Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer both questions please Review of housing Calculate the answers to the following questions. 1. If John's annual salary is $72000, John has no car

answer both questions please

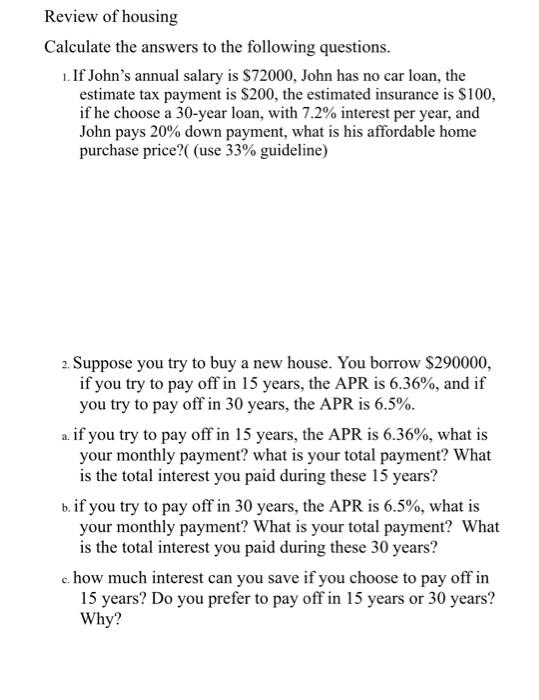

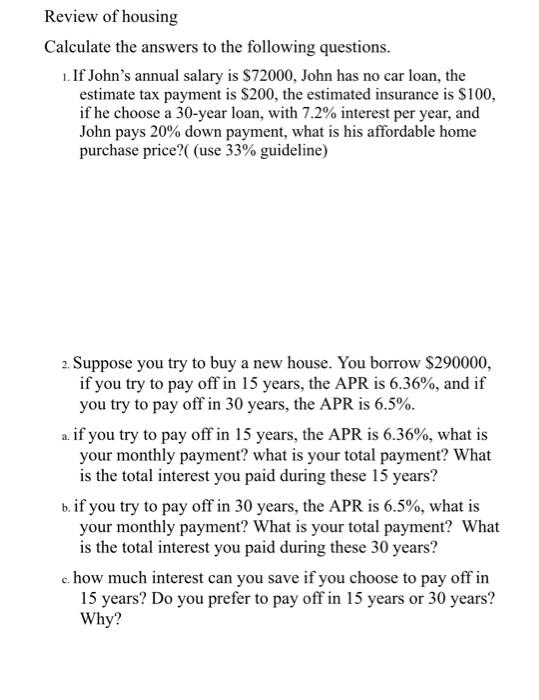

Review of housing Calculate the answers to the following questions. 1. If John's annual salary is $72000, John has no car loan, the estimate tax payment is $200, the estimated insurance is $100, if he choose a 30-year loan, with 7.2% interest per year, and John pays 20% down payment, what is his affordable home purchase price? ( (use 33% guideline) 2. Suppose you try to buy a new house. You borrow $290000, if you try to pay off in 15 years, the APR is 6.36%, and if you try to pay off in 30 years, the APR is 6.5%. a. if you try to pay off in 15 years, the APR is 6.36%, what is your monthly payment? what is your total payment? What is the total interest you paid during these 15 years? b. if you try to pay off in 30 years, the APR is 6.5%, what is your monthly payment? What is your total payment? What is the total interest you paid during these 30 years? c. how much interest can you save if you choose to pay off in 15 years? Do you prefer to pay off in 15 years or 30 years? Why? Review of housing Calculate the answers to the following questions. 1. If John's annual salary is $72000, John has no car loan, the estimate tax payment is $200, the estimated insurance is $100, if he choose a 30-year loan, with 7.2% interest per year, and John pays 20% down payment, what is his affordable home purchase price? ( (use 33% guideline) 2. Suppose you try to buy a new house. You borrow $290000, if you try to pay off in 15 years, the APR is 6.36%, and if you try to pay off in 30 years, the APR is 6.5%. a. if you try to pay off in 15 years, the APR is 6.36%, what is your monthly payment? what is your total payment? What is the total interest you paid during these 15 years? b. if you try to pay off in 30 years, the APR is 6.5%, what is your monthly payment? What is your total payment? What is the total interest you paid during these 30 years? c. how much interest can you save if you choose to pay off in 15 years? Do you prefer to pay off in 15 years or 30 years? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started