answer case questione 1-4

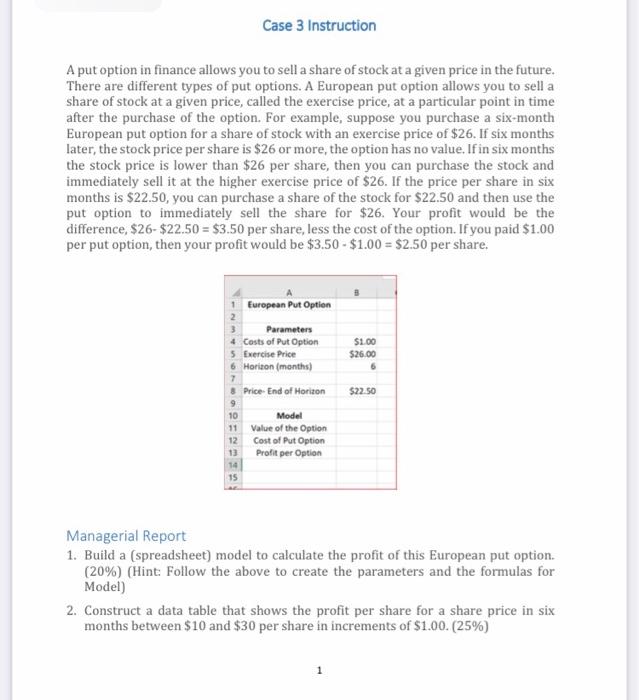

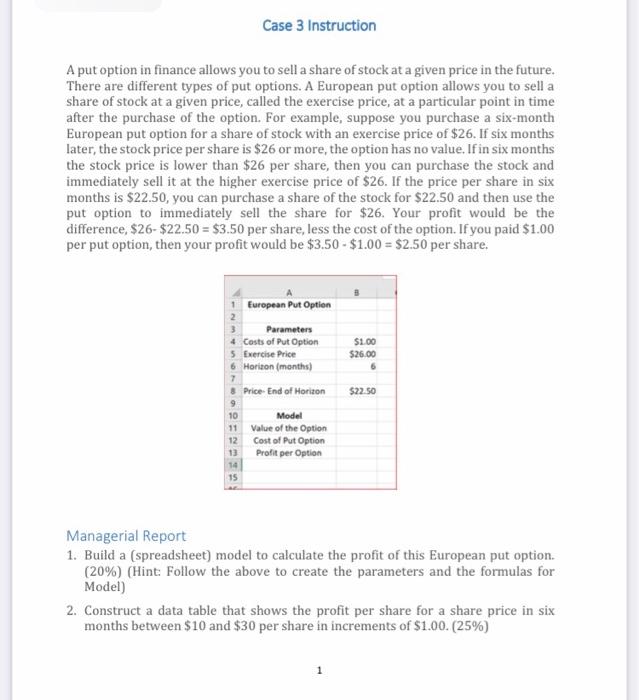

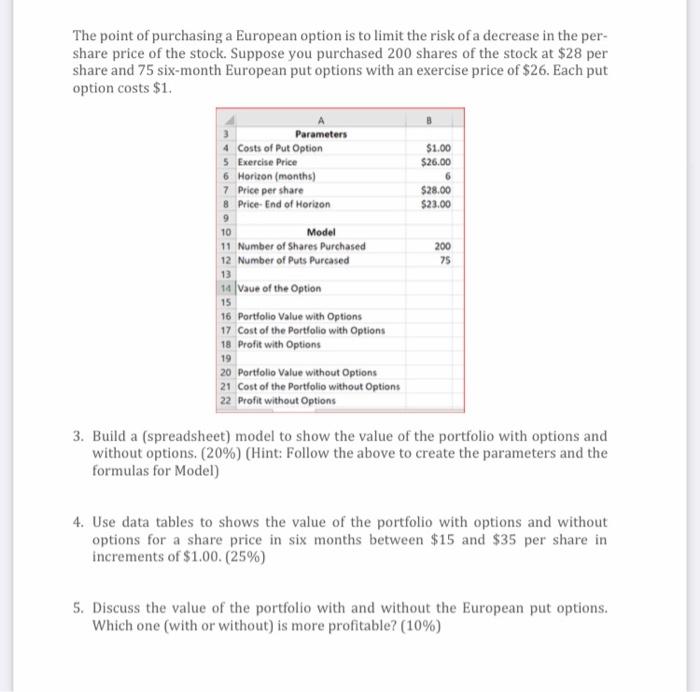

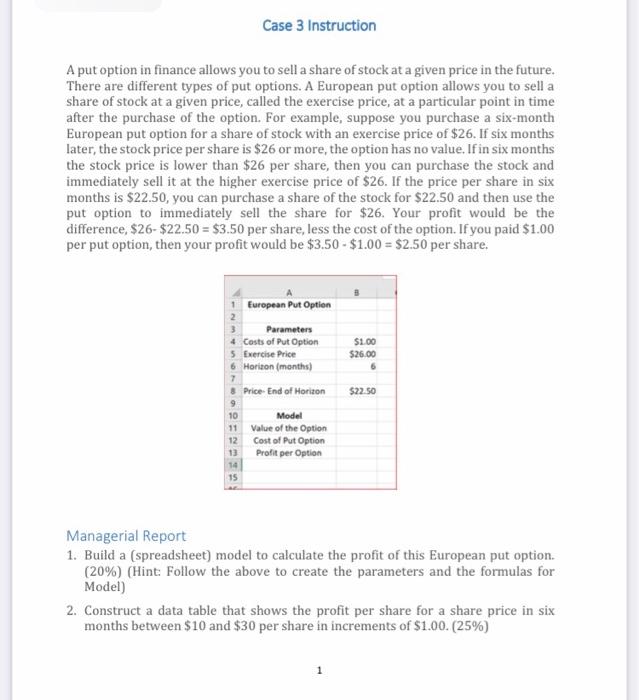

Case 3 Instruction A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put options. A European put option allows you to sell a share of stock at a given price, called the exercise price, at a particular point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a share of stock with an exercise price of $26. If six months later, the stock price per share is $26 or more, the option has no value. If in six months the stock price is lower than $26 per share, then you can purchase the stock and immediately sell it at the higher exercise price of $26. If the price per share in six months is $22.50, you can purchase a share of the stock for $22.50 and then use the put option to immediately sell the share for $26. Your profit would be the difference, $26- $22.50 = $3.50 per share, less the cost of the option. If you paid $1.00 per put option, then your profit would be $3.50 - $1.00 = $2.50 per share. 1 European Put Option $1.00 $26.00 $22.50 3 Parameters 4 Costs of Put Option 5 Exercise Price 6 Horizon (months) 7 8 Price End of Horizon 9 10 Model 11 Value of the Option 12 Cost of Put Option 13 Profit per Option 14 15 Managerial Report 1. Build a (spreadsheet) model to calculate the profit of this European put option. (20%) (Hint: Follow the above to create the parameters and the formulas for Model) 2. Construct a data table that shows the profit per share for a share price in six months between $10 and $30 per share in increments of $1.00. (25%) 1 The point of purchasing a European option is to limit the risk of a decrease in the per- share price of the stock. Suppose you purchased 200 shares of the stock at $28 per share and 75 six-month European put options with an exercise price of $26. Each put option costs $1. $1.00 $26.00 6 $28.00 $23.00 9 10 200 75 Parameters 4 Costs of Put Option 5 Exercise Price 6 Horizon (months) 7 Price per share 8 Price-End of Horizon Model 11 Number of Shares Purchased 12 Number of Puts Purcased 13 14 Vaue of the Option 15 16 Portfolio Value with Options 17 Cost of the Portfolio with Options 18 Profit with Options 19 20 Portfolio Value without Options 21 Cost of the Portfolio without Options 22 Profit without Options 3. Build a (spreadsheet) model to show the value of the portfolio with options and without options. (20%) (Hint: Follow the above to create the parameters and the formulas for Model) 4. Use data tables to shows the value of the portfolio with options and without options for a share price in six months between $15 and $35 per share in increments of $1.00. (25%) 5. Discuss the value of the portfolio with and without the European put options. Which one (with or without) is more profitable? (10%) Case 3 Instruction A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put options. A European put option allows you to sell a share of stock at a given price, called the exercise price, at a particular point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a share of stock with an exercise price of $26. If six months later, the stock price per share is $26 or more, the option has no value. If in six months the stock price is lower than $26 per share, then you can purchase the stock and immediately sell it at the higher exercise price of $26. If the price per share in six months is $22.50, you can purchase a share of the stock for $22.50 and then use the put option to immediately sell the share for $26. Your profit would be the difference, $26- $22.50 = $3.50 per share, less the cost of the option. If you paid $1.00 per put option, then your profit would be $3.50 - $1.00 = $2.50 per share. 1 European Put Option $1.00 $26.00 $22.50 3 Parameters 4 Costs of Put Option 5 Exercise Price 6 Horizon (months) 7 8 Price End of Horizon 9 10 Model 11 Value of the Option 12 Cost of Put Option 13 Profit per Option 14 15 Managerial Report 1. Build a (spreadsheet) model to calculate the profit of this European put option. (20%) (Hint: Follow the above to create the parameters and the formulas for Model) 2. Construct a data table that shows the profit per share for a share price in six months between $10 and $30 per share in increments of $1.00. (25%) 1 The point of purchasing a European option is to limit the risk of a decrease in the per- share price of the stock. Suppose you purchased 200 shares of the stock at $28 per share and 75 six-month European put options with an exercise price of $26. Each put option costs $1. $1.00 $26.00 6 $28.00 $23.00 9 10 200 75 Parameters 4 Costs of Put Option 5 Exercise Price 6 Horizon (months) 7 Price per share 8 Price-End of Horizon Model 11 Number of Shares Purchased 12 Number of Puts Purcased 13 14 Vaue of the Option 15 16 Portfolio Value with Options 17 Cost of the Portfolio with Options 18 Profit with Options 19 20 Portfolio Value without Options 21 Cost of the Portfolio without Options 22 Profit without Options 3. Build a (spreadsheet) model to show the value of the portfolio with options and without options. (20%) (Hint: Follow the above to create the parameters and the formulas for Model) 4. Use data tables to shows the value of the portfolio with options and without options for a share price in six months between $15 and $35 per share in increments of $1.00. (25%) 5. Discuss the value of the portfolio with and without the European put options. Which one (with or without) is more profitable? (10%)