ANSWER EACH PART TO THE QUESTION PLEASEE IF NOT PLEASE LET SOMEONE ELSE ANSWER PLEASE!

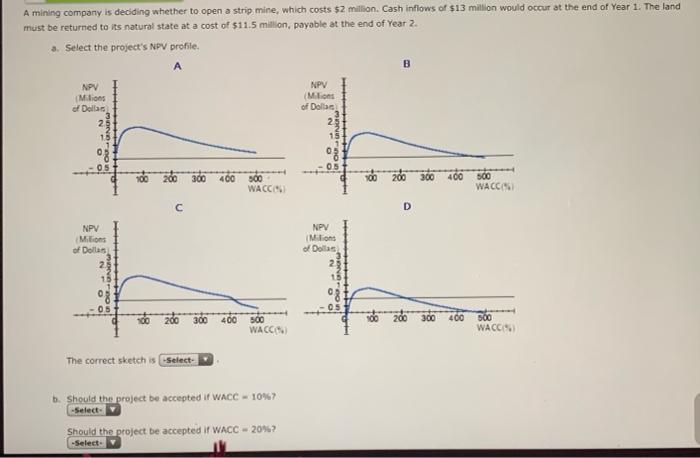

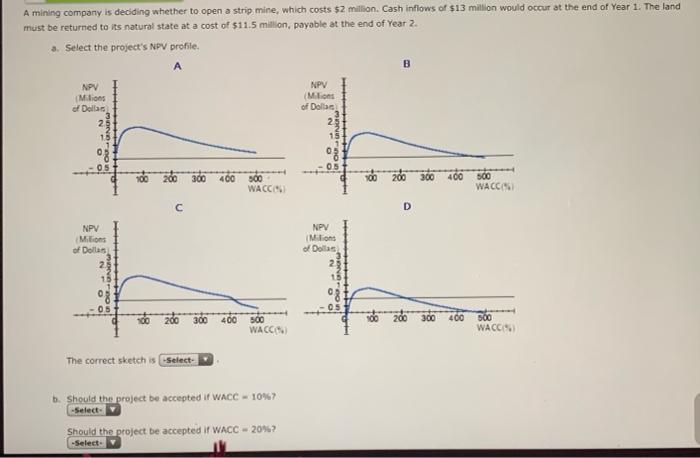

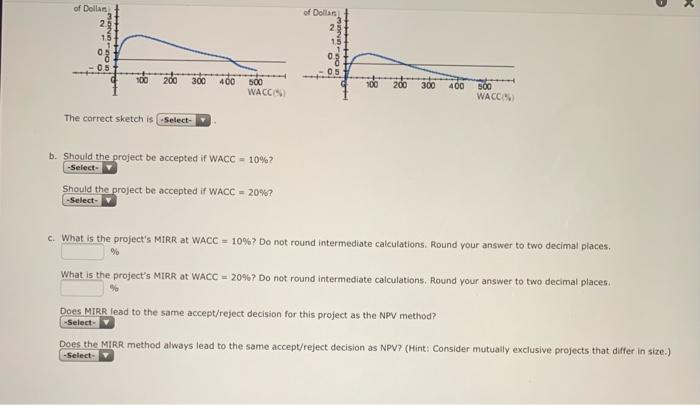

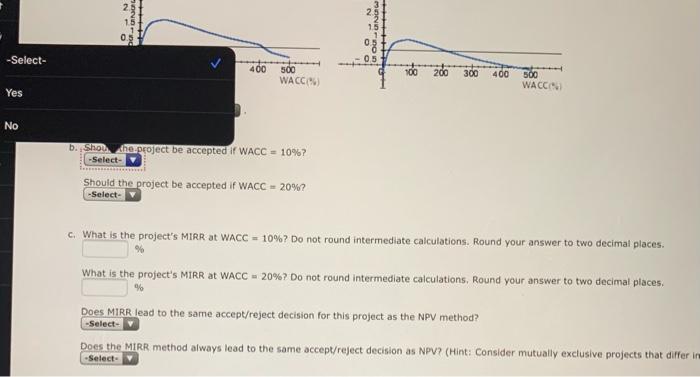

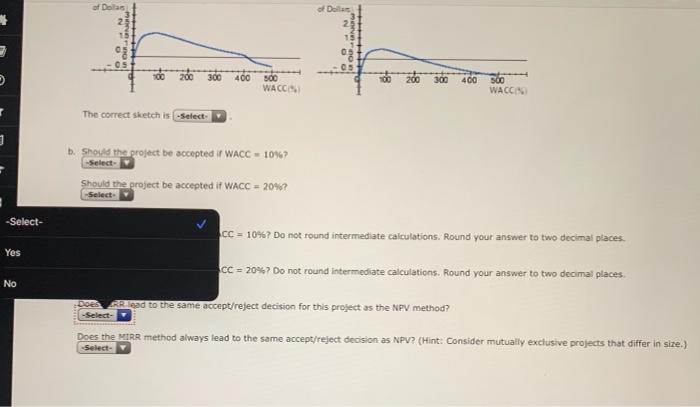

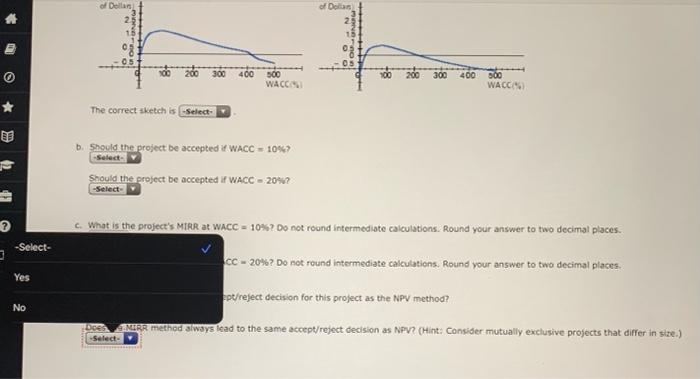

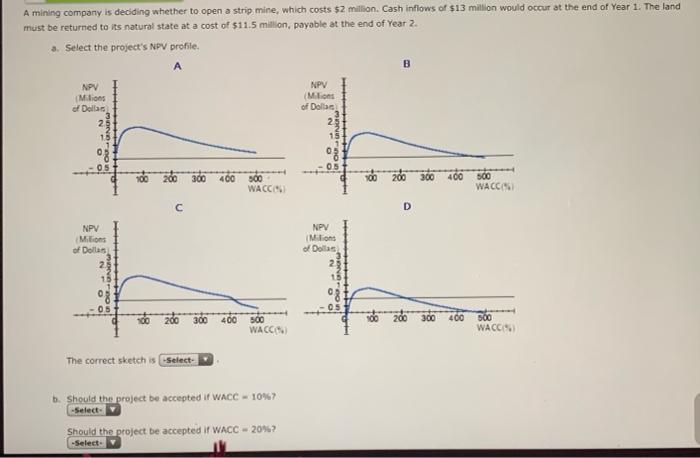

A mining company is deciding whether to open a strip mine, which costs $2 million. Cash inflows of $13 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $11.5 million, payable at the end of Year 2. 3. Select the project's NPV profile. A B NPV Milions of Dollars 2 NPV (Milions of Dolls 23 15 0 OURG - oO 100 200 300 400 100 260 500 WACCS 400 500 WACCS C D NPV Millions of Dolls 2 18 NPV IM.lions of Dolls 2 80200 300 400 300 400 500 WACCS 500 WACCS The correct sketch is Select b. Should the project be accepted I WACC - 10% -Select- Should the project be accepted I WACC -20%? -Select- of Dollars 2 MINDA of Dollar 2 13 OON 1. ott 0.5 ot 200 300 400 500 WACCIA 100 200 300 400 500 WACCS The correct sketch is-Select- b. Should the project be accepted if WACC - 10%? -Select- Should the project be accepted if WACC = 20%? -Select- c. What is the project's MIRR at WACC = 10%? Do not round Intermediate calculations. Round your answer to two decimal places, % What is the project's MIRR at WACC + 20%? Do not round intermediate calculations, Round your answer to two decimal places -Select- Does MIRR lead to the same accept/reject decision for this project as the NPV method? Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) -Select- NO Und -Select- 05 400 500 100 200 300 400 WACC) 500 WACCA Yes No b. Shole project be accepted it WACC = 10%? -Select- Should the project be accepted if WACC = 20%? -Select- c. What is the project's MIRR at WACC = 10%? Do not round intermediate calculations. Round your answer to two decimal places. % What is the project's MIRR at WACC + 20%? Do not round intermediate calculations, Round your answer to two decimal places % Does MIRR lead to the same accept/reject decision for this project as the NPV method? -Select- Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in -Select- OO noul Ang DO 100 200 300 400 500 WACC 100 87 300 400 500 WACCA -Select- Yes WACC - 10% No o project be accepted t WACC - 2002 -Select- . c. What is the project's MIRR at WACC = 10%? Do not round intermediate calculations. Round your answer to two decimal places. 96 What is the project's MIRR at WACC + 20%? Do not round intermediate calculations. Round your answer to two decimal places. % Does MIRR lead to the same accept/reject decision for this project as the NPV method? -Select- Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) -Select- of Dallas of Dolls ORA NO Port 05 200 300 400 500 WACCS de 200 300 400 500 WACCA The correct sketch is Select 3 b. Shoyed the project be accepted i WACC - 10%? -Select Should the project be accepted if WACC = 2047 -Select- -Select- CC = 10%? Do not round intermediate calculations. Round your answer to two decimal places. Yes CC = 20%? Do not round intermediate calculations. Round your answer to two decimal places. No head to the same accept/reject decision for this project as the NPV method? -Select- Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) Select- of Dollar 2 URO of Dorn 2 18 - 0 05 200 300 100 200 400 500 WACOS 300 400 500 WACCO The correct sketch is-Select- b. Should the project be accepted Y WACC - 10%* Select Should the project be accepted It WACC - 20%? -Select- c. What is the project's MERR at WACC - 10%? Do not round intermediate calculations. Round your answer to two decimal places. -Select- 3 cc - 20%? Do not round intermediate calculations. Round your answer to two decimal places Yes pt/reject decision for this project as the NPV method? No CAMER method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) -Select