Answered step by step

Verified Expert Solution

Question

1 Approved Answer

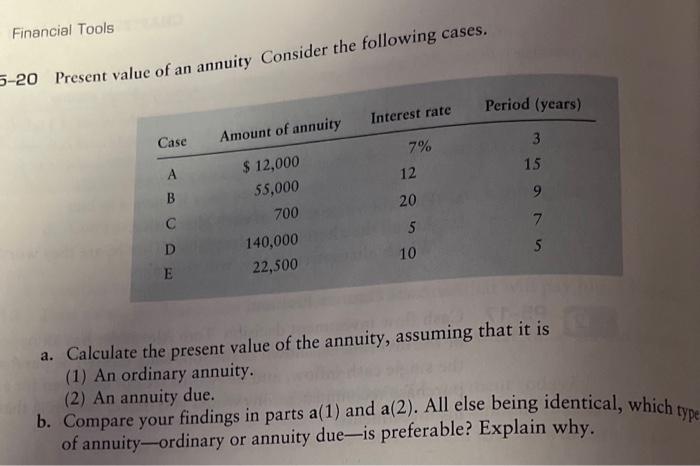

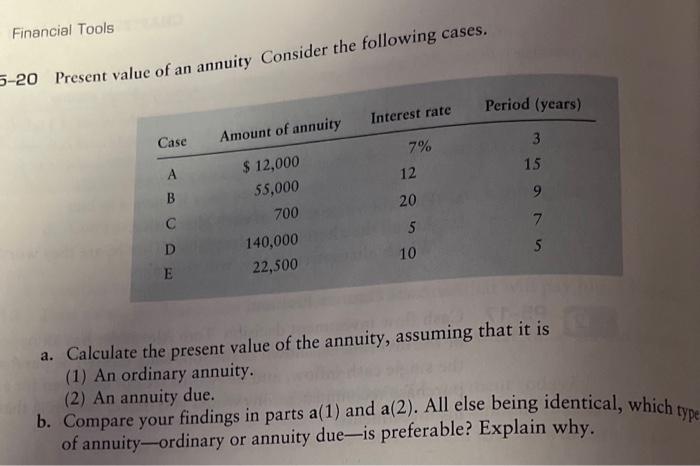

answer case A part A only Financial Tools 5-20 Present value of an annuity Consider the following cases. Period (years) Interest rate Case 7% 3

answer case A part A only

Financial Tools 5-20 Present value of an annuity Consider the following cases. Period (years) Interest rate Case 7% 3 15 12 B 9 Amount of annuity $ 12,000 55,000 700 140,000 22,500 20 7 5 D E 5 10 a. Calculate the present value of the annuity, assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity dueis preferable? Explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started