Question

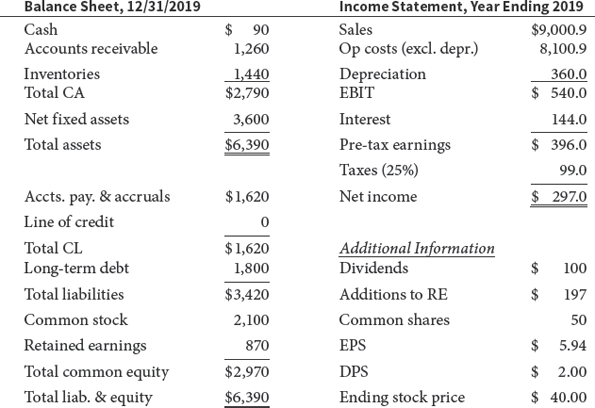

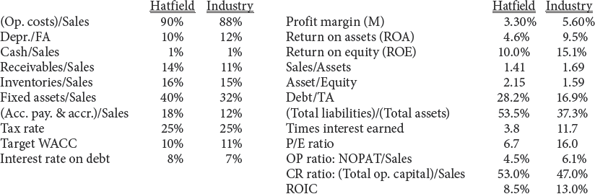

ANSWER BOLDED QUESTION Use the following assumptions to answer the following questions: (1) Operating ratios remain unchanged. (2) Sales will grow by 11.1%, 8%, 5%,

ANSWER BOLDED QUESTION

-

Use the following assumptions to answer the following questions: (1) Operating ratios remain unchanged. (2) Sales will grow by 11.1%, 8%, 5%, and 5% for the next 4 years. (3) The target weighted average cost of capital (WACC) is 10%. This is the No Change scenario because operations remain unchanged.

- (1)

For each of the next 4 years, forecast the following items: sales, cash, accounts receivable, inventories, net fixed assets, accounts payable and accruals, operating costs (excluding depreciation), depreciation, and earnings before interest and taxes (EBIT).

- (2)

Using the previously forecasted items, calculate for each of the next 4 years the net operating profit after taxes (NOPAT), net operating working capital, total operating capital, free cash flow (FCF), annual growth rate in FCF, and return on invested capital. What does the forecasted free cash flow in the first year imply about the need for external financing? Compare the forecasted ROIC with the WACC. What does this imply about how well the company is performing?

- 3)

Assume that FCF will continue to grow at the growth rate for the last year in the forecast horizon. (Hint: .) What is the horizon value at 2023? What is the present value of the horizon value? What is the present value of the forecasted FCF? (Hint: Use the free cash flows for 2020 through 2023.) What is the current value of operations? Using information from the 2019 financial statements, what is the current estimated intrinsic stock price?

- (1)

-

Continue with the same assumptions for the No Change scenario from the previous question, but now forecast the balance sheet and income statements for 2020 (but not for the following 3 years) using the following preliminary financial policy. (1) Regular dividends will grow by 10%. (2) No additional long-term debt or common stock will be issued. (3) The interest rate on all debt is 8%. (4) Interest expense for long-term debt is based on the average balance during the year. (5) If the operating results and the preliminary financing plan cause a financing deficit, eliminate the deficit by drawing on a line of credit. The line of credit would be tapped on the last day of the year, so it would create no additional interest expenses for that year. (6) If there is a financing surplus, eliminate it by paying a special dividend. After forecasting the 2020 financial statements, answer the following questions.

- (1)

How much will Hatfield need to draw on the line of credit?

- (2)

What are some alternative ways than those in the preliminary financial policy that Hatfield might choose to eliminate the financing deficit?

- (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started