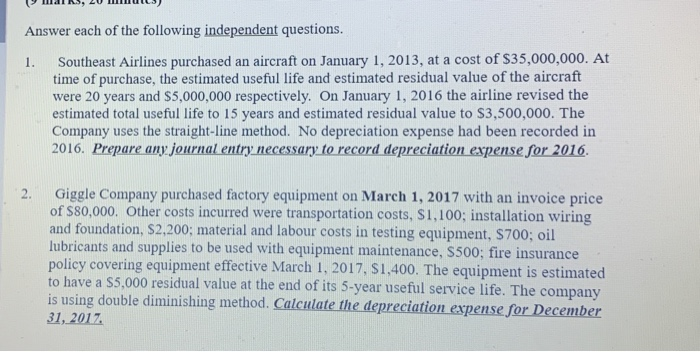

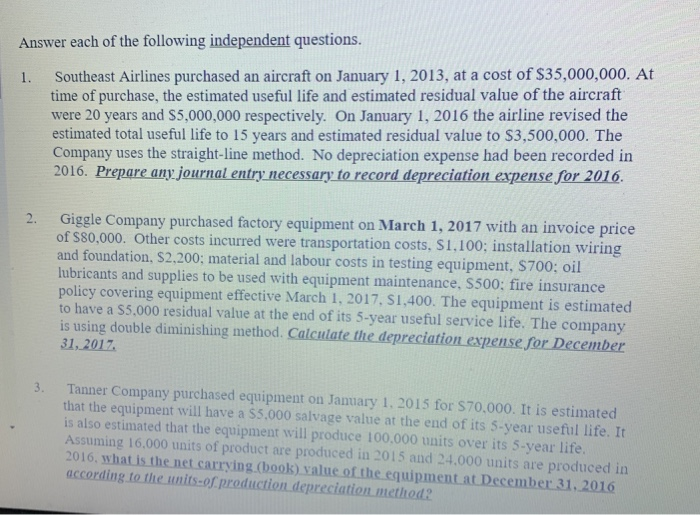

Answer each of the following independent questions. 1. Southeast Airlines purchased an aircraft on January 1, 2013, at a cost of $35,000,000. At time of purchase, the estimated useful life and estimated residual value of the aircraft were 20 years and $5,000,000 respectively. On January 1, 2016 the airline revised the estimated total useful life to 15 years and estimated residual value to $3,500,000. The Company uses the straight-line method. No depreciation expense had been recorded in 2016. Prepare any journal entry necessary to record depreciation expense for 2016. 2. Giggle Company purchased factory equipment on March 1, 2017 with an invoice price of $80,000. Other costs incurred were transportation costs, $1,100; installation wiring and foundation, $2,200; material and labour costs in testing equipment, $700; oil lubricants and supplies to be used with equipment maintenance, S500; fire insurance policy covering equipment effective March 1, 2017, $1,400. The equipment is estimated to have a $5,000 residual value at the end of its 5-year useful service life. The company is using double diminishing method. Calculate the depreciation expense for December 31, 2017 Answer each of the following independent questions. 1. Southeast Airlines purchased an aircraft on January 1, 2013, at a cost of $35,000,000. At time of purchase, the estimated useful life and estimated residual value of the aircraft were 20 years and $5,000,000 respectively. On January 1, 2016 the airline revised the estimated total useful life to 15 years and estimated residual value to $3,500,000. The Company uses the straight-line method. No depreciation expense had been recorded in 2016. Prepare any journal entry necessary to record depreciation expense for 2016. 2. Giggle Company purchased factory equipment on March 1, 2017 with an invoice price of $80,000. Other costs incurred were transportation costs, S1,100; installation wiring and foundation, $2.200; material and labour costs in testing equipment, S700: oil lubricants and supplies to be used with equipment maintenance, S500: fire insurance policy covering equipment effective March 1, 2017, 51,400. The equipment is estimated to have a $5,000 residual value at the end of its 5-year useful service life. The company is using double diminishing method. Calculate the depreciation expense for December 31, 2017 3 Tanner Company purchased equipment on January 1, 2015 for $70,000. It is estimated that the equipment will have a $5,000 salvage value at the end of its 5-year useful life. It is also estimated that the equipment will produce 100,000 units over its 5-year life. Assuming 16,000 units of product are produced in 2015 and 24.000 units are produced in 2016. what is the net carrying (book) value of the equipment at December 31, 2016 according to the units of production depreciation method