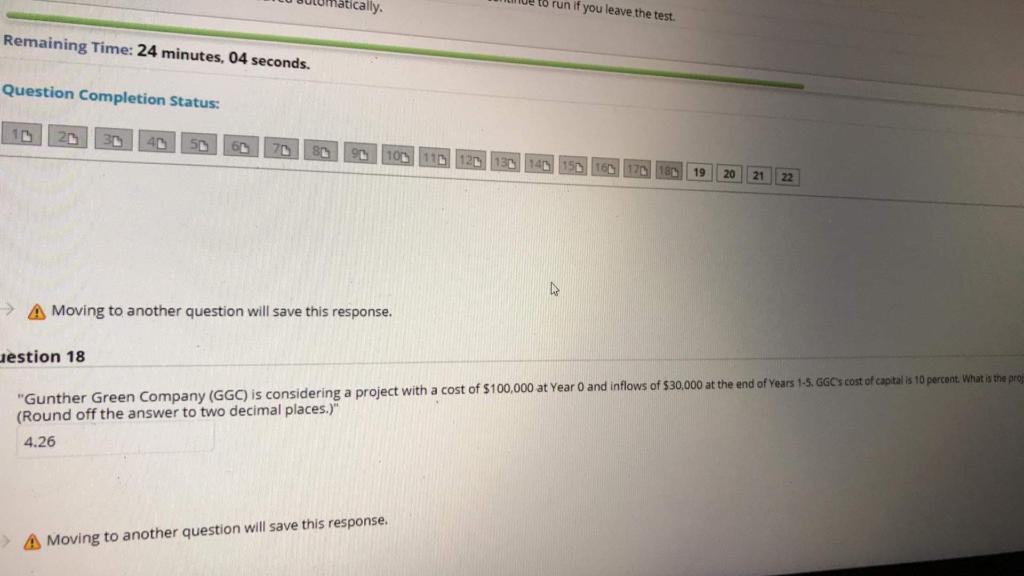

CIOS Moving to another question will save this response. ke Question Testion 17 10 poin "Aira Lanzanas, CFA and Audrey Pangilinan, CFA is evaluating a project that requires 10 Million initial investment. The company s cost of capital and tax rate is 12 percent and 40 percent respectively. Assuming that the project earns an after tax cash flow of 1 Million during years 1 to 5 and 3 Million during years 11 to 15. How much after tax operating cash flow should the earn annually (equal annual earnings) during years 6 to 10 to have an NPV of 10 Million? Round-off your answers to 2 decimal places in Millions (e.g., 2,532,000 = 2.53)" 6.311 I Question 1 Moving to another question will save this response. Close CIOS Moving to another question will save this response. ke Question Testion 17 10 poin "Aira Lanzanas, CFA and Audrey Pangilinan, CFA is evaluating a project that requires 10 Million initial investment. The company s cost of capital and tax rate is 12 percent and 40 percent respectively. Assuming that the project earns an after tax cash flow of 1 Million during years 1 to 5 and 3 Million during years 11 to 15. How much after tax operating cash flow should the earn annually (equal annual earnings) during years 6 to 10 to have an NPV of 10 Million? Round-off your answers to 2 decimal places in Millions (e.g., 2,532,000 = 2.53)" 6.311 I Question 1 Moving to another question will save this response. Close 26 SL 90 100 110 120 130 149 150 L A Moving to another question will save this response. Question 20 "Geller Inc. is evaluating two mutually exclusive projects Project Chandler and Project Monica. The initial cash outflow is $50,000 for next five years. Project Monica results in one cash inflow of $99.500 at the end of the fifth year. The required rate of return of Geller should be positive and rounded off to 2 decimal places." 46.602 I har Loction will save this response. to run if you leave the test. Remaining Time: 24 minutes, 04 seconds. Question Completion Status: 4 6 19 20 22 A Moving to another question will save this response. uestion 18 "Gunther Green Company (GGC) is considering a project with a cost of $100,000 at Year O and inflows of $30,000 at the end of Years 1-5. GGC's cost of capital is 10 percent. What is the proje (Round off the answer to two decimal places.)" 4.26 A Moving to another question will save this response