ANSWER EACH PART PLEASE IF NOT PLEASE LEAVE FOR ANOTHER EXPERT THANK YOU PLEASE!

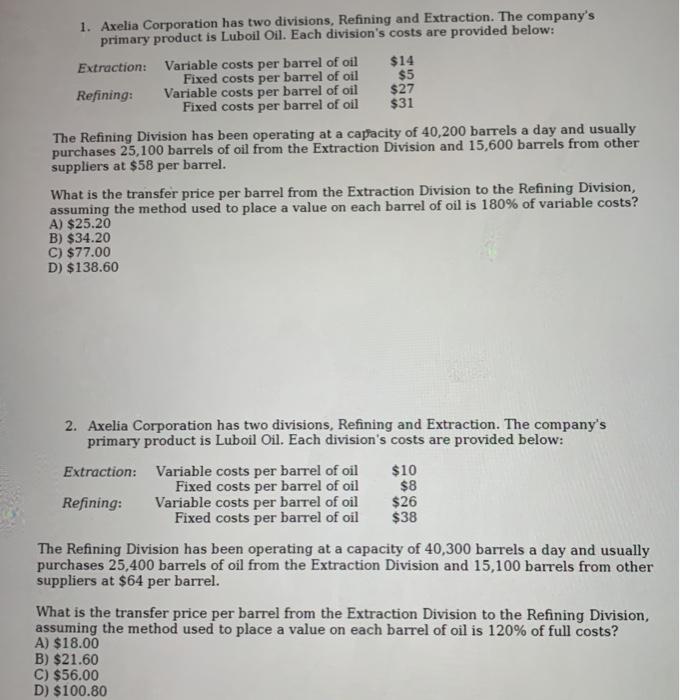

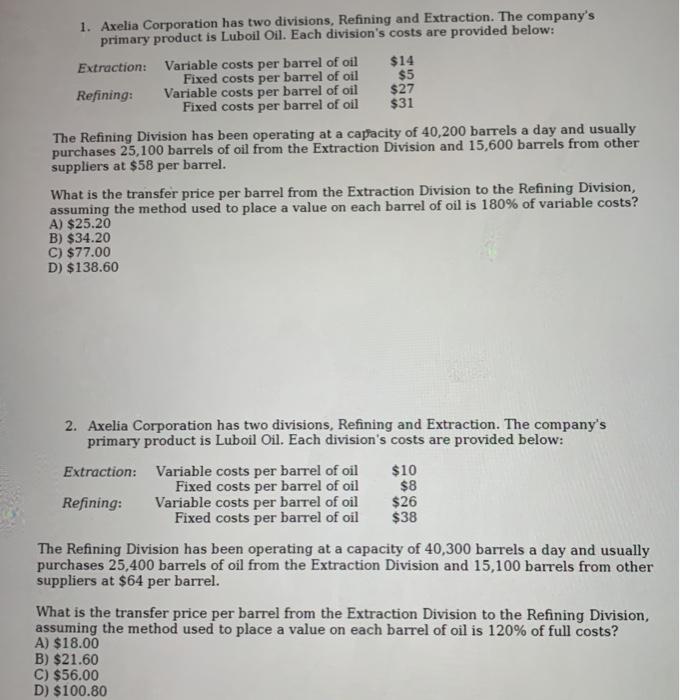

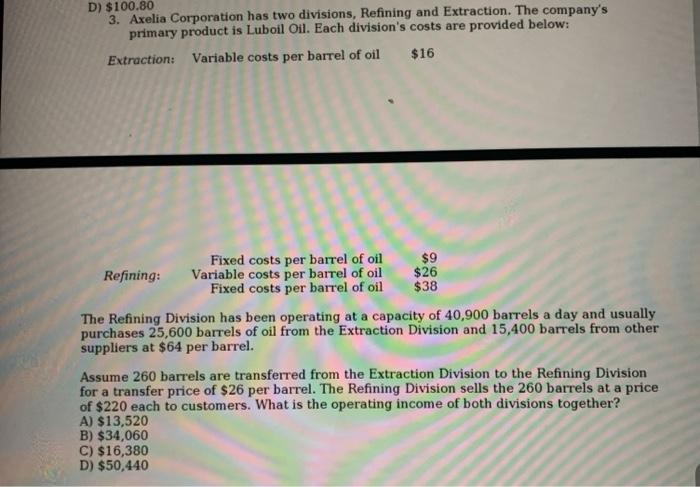

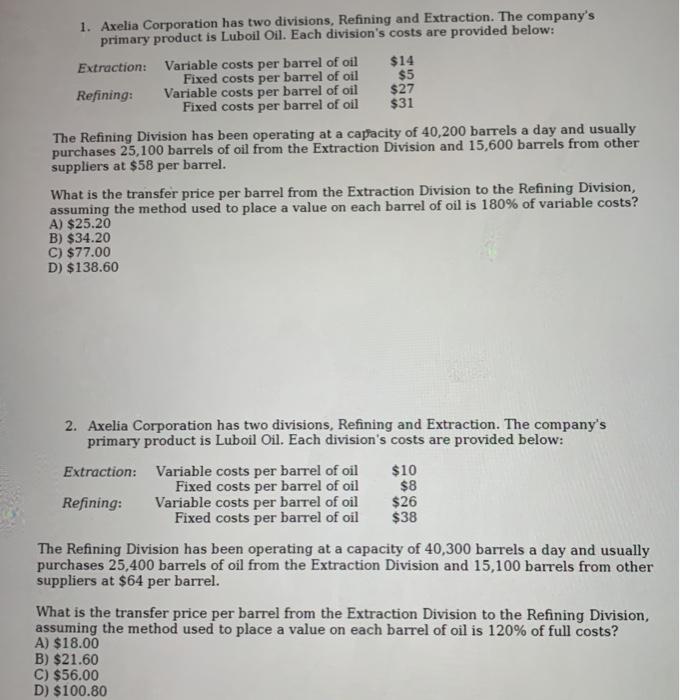

1. Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below: Extraction: Variable costs per barrel of oil $14 Fixed costs per barrel of oil $5 Refining: Variable costs per barrel of oil $27 Fixed costs per barrel of oil $31 The Refining Division has been operating at a capacity of 40,200 barrels a day and usually purchases 25,100 barrels of oil from the Extraction Division and 15,600 barrels from other suppliers at $58 per barrel. What is the transfer price per barrel from the Extraction Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 180% of variable costs? A) $25.20 B) $34.20 C) $77.00 D) $138.60 2. Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below: Extraction: Variable costs per barrel of oil $10 Fixed costs per barrel of oil $8 Refining: Variable costs per barrel of oil $26 Fixed costs per barrel of oil $38 The Refining Division has been operating at a capacity of 40,300 barrels a day and usually purchases 25,400 barrels of oil from the Extraction Division and 15,100 barrels from other suppliers at $64 per barrel. What is the transfer price per barrel from the Extraction Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 120% of full costs? A) $18.00 B) $21.60 C) $56.00 D) $100.80 D) $100.80 3. Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below: Extraction: Variable costs per barrel of oil $16 Fixed costs per barrel of oil $9 Refining: Variable costs per barrel of oil $26 Fixed costs per barrel of oil $38 The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel. Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel. The Refining Division sells the 260 barrels at a price of $220 each to customers. What is the operating income of both divisions together? A) $13,520 B) $34,060 C) $16,380 D) $50,440