answer emails with questions about the assignment received after 6 pm on the due date. 1. Motives for risk management (10 points). State and explain five different motives for why risk management creates value in your own words. For each selected motive, summarize the main idea in a few sentences.

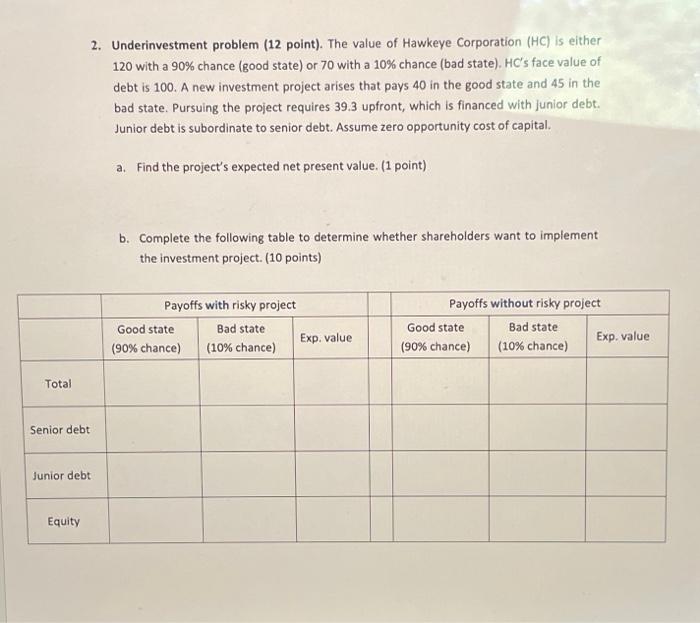

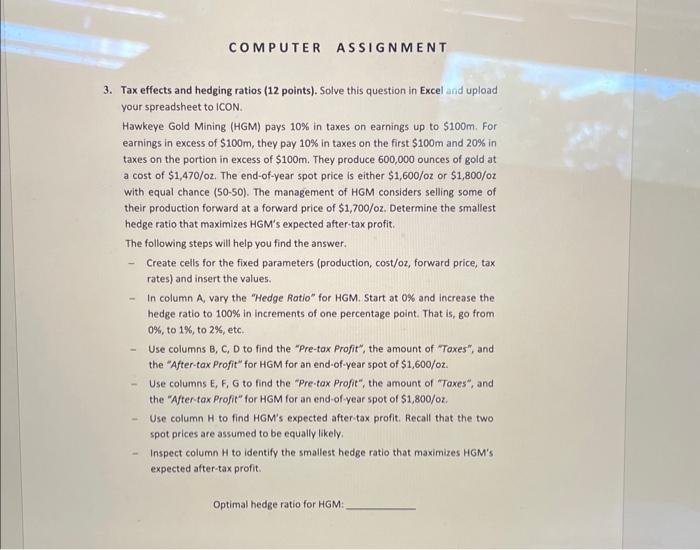

answer emails with questions about the assignment received after 6pm on the due date. 1. Motives for risk management (10 points). State and explain five different motives for why risk management creates value in your own words. For each selected motive, summarize the main idea in a few sentences. c. Is the shareholder's decision efficient? (1 point) 3. Tax effects and hedging ratios (12 points). Solve this question in Excel and upload your spreadsheet to ICON. Hawkeye Gold Mining (HGM) pays 10% in taxes on earnings up to $100m. For earnings in excess of $100m, they pay 10% in taxes on the first $100m and 20% in taxes on the portion in excess of $100m. They produce 600,000 ounces of gold at a cost of $1,470/oz. The end-of-year spot price is either $1,600/oz or $1,800/oz with equal chance (50-50). The management of HGM considers selling some of their production forward at a forward price of $1,700/oz. Determine the smallest hedge ratio that maximizes HGM's expected after-tax profit. The following steps will help you find the answer. - Create cells for the fixed parameters (production, cost/oz, forward price, tax rates) and insert the values. - In column A, vary the "Hedge Ratio" for HGM. Start at 0% and increase the hedge ratio to 100% in increments of one percentage point. That is, go from 0%, to 1%, to 2%, etc. - Use columns B, C, D to find the "Pre-tox Profit", the amount of "Toxes", and the "After-tax Profit" for HGM for an end-of-year spot of $1,600/0z. - Use columns E, F, G to find the "Pre-tax Profit", the amount of "Taxes", and the "After-tax Profit" for HGM for an end-of year spot of $1,800/0z. - Use column H to find HGM's expected after-tax profit. Recall that the two spot prices are assumed to be equally likely. - Inspect column H to identify the smallest hedge ratio that maximizes HGM's expected after-tax profit. Optimal hedge ratio for HGM: 2. Underinvestment problem (12 point). The value of Hawkeye Corporation ( HC ) is either 120 with a 90% chance (good state) or 70 with a 10% chance (bad state). HC's face value of debt is 100. A new investment project arises that pays 40 in the good state and 45 in the bad state. Pursuing the project requires 39.3 upfront, which is financed with junior debt. Junior debt is subordinate to senior debt. Assume zero opportunity cost of capital. a. Find the project's expected net present value. (1 point) b. Complete the following table to determine whether shareholders want to implement the investment project. (10 points)