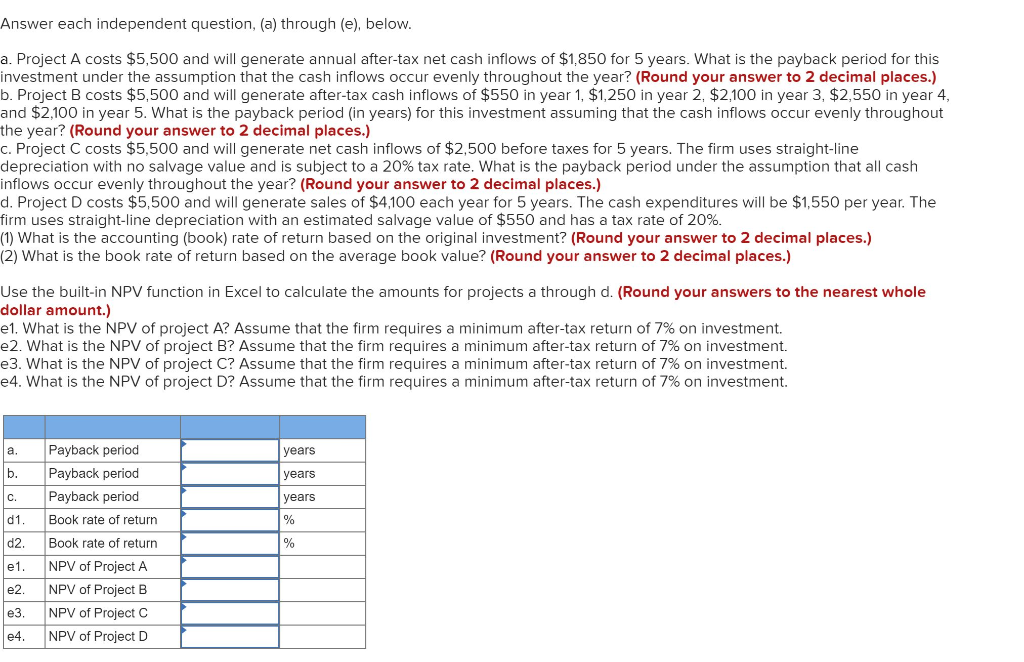

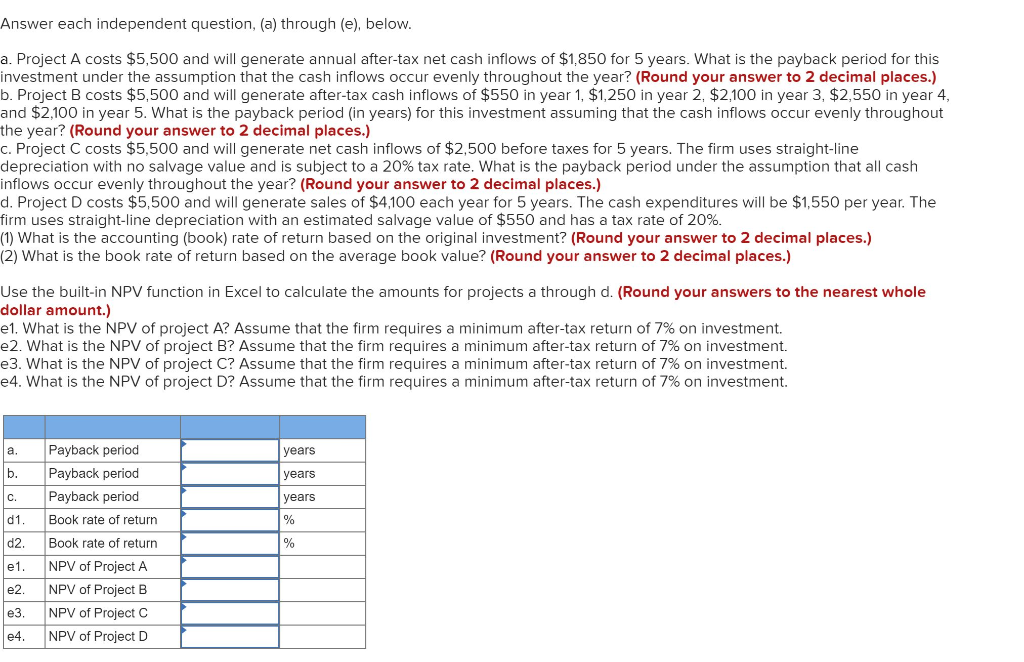

Answer each independent question, (a) through (e), below. a. Project A costs $5,500 and will generate annual after-tax net cash inflows of $1,850 for 5 years. What is the payback period for this investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) b. Project B costs $5,500 and will generate after-tax cash inflows of $550 in year 1, $1,250 in year 2, $2,100 in year 3, $2,550 in year 4 and $2,100 in year 5. What is the payback period (in years) for this investment assuming that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) c. Project C costs $5,500 and will generate net cash inflows of $2,500 before taxes for 5 years. The firm uses straight-line depreciation with no salvage value and is subject to a 20% tax rate. What is the payback period under the assumption that all cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) d. Project D costs $5,500 and will generate sales of $4,100 each year for 5 years. The cash expenditures will be $1,550 per year. The firm uses straight-line depreciation with an estimated salvage value of $550 and has a tax rate of 20% (1) What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) (2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) Use the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole dollar amount.) e1. What is the NPV of project A? Assume that the firm requires e2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 7% on investment. e3. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 7% on investment. e4. What is the NPV of project D? Assume that the firm requires a minimum after-tax return of 7% on investment minimum after-tax return of 7% on investment Payback period a. years Payback period vears Payback period c. years d1. Book rate of return Book rate of return d2. NPV of Project A e 1. NPV of Project B NPV of Project C e3. e4. NPV of Project D e2