answer both correctly for an upvote

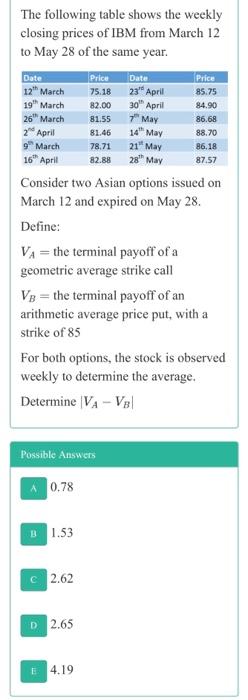

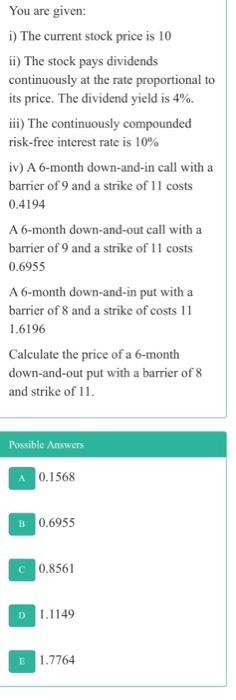

Price 75.18 82.00 81.55 81.46 78,71 82.88 Price 85.75 84.90 86.68 88.70 86.18 87.57 The following table shows the weekly closing prices of IBM from March 12 to May 28 of the same year. Date Date 12 March 23 April 19 March 30 April 26 March Y" May 2 April 14 May 9 March 21 May 16 April 28 May Consider two Asian options issued on March 12 and expired on May 28. Define: VA = the terminal payoff of a geometric average strike call Ve= the terminal payoff of an arithmetic average price put, with a Strike of 85 For both options, the stock is observed weekly to determine the average. Determine VA- Vol Possible Answers 0.78 3 1.53 c 2.62 D 2.65 4.19 You are given: 1) The current stock price is 10 ii) The stock pays dividends continuously at the rate proportional to its price. The dividend yield is 4%. iii) The continuously compounded risk-free interest rate is 10% iv) A 6-month down-and-in call with a barrier of 9 and a strike of 11 costs 0.4194 A 6-month down-and-out call with a barrier of 9 and a strike of 11 costs 0.6955 A 6-month down-and-in put with a barrier of 8 and a strike of costs 11 1.6196 Calculate the price of a 6-month down-and-out put with a barrier of 8 and strike of 11. Possible Answers 0.1568 30.6955 0.8561 D 1.1149 E 1.7764 Price 75.18 82.00 81.55 81.46 78,71 82.88 Price 85.75 84.90 86.68 88.70 86.18 87.57 The following table shows the weekly closing prices of IBM from March 12 to May 28 of the same year. Date Date 12 March 23 April 19 March 30 April 26 March Y" May 2 April 14 May 9 March 21 May 16 April 28 May Consider two Asian options issued on March 12 and expired on May 28. Define: VA = the terminal payoff of a geometric average strike call Ve= the terminal payoff of an arithmetic average price put, with a Strike of 85 For both options, the stock is observed weekly to determine the average. Determine VA- Vol Possible Answers 0.78 3 1.53 c 2.62 D 2.65 4.19 You are given: 1) The current stock price is 10 ii) The stock pays dividends continuously at the rate proportional to its price. The dividend yield is 4%. iii) The continuously compounded risk-free interest rate is 10% iv) A 6-month down-and-in call with a barrier of 9 and a strike of 11 costs 0.4194 A 6-month down-and-out call with a barrier of 9 and a strike of 11 costs 0.6955 A 6-month down-and-in put with a barrier of 8 and a strike of costs 11 1.6196 Calculate the price of a 6-month down-and-out put with a barrier of 8 and strike of 11. Possible Answers 0.1568 30.6955 0.8561 D 1.1149 E 1.7764