answer concisely. thank you so i will understand

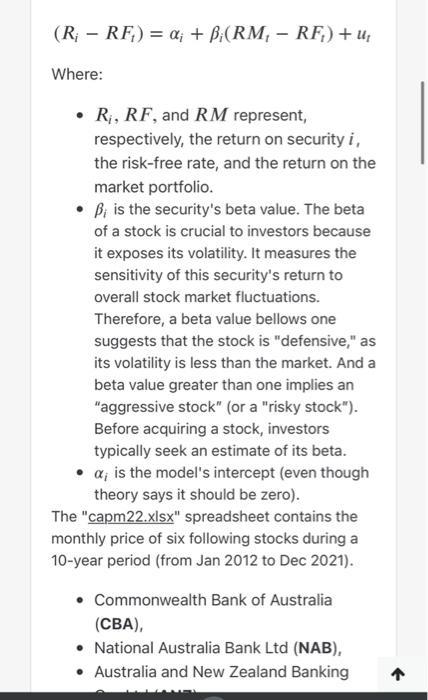

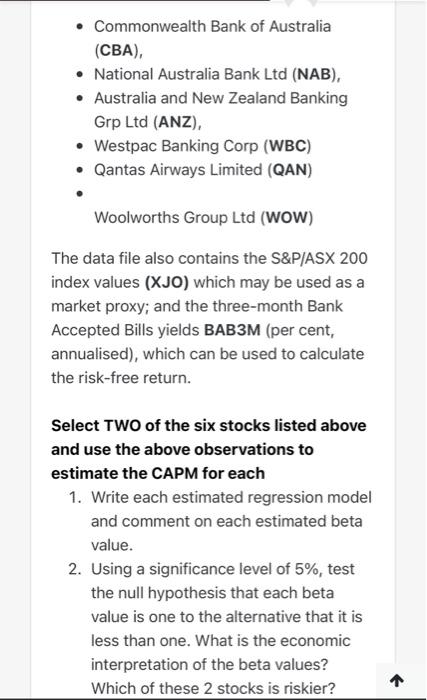

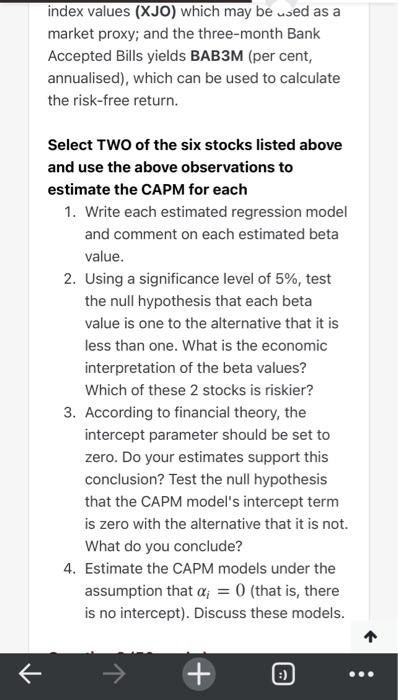

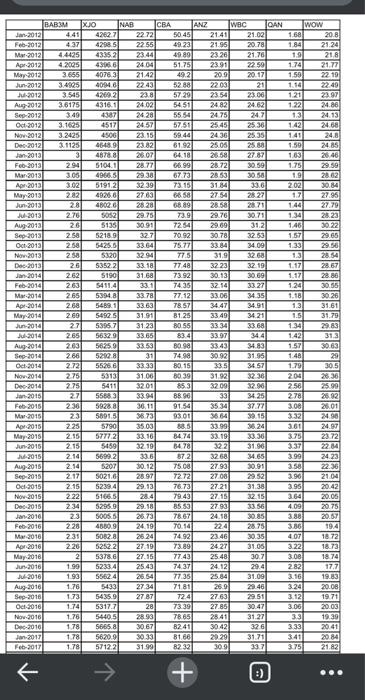

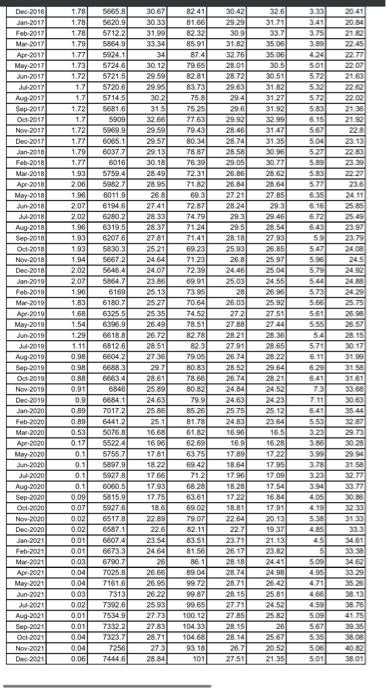

(RiRFt)=i+i(RMtRFt)+ut Where: - Ri,RF, and RM represent, respectively, the return on security i, the risk-free rate, and the return on the market portfolio. - i is the security's beta value. The beta of a stock is crucial to investors because it exposes its volatility. It measures the sensitivity of this security's return to overall stock market fluctuations. Therefore, a beta value bellows one suggests that the stock is "defensive," as its volatility is less than the market. And a beta value greater than one implies an "aggressive stock" (or a "risky stock"). Before acquiring a stock, investors typically seek an estimate of its beta. - i is the model's intercept (even though theory says it should be zero). The "capm22.xlsx" spreadsheet contains the monthly price of six following stocks during a 10-year period (from Jan 2012 to Dec 2021). - Commonwealth Bank of Australia (CBA), - National Australia Bank Ltd (NAB), - Australia and New Zealand Banking - Commonwealth Bank of Australia (CBA), - National Australia Bank Ltd (NAB), - Australia and New Zealand Banking Grp Ltd (ANZ), - Westpac Banking Corp (WBC) - Qantas Airways Limited (QAN) Woolworths Group Ltd (WOW) The data file also contains the S\&P/ASX 200 index values (XJO) which may be used as a market proxy; and the three-month Bank Accepted Bills yields BAB3M (per cent, annualised), which can be used to calculate the risk-free return. Select TWO of the six stocks listed above and use the above observations to estimate the CAPM for each 1. Write each estimated regression model and comment on each estimated beta value. 2. Using a significance level of 5%, test the null hypothesis that each beta value is one to the alternative that it is less than one. What is the economic interpretation of the beta values? Which of these 2 stocks is riskier? index values (XJO) which may be used as a market proxy; and the three-month Bank Accepted Bills yields BAB3M (per cent, annualised), which can be used to calculate the risk-free return. Select TWO of the six stocks listed above and use the above observations to estimate the CAPM for each 1. Write each estimated regression model and comment on each estimated beta value. 2. Using a significance level of 5%, test the null hypothesis that each beta value is one to the alternative that it is less than one. What is the economic interpretation of the beta values? Which of these 2 stocks is riskier? 3. According to financial theory, the intercept parameter should be set to zero. Do your estimates support this conclusion? Test the null hypothesis that the CAPM model's intercept term is zero with the alternative that it is not. What do you conclude? 4. Estimate the CAPM models under the assumption that i=0 (that is, there is no intercept). Discuss these models. (RiRFt)=i+i(RMtRFt)+ut Where: - Ri,RF, and RM represent, respectively, the return on security i, the risk-free rate, and the return on the market portfolio. - i is the security's beta value. The beta of a stock is crucial to investors because it exposes its volatility. It measures the sensitivity of this security's return to overall stock market fluctuations. Therefore, a beta value bellows one suggests that the stock is "defensive," as its volatility is less than the market. And a beta value greater than one implies an "aggressive stock" (or a "risky stock"). Before acquiring a stock, investors typically seek an estimate of its beta. - i is the model's intercept (even though theory says it should be zero). The "capm22.xlsx" spreadsheet contains the monthly price of six following stocks during a 10-year period (from Jan 2012 to Dec 2021). - Commonwealth Bank of Australia (CBA), - National Australia Bank Ltd (NAB), - Australia and New Zealand Banking - Commonwealth Bank of Australia (CBA), - National Australia Bank Ltd (NAB), - Australia and New Zealand Banking Grp Ltd (ANZ), - Westpac Banking Corp (WBC) - Qantas Airways Limited (QAN) Woolworths Group Ltd (WOW) The data file also contains the S\&P/ASX 200 index values (XJO) which may be used as a market proxy; and the three-month Bank Accepted Bills yields BAB3M (per cent, annualised), which can be used to calculate the risk-free return. Select TWO of the six stocks listed above and use the above observations to estimate the CAPM for each 1. Write each estimated regression model and comment on each estimated beta value. 2. Using a significance level of 5%, test the null hypothesis that each beta value is one to the alternative that it is less than one. What is the economic interpretation of the beta values? Which of these 2 stocks is riskier? index values (XJO) which may be used as a market proxy; and the three-month Bank Accepted Bills yields BAB3M (per cent, annualised), which can be used to calculate the risk-free return. Select TWO of the six stocks listed above and use the above observations to estimate the CAPM for each 1. Write each estimated regression model and comment on each estimated beta value. 2. Using a significance level of 5%, test the null hypothesis that each beta value is one to the alternative that it is less than one. What is the economic interpretation of the beta values? Which of these 2 stocks is riskier? 3. According to financial theory, the intercept parameter should be set to zero. Do your estimates support this conclusion? Test the null hypothesis that the CAPM model's intercept term is zero with the alternative that it is not. What do you conclude? 4. Estimate the CAPM models under the assumption that i=0 (that is, there is no intercept). Discuss these models