answer (E) please!

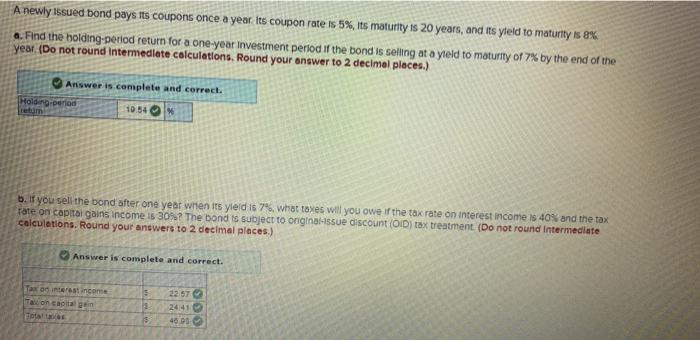

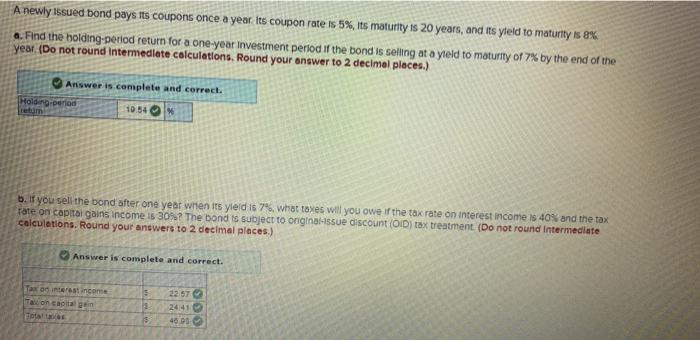

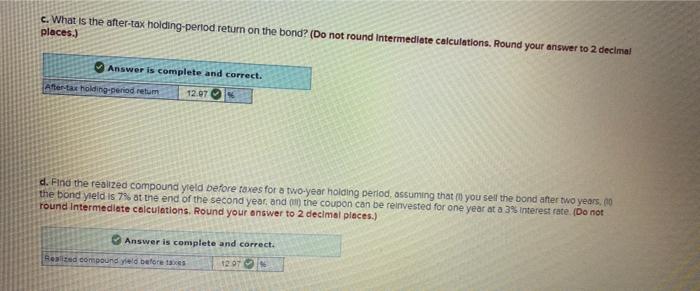

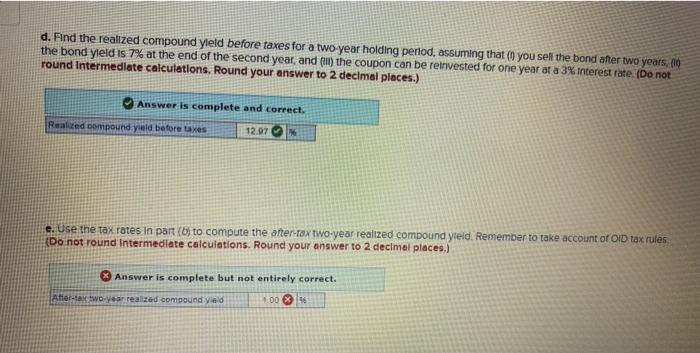

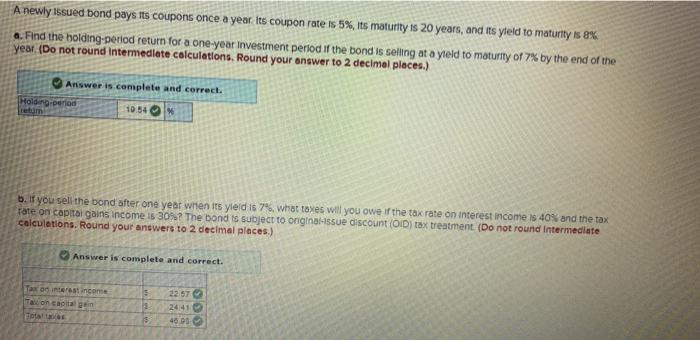

A newly issued bond pays its coupons once a year its coupon rate is 5%, its maturity is 20 years, and its yteld to maturity is 8% a. Find the holding period return for a one-year investment period if the bond is selling at a yield to maturity of 7% by the end of the year (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Holding period retum 10.54 b. If you sell the bond after one year when its yield is 7%, who taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to ongina-ssue discount (OD) tax treatment (Do not round Intermediate calculations. Round your answers to 2 decimal places) Answer is complete and correct. Taxontest income con capitain Float $ 3 22.57 2441 46 D c. What is the after-tax holding-period return on the bond? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. After-tax holding period retum 12.07 d. Find the realized compound yield before taxes for a two-year holding period, assuming that you sell the bond after two years, 00 the bond yield is 7% at the end of the second year and on the coupon can be reinvested for one year at a 3% interest rate (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Belted compound yield before 12075 d. Find the realized compound yield before taxes for a two year holding period, assuming that you sell the bond after two years, 00 the bond yield is 7% at the end of the second year, and (ii) the coupon can be retrivested for one year at a 3% interest rate. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Realized compound yield before taxes 12.07 c. Use the tax rates in part (b) to compute the after-tax two-year realized compound yield. Remember to take account or oid tax rules. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) * Answer is complete but not entirely correct. After-tax two-year realized compounded 100 %