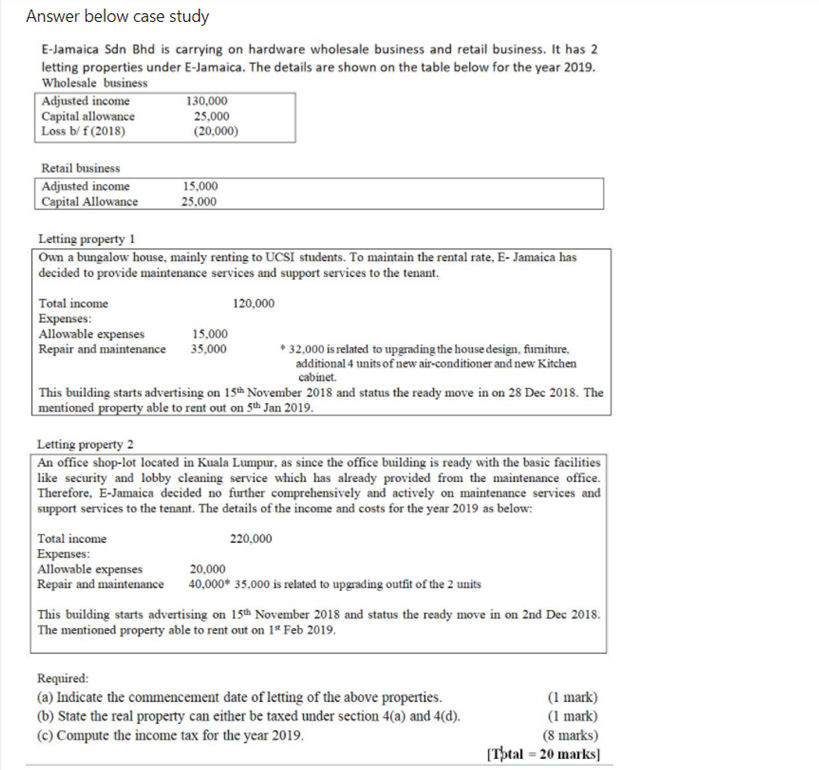

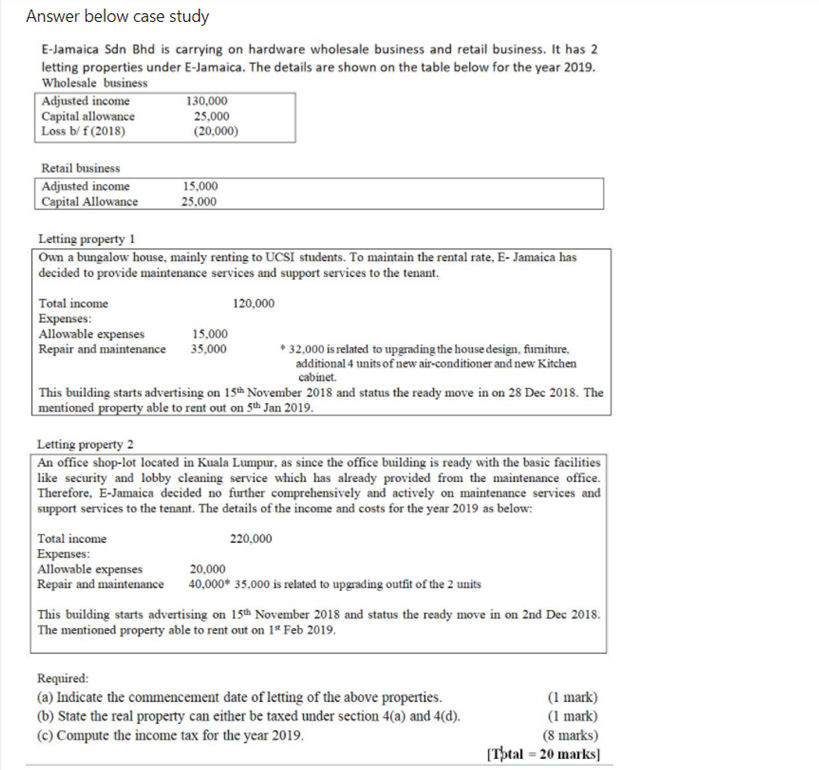

Answer below case study E-Jamaica Sdn Bhd is carrying on hardware wholesale business and retail business. It has 2 letting properties under E-Jamaica. The details are shown on the table below for the year 2019. Wholesale business Adjusted income 130,000 Capital allowance 25,000 Loss b/ f (2018) (20,000) Retail business Adjusted income Capital Allowance 15.000 25,000 Letting property 1 Own a bungalow house, mainly renting to UCSI students. To maintain the rental rate, E- Jamaica has decided to provide maintenance services and support services to the tenant Total income 120,000 Expenses: Allowable expenses 15,000 Repair and maintenance 35,000 * 32,000 is related to upgrading the house design, fumiture, additional 4 units of new air-conditioner and new Kitchen cabinet This building starts advertising on 15 November 2018 and status the ready move in on 28 Dec 2018. The mentioned property able to rent out on 5th Jan 2019. Letting property 2 An office shop-lot located in Kuala Lumpur, as since the office building is ready with the basic facilities like security and lobby cleaning service which has already provided from the maintenance office. Therefore, E-Jamaica decided no further comprehensively and actively on maintenance services and support services to the tenant. The details of the income and costs for the year 2019 as below: Total income 220,000 Expenses: Allowable expenses 20,000 Repair and maintenance 40,000* 35,000 is related to upgrading outfit of the 2 units This building starts advertising on 15th November 2018 and status the ready move in on 2nd Dec 2018. The mentioned property able to rent out on 1" Feb 2019. Required: (a) Indicate the commencement date of letting of the above properties. (b) State the real property can either be taxed under section 4(a) and 4(d). (c) Compute the income tax for the year 2019. (1 mark) (1 mark) (8 marks) [Total = 20 marks) Answer below case study E-Jamaica Sdn Bhd is carrying on hardware wholesale business and retail business. It has 2 letting properties under E-Jamaica. The details are shown on the table below for the year 2019. Wholesale business Adjusted income 130,000 Capital allowance 25,000 Loss b/ f (2018) (20,000) Retail business Adjusted income Capital Allowance 15.000 25,000 Letting property 1 Own a bungalow house, mainly renting to UCSI students. To maintain the rental rate, E- Jamaica has decided to provide maintenance services and support services to the tenant Total income 120,000 Expenses: Allowable expenses 15,000 Repair and maintenance 35,000 * 32,000 is related to upgrading the house design, fumiture, additional 4 units of new air-conditioner and new Kitchen cabinet This building starts advertising on 15 November 2018 and status the ready move in on 28 Dec 2018. The mentioned property able to rent out on 5th Jan 2019. Letting property 2 An office shop-lot located in Kuala Lumpur, as since the office building is ready with the basic facilities like security and lobby cleaning service which has already provided from the maintenance office. Therefore, E-Jamaica decided no further comprehensively and actively on maintenance services and support services to the tenant. The details of the income and costs for the year 2019 as below: Total income 220,000 Expenses: Allowable expenses 20,000 Repair and maintenance 40,000* 35,000 is related to upgrading outfit of the 2 units This building starts advertising on 15th November 2018 and status the ready move in on 2nd Dec 2018. The mentioned property able to rent out on 1" Feb 2019. Required: (a) Indicate the commencement date of letting of the above properties. (b) State the real property can either be taxed under section 4(a) and 4(d). (c) Compute the income tax for the year 2019. (1 mark) (1 mark) (8 marks) [Total = 20 marks)