Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer each question as detailed as possible. To receive full credit you must provide all calculations. Don't forget to put your name on the copy

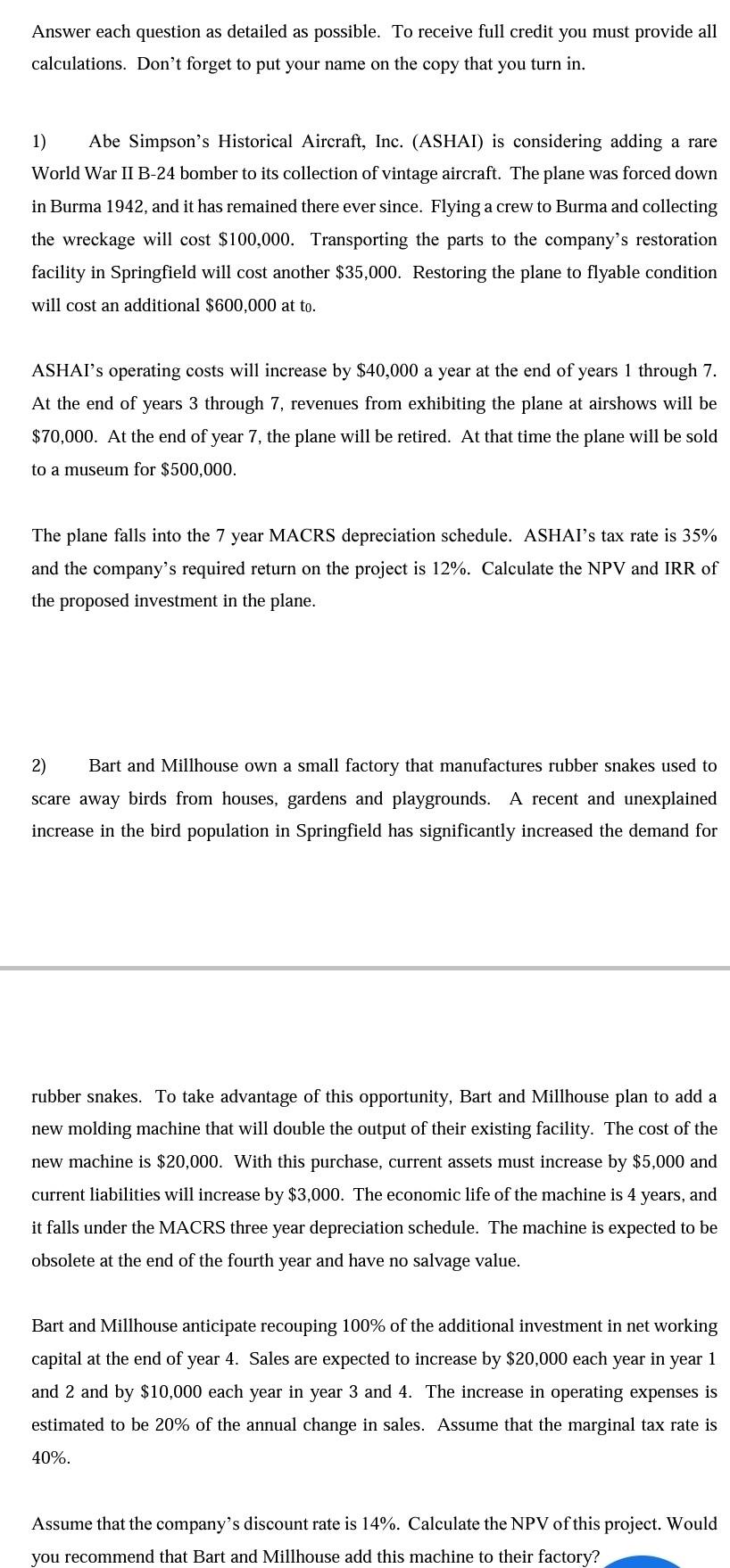

Answer each question as detailed as possible. To receive full credit you must provide all calculations. Don't forget to put your name on the copy that you turn in. 1) Abe Simpson's Historical Aircraft, Inc. (ASHAI) is considering adding a rare World War II B-24 bomber to its collection of vintage aircraft. The plane was forced down in Burma 1942, and it has remained there ever since. Flying a crew to Burma and collecting the wreckage will cost $100,000. Transporting the parts to the company's restoration facility in Springfield will cost another $35,000. Restoring the plane to flyable condition will cost an additional $600,000 at to. ASHAI's operating costs will increase by $40,000 a year at the end of years 1 through 7. At the end of years 3 through 7, revenues from exhibiting the plane at airshows will be $70,000. At the end of year 7, the plane will be retired. At that time the plane will be sold to a museum for $500,000. The plane falls into the 7 year MACRS depreciation schedule. ASHAI's tax rate is 35% and the company's required return on the project is 12%. Calculate the NPV and IRR of the proposed investment in the plane. 2) Bart and Millhouse own a small factory that manufactures rubber snakes used to scare away birds from houses, gardens and playgrounds. A recent and unexplained increase in the bird population in Springfield has significantly increased the demand for rubber snakes. To take advantage of this opportunity, Bart and Millhouse plan to add a new molding machine that will double the output of their existing facility. The cost of the new machine is $20,000. With this purchase, current assets must increase by $5,000 and current liabilities will increase by $3,000. The economic life of the machine is 4 years, and it falls under the MACRS three year depreciation schedule. The machine is expected to be obsolete at the end of the fourth year and have no salvage value. Bart and Millhouse anticipate recouping 100% of the additional investment in net working capital at the end of year 4. Sales are expected to increase by $20,000 each year in year 1 and 2 and by $10,000 each year in year 3 and 4. The increase in operating expenses is estimated to be 20% of the annual change in sales. Assume that the marginal tax rate is 40%. Assume that the company's discount rate is 14%. Calculate the NPV of this project. Would you recommend that Bart and Millhouse add this machine to their factory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started