answer asap

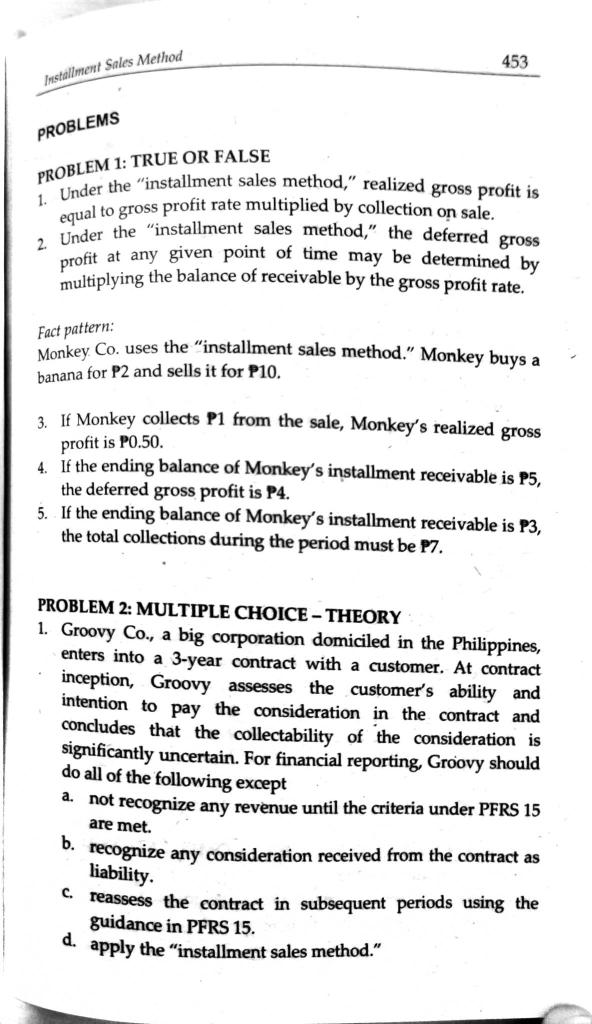

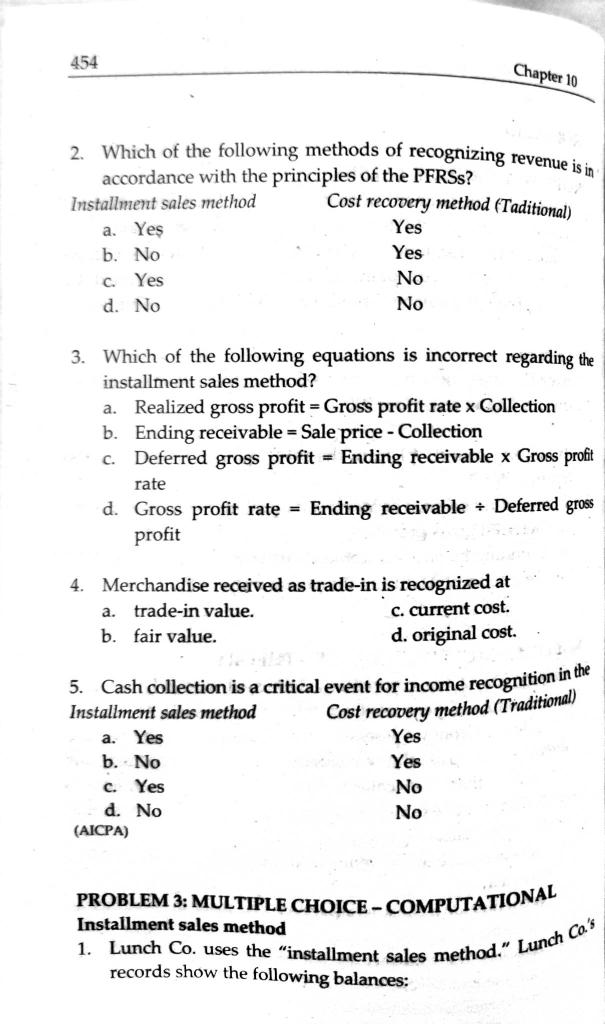

PROBLEM 1: TRUE OR FALSE 1. Under the "installment sales method," realized gross profit is equal to gross profit rate multiplied by collection on sale. 2. Under the "installment sales method," the deferred gross profit at any given point of time may be determined by multiplying the balance of receivable by the gross profit rate. Fact pattern: Monkey. Co. uses the "installment sales method." Monkey buys a banana for P2 and sells it for P10. 3. If Monkey collects P1 from the sale, Monkey's realized gross profit is P00.50. 4. If the ending balance of Monkey's installment receivable is P5, the deferred gross profit is P4. 5. If the ending balance of Monkey's installment receivable is P3, the total collections during the period must be P7. PROBLEM 2: MULTIPLE CHOICE - THEORY 1. Groovy Co., a big corporation domiciled in the Philippines, enters into a 3-year contract with a customer. At contract inception, Groovy assesses the customer's ability and intention to pay the consideration in the contract and concludes that the collectability of the consideration is significantly uncertain. For financial reporting, Groovy should do all of the following except a. not recognize any revenue until the criteria under PFRS 15 are met. b. recognize any consideration received from the contract as liability. c. reassess the contract in subsequent periods using the guidance in PFRS 15. d. apply the "installment sales method." 2. Which of the following methods of recognizing revenue is in accordance with the principles of the PFRSs? 3. Which of the following equations is incorrect regarding the installment sales method? a. Realized gross profit = Gross profit rate Collection b. Ending receivable = Sale price Collection c. Deferred gross profit = Ending receivable Gross profit rate d. Gross profit rate = Ending receivable Deferred gross profit 4. Merchandise received as trade-in is recognized at a. trade-in value. c. current cost. b. fair value. d. original cost. 5. Cash collection is a critical event for income recognition in the Installment sales method Cost recovery method (Traditional) a. Yes Yes b. No Yes c. Yes No d. No No (AICPA) PROBLEM 3: MULTIPLE CHOICE - COMPUTATIONAL Installment sales method 1. Lunch Co. uses the "installment sales method." Lunch ca.'s records show the following balances