Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer e, f, g,h ACCT2112 Management Accounting Semester One 2023 Group Assignment (20% of Overall Unit Score) This assignment is based on Budgets and consists

Answer e, f, g,h

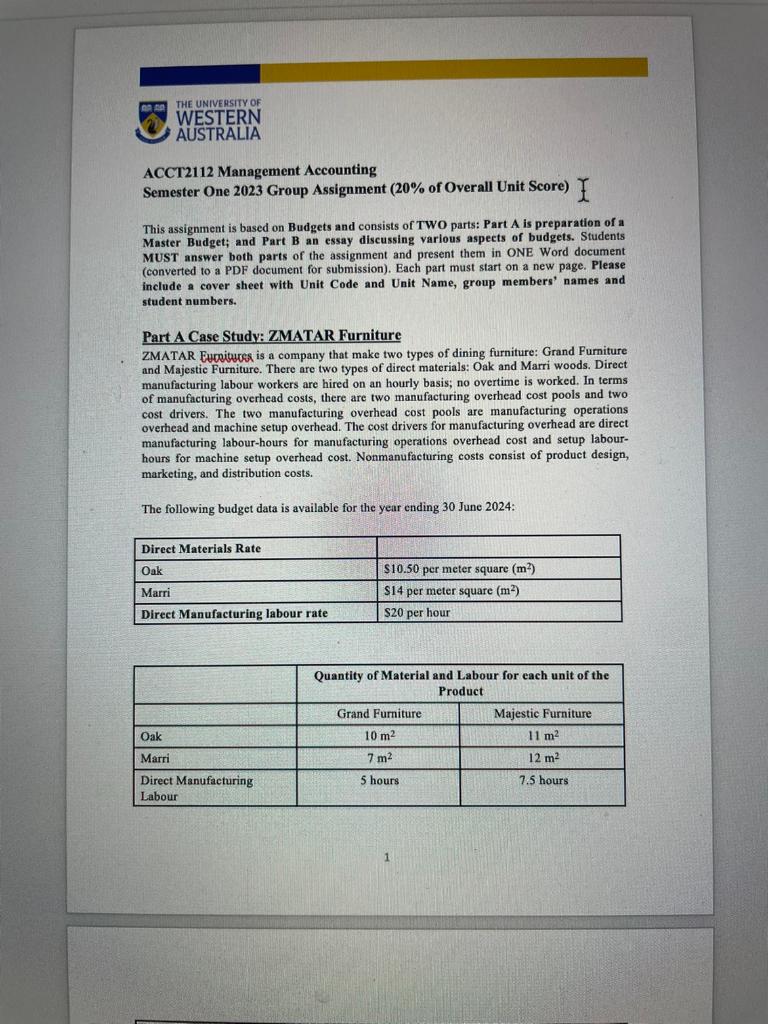

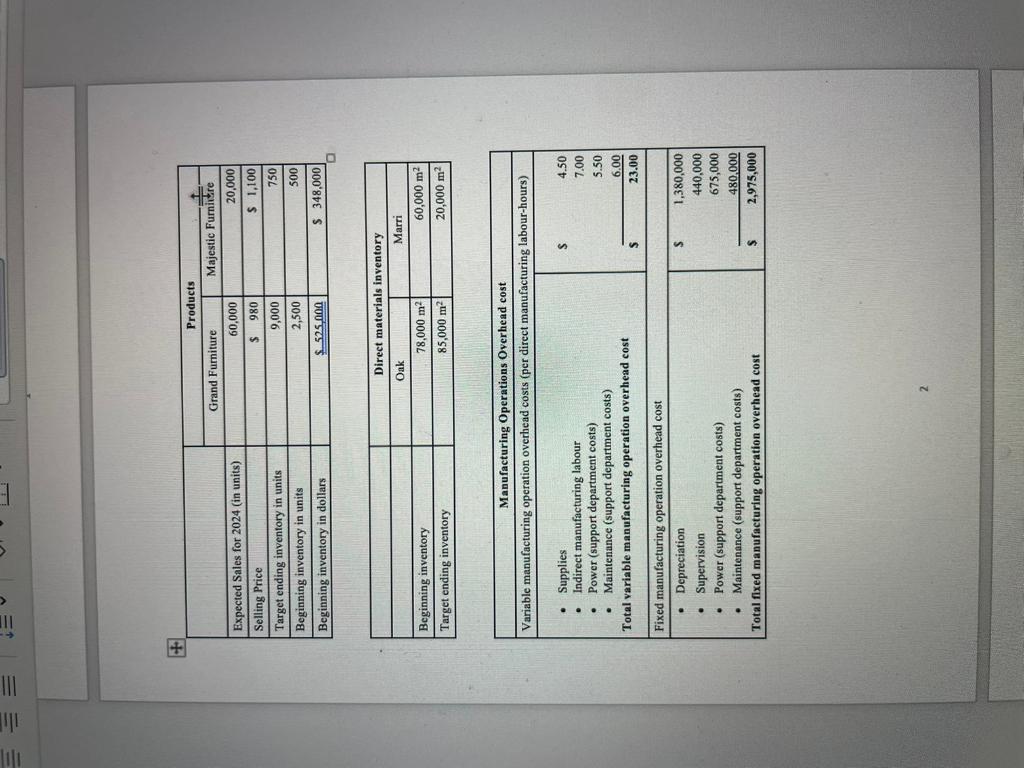

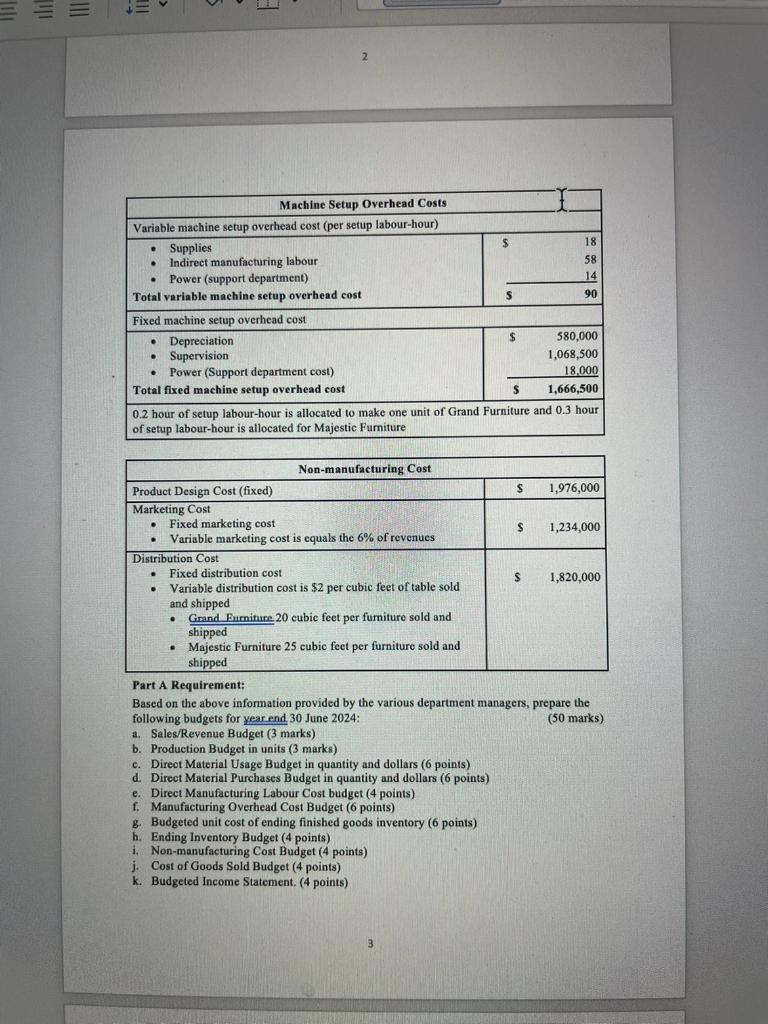

ACCT2112 Management Accounting Semester One 2023 Group Assignment (20\% of Overall Unit Score) This assignment is based on Budgets and consists of TWO parts: Part A is preparation of a Master Budget; and Part B an essay discussing various aspeets of budgets. Students MUST answer both parts of the assignment and present them in ONE Word document (converted to a PDF document for submission). Each part must start on a new page. Please include a cover sheet with Unit Code and Unit Name, group members' names and student numbers. Part A Case Studv: ZMATAR Furniture ZMATAR Eucitures is a company that make two types of dining furniture: Grand Furniture and Majestic Furniture. There are two types of direct materials: Oak and Marri woods. Direct manufacturing labour workers are hired on an hourly basis; no overtime is worked. In terms of manufacturing overhead costs, there are two manufacturing overhead cost pools and two cost drivers. The two manufacturing overhead cost pools are manufacturing operations overhead and machine setup overhead. The cost drivers for manufacturing overhead are direct manufacturing labour-hours for manufacturing operations overhead cost and setup labourhours for machine setup overhead cost. Nonmanufacturing costs consist of product design, marketing, and distribution costs. The following budget data is available for the year ending 30 June 2024: \begin{tabular}{|l|r|r|} \hline \multirow{2}{*}{} & \multicolumn{2}{|c|}{ Products } \\ \cline { 2 - 4 } & Grand Furniture & Majestic Furnitrre \\ \hline Expected Sales for 2024 (in units) & 60,000 & 20,000 \\ \hline Selling Price & $980 & $9,100 \\ \hline Target ending inventory in units & 9,000 & 750 \\ \hline Beginning inventory in units & 2,500 & 500 \\ \hline Beginning inventory in dollars & $525,000 & $348,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline & \multicolumn{2}{|c|}{ Direct materials inventory } \\ \hline & \multicolumn{1}{|c|}{ Oak } & \multicolumn{1}{|c|}{ Marri } \\ \hline Beginning inventory & 78,000m2 & 60,000m2 \\ \hline Target ending inventory & 85,000m2 & 20,000m2 \\ \hline \end{tabular} \begin{tabular}{|l|rr|} \hline \multicolumn{2}{|c|}{ Manufacturing Operations Overhead cost } \\ \hline Variable manufacturing operation overhead costs (per direct manufacturing labour-hours) \\ \hline - Supplies & & \\ - Indirect manufacturing labour & & 4.50 \\ Power (support department costs) & & 7.00 \\ - Maintenance (support department costs) & 5.50 \\ Total variable manufacturing operation overhead cost & & 6.00 \\ \hline Fixed manufacturing operation overhead cost & 23.00 \\ \hline - Depreciation & & \\ - Supervision & & 1,380,000 \\ - Power (support department costs) & 440,000 \\ - Maintenance (support department costs) & 675,000 \\ Total fixed manufacturing operation overhead cost & & 480,000 \\ \hline \end{tabular} 2 Part A Requirement: Based on the above information provided by the various department managers, prepare the following budgets for year and 30 June 2024: (50 marks) a. Sales/Revenue Budget ( 3 marks) b. Production Budget in units ( 3 marks) c. Direot Material Usage Budget in quantity and dollars ( 6 points) d. Direct Material Purchases Budget in quantity and dollars ( 6 points) e. Direct Manufacturing Labour Cost budget (4 points) f. Manufacturing Overhead Cost Budget ( 6 points) g. Budgeted unit cost of ending finished goods inventory ( 6 points) h. Ending Inventory Budget ( 4 points) i. Non-manufacturing Cost Budget (4 points) j. Cost of Goods Sold Budget (4 points) k. Budgeted Income Statement. (4 points) ACCT2112 Management Accounting Semester One 2023 Group Assignment (20\% of Overall Unit Score) This assignment is based on Budgets and consists of TWO parts: Part A is preparation of a Master Budget; and Part B an essay discussing various aspeets of budgets. Students MUST answer both parts of the assignment and present them in ONE Word document (converted to a PDF document for submission). Each part must start on a new page. Please include a cover sheet with Unit Code and Unit Name, group members' names and student numbers. Part A Case Studv: ZMATAR Furniture ZMATAR Eucitures is a company that make two types of dining furniture: Grand Furniture and Majestic Furniture. There are two types of direct materials: Oak and Marri woods. Direct manufacturing labour workers are hired on an hourly basis; no overtime is worked. In terms of manufacturing overhead costs, there are two manufacturing overhead cost pools and two cost drivers. The two manufacturing overhead cost pools are manufacturing operations overhead and machine setup overhead. The cost drivers for manufacturing overhead are direct manufacturing labour-hours for manufacturing operations overhead cost and setup labourhours for machine setup overhead cost. Nonmanufacturing costs consist of product design, marketing, and distribution costs. The following budget data is available for the year ending 30 June 2024: \begin{tabular}{|l|r|r|} \hline \multirow{2}{*}{} & \multicolumn{2}{|c|}{ Products } \\ \cline { 2 - 4 } & Grand Furniture & Majestic Furnitrre \\ \hline Expected Sales for 2024 (in units) & 60,000 & 20,000 \\ \hline Selling Price & $980 & $9,100 \\ \hline Target ending inventory in units & 9,000 & 750 \\ \hline Beginning inventory in units & 2,500 & 500 \\ \hline Beginning inventory in dollars & $525,000 & $348,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline & \multicolumn{2}{|c|}{ Direct materials inventory } \\ \hline & \multicolumn{1}{|c|}{ Oak } & \multicolumn{1}{|c|}{ Marri } \\ \hline Beginning inventory & 78,000m2 & 60,000m2 \\ \hline Target ending inventory & 85,000m2 & 20,000m2 \\ \hline \end{tabular} \begin{tabular}{|l|rr|} \hline \multicolumn{2}{|c|}{ Manufacturing Operations Overhead cost } \\ \hline Variable manufacturing operation overhead costs (per direct manufacturing labour-hours) \\ \hline - Supplies & & \\ - Indirect manufacturing labour & & 4.50 \\ Power (support department costs) & & 7.00 \\ - Maintenance (support department costs) & 5.50 \\ Total variable manufacturing operation overhead cost & & 6.00 \\ \hline Fixed manufacturing operation overhead cost & 23.00 \\ \hline - Depreciation & & \\ - Supervision & & 1,380,000 \\ - Power (support department costs) & 440,000 \\ - Maintenance (support department costs) & 675,000 \\ Total fixed manufacturing operation overhead cost & & 480,000 \\ \hline \end{tabular} 2 Part A Requirement: Based on the above information provided by the various department managers, prepare the following budgets for year and 30 June 2024: (50 marks) a. Sales/Revenue Budget ( 3 marks) b. Production Budget in units ( 3 marks) c. Direot Material Usage Budget in quantity and dollars ( 6 points) d. Direct Material Purchases Budget in quantity and dollars ( 6 points) e. Direct Manufacturing Labour Cost budget (4 points) f. Manufacturing Overhead Cost Budget ( 6 points) g. Budgeted unit cost of ending finished goods inventory ( 6 points) h. Ending Inventory Budget ( 4 points) i. Non-manufacturing Cost Budget (4 points) j. Cost of Goods Sold Budget (4 points) k. Budgeted Income Statement. (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started