answer everything

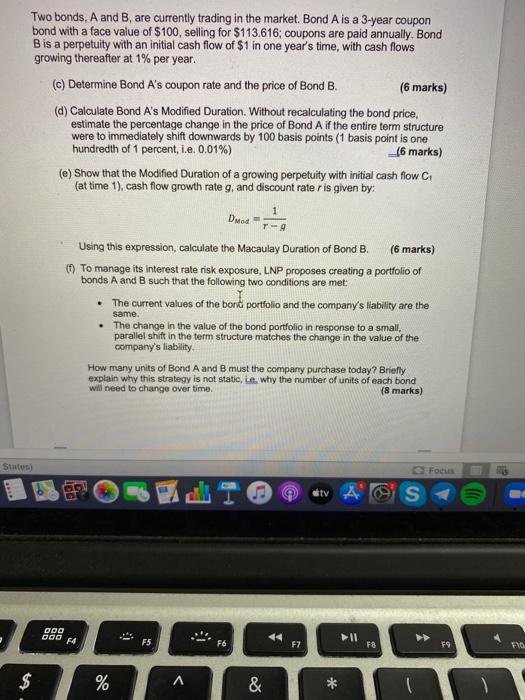

se (co mat Tools Table Window Help FN2190 ZB final for UOL References Mailings Review View A abc E AaBb CcD AaBbCcDd AaBbc 3) 3 4 H2 Question 3 LNP is a company with a liability of $110 million due in 10 years. The company's only asset is $70 million held in cash. Throughout this question, assume the term structure of interest rates is flat at 5%. (a) Determine the present value of the company's liability (3 marks) (6) Without doing any calculations, briefly explain why holding all its assets in cash is problematic for LNP from an interest rate risk management perspective (4 marks) Two bonds. A and B are currently trading in the market. Bond A is a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond Bis a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond Af the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent. 1.0.0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1), cash flow growth rate g. And discount rato ris given by: Desde Using this expression, calculate the Macaulay Duration of Bond 8. (6 marks) To manage its interest rate risk exposure. LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's Nabilty are the same The change in the value of the bond portfolio in response to a small, parallel ship in the term structure matches the change in the value of the company's liability sh (United States Focus S 90 DOD F9 00 74 II F& F7 79 FYO Two bonds, A and B, are currently trading in the market. Bond Ais a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond Bis a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond A if the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent, i.e. 0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1). cash flow growth rate g, and discount rater is given by: 1 Dod T- Using this expression, calculate the Macaulay Duration of Bond B. (6 marks) To manage its interest rate risk exposure, LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's liability are the same. The change in the value of the bond portfolio in response to a small, parallel shift in the term structure matches the change in the value of the company's liability How many units of Bond A and B must the company purchase today? Briefly explain why this strategy is not static, Lo why the number of units of each bond will need to change over time. (8 marks) States) Focus ty S 000 F4 Il F5 F6 F7 F8 FO FO $ % A & * se (co mat Tools Table Window Help FN2190 ZB final for UOL References Mailings Review View A abc E AaBb CcD AaBbCcDd AaBbc 3) 3 4 H2 Question 3 LNP is a company with a liability of $110 million due in 10 years. The company's only asset is $70 million held in cash. Throughout this question, assume the term structure of interest rates is flat at 5%. (a) Determine the present value of the company's liability (3 marks) (6) Without doing any calculations, briefly explain why holding all its assets in cash is problematic for LNP from an interest rate risk management perspective (4 marks) Two bonds. A and B are currently trading in the market. Bond A is a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond Bis a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond Af the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent. 1.0.0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1), cash flow growth rate g. And discount rato ris given by: Desde Using this expression, calculate the Macaulay Duration of Bond 8. (6 marks) To manage its interest rate risk exposure. LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's Nabilty are the same The change in the value of the bond portfolio in response to a small, parallel ship in the term structure matches the change in the value of the company's liability sh (United States Focus S 90 DOD F9 00 74 II F& F7 79 FYO Two bonds, A and B, are currently trading in the market. Bond Ais a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond Bis a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond A if the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent, i.e. 0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1). cash flow growth rate g, and discount rater is given by: 1 Dod T- Using this expression, calculate the Macaulay Duration of Bond B. (6 marks) To manage its interest rate risk exposure, LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's liability are the same. The change in the value of the bond portfolio in response to a small, parallel shift in the term structure matches the change in the value of the company's liability How many units of Bond A and B must the company purchase today? Briefly explain why this strategy is not static, Lo why the number of units of each bond will need to change over time. (8 marks) States) Focus ty S 000 F4 Il F5 F6 F7 F8 FO FO $ % A & *