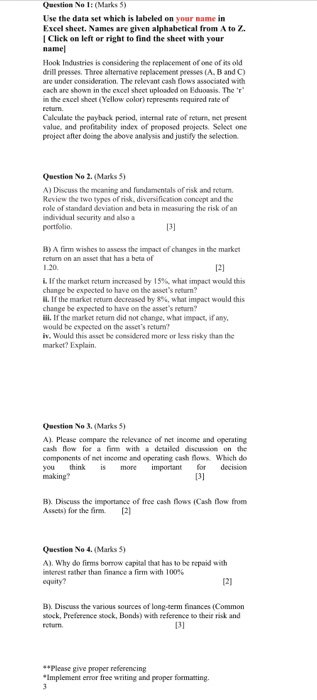

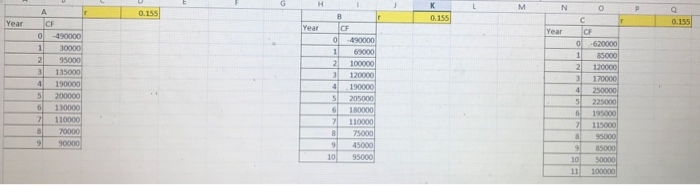

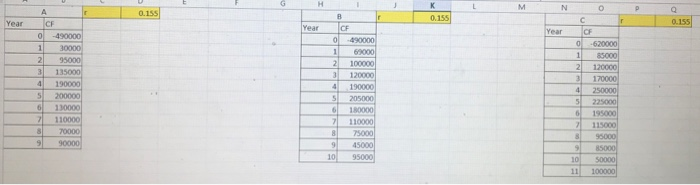

answer based on this data sheet

Question No 1: (Marks 5) Use the data set which is labeled on your name in Excel sheet. Names are given alphabetical from A to Z. Click on left or right to find the sheet with your namel Hook Industries is considering the replacement of one of its old drill presses. Three alternative replacement presses (A, B and C) are under consideration. The relevant cash flows associated with cach are shown in the excel sheet uploaded on Eduoasis. Ther in the excel sheet (Yellow color) represents required rate of Calculate the payback period, internal rate of return, net present value, and profitability index of proposed projects. Select one project after doing the above analysis and justify the selection Question No 2. (Marks 5) A) Discuss the meaning and fundamentals of risk and return Review the two types of risk, diversification concept and the role of standard deviation and beta in measuring the risk of an individual security and also a portfolio [3] B) A firm wishes to assess the impact of changes in the market retum on an asset that has a beta of 1.20 121 i. If the market return increased by 15%, what impact would this change be expected to have on the asset's retur? IL. If the market return decreased by 8%, what impact would this change be expected to have on the asset's return ili. If the market retum did not change. What impact, if any, would be expected on the asset's retum iv. Would this asset be considered more or less risky than the market? Explain. Question No 3. (Marks 5) A). Please compare the relevance of net income and operating cash flow for a firm with a detailed discussion on the components of net income and operating cash flows. Which do you think is more important for decision making? 131 B). Discuss the importance of free cash flows (Cash flow from Assets) for the firm 121 Question No 4. (Marks 5) A). Why do firms borrow capital that has to be repaid with interest rather than finance a firm with 100% 121 B). Discuss the various sources of long-term finances (Common stock, Preference stock, Bonds) with reference to their risk and return **Please give proper referencing *Implement error free writing and proper formatting. H 1 M N O A p a 0.155 K 0.155 Year r 0.155 Year Year 0 D 1 N 3 4 - 490000 30000 95000 135000 190000 200000 130000 110000 70000 90000 B |CF 0 - 490000 1 69000 2 100000 120000 4 190000 5 205000 6 180000 7 110000 75000 45000 95000 5 c OF -620000 85000 2 120000 3 170000 4 250000 5 225000 195000 115000 8 95000 9 85000 10 50000 11 100000 6 9 2 8 8 6 OT H 1 M N O A p a 0.155 K 0.155 Year r 0.155 Year Year 0 D 1 N 3 4 - 490000 30000 95000 135000 190000 200000 130000 110000 70000 90000 B |CF 0 - 490000 1 69000 2 100000 120000 4 190000 5 205000 6 180000 7 110000 75000 45000 95000 5 c OF -620000 85000 2 120000 3 170000 4 250000 5 225000 195000 115000 8 95000 9 85000 10 50000 11 100000 6 9 2 8 8 6 OT Question No 1: (Marks 5) Use the data set which is labeled on your name in Excel sheet. Names are given alphabetical from A to Z. Click on left or right to find the sheet with your namel Hook Industries is considering the replacement of one of its old drill presses. Three alternative replacement presses (A, B and C) are under consideration. The relevant cash flows associated with cach are shown in the excel sheet uploaded on Eduoasis. Ther in the excel sheet (Yellow color) represents required rate of Calculate the payback period, internal rate of return, net present value, and profitability index of proposed projects. Select one project after doing the above analysis and justify the selection Question No 2. (Marks 5) A) Discuss the meaning and fundamentals of risk and return Review the two types of risk, diversification concept and the role of standard deviation and beta in measuring the risk of an individual security and also a portfolio [3] B) A firm wishes to assess the impact of changes in the market retum on an asset that has a beta of 1.20 121 i. If the market return increased by 15%, what impact would this change be expected to have on the asset's retur? IL. If the market return decreased by 8%, what impact would this change be expected to have on the asset's return ili. If the market retum did not change. What impact, if any, would be expected on the asset's retum iv. Would this asset be considered more or less risky than the market? Explain. Question No 3. (Marks 5) A). Please compare the relevance of net income and operating cash flow for a firm with a detailed discussion on the components of net income and operating cash flows. Which do you think is more important for decision making? 131 B). Discuss the importance of free cash flows (Cash flow from Assets) for the firm 121 Question No 4. (Marks 5) A). Why do firms borrow capital that has to be repaid with interest rather than finance a firm with 100% 121 B). Discuss the various sources of long-term finances (Common stock, Preference stock, Bonds) with reference to their risk and return **Please give proper referencing *Implement error free writing and proper formatting. H 1 M N O A p a 0.155 K 0.155 Year r 0.155 Year Year 0 D 1 N 3 4 - 490000 30000 95000 135000 190000 200000 130000 110000 70000 90000 B |CF 0 - 490000 1 69000 2 100000 120000 4 190000 5 205000 6 180000 7 110000 75000 45000 95000 5 c OF -620000 85000 2 120000 3 170000 4 250000 5 225000 195000 115000 8 95000 9 85000 10 50000 11 100000 6 9 2 8 8 6 OT H 1 M N O A p a 0.155 K 0.155 Year r 0.155 Year Year 0 D 1 N 3 4 - 490000 30000 95000 135000 190000 200000 130000 110000 70000 90000 B |CF 0 - 490000 1 69000 2 100000 120000 4 190000 5 205000 6 180000 7 110000 75000 45000 95000 5 c OF -620000 85000 2 120000 3 170000 4 250000 5 225000 195000 115000 8 95000 9 85000 10 50000 11 100000 6 9 2 8 8 6 OT