Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer fast in 5-10 minutes please on 5 red 1 out of Mr. Ramesh Goel, erstwhile chairman of Balast Industries, is considering an investment, which

Answer fast in 5-10 minutes please

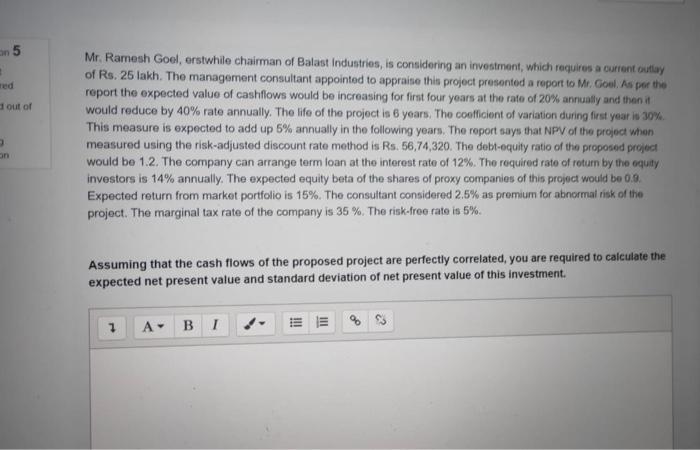

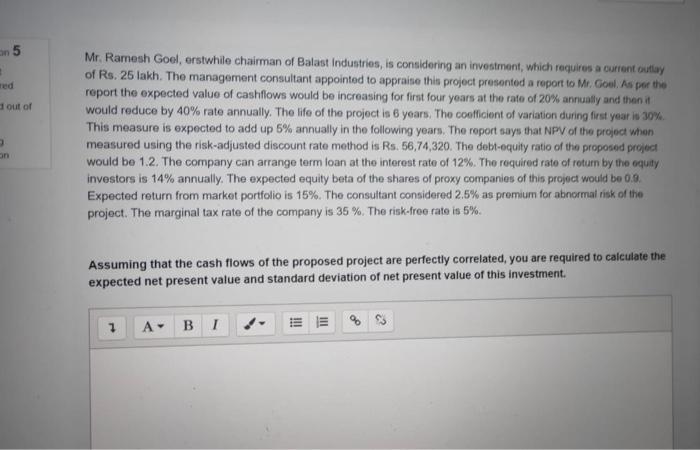

on 5 red 1 out of Mr. Ramesh Goel, erstwhile chairman of Balast Industries, is considering an investment, which requires a current outlay of Rs. 25 lakh. The management consultant appointed to appraise this project presented a report to Mr. Gool. As per the report the expected value of cashflows would be increasing for first four years at the rate of 20% annually and then it would reduce by 40% rate annually. The life of the project is 6 years. The coofficient of variation during first year is 30% This measure is expected to add up 5% annually in the following years. The report says that NPV of the project when measured using the risk-adjusted discount rate method is Rs. 56,74,320. The debt-equity ratio of the proposed project would be 1.2. The company can arrange term loan at the interest rate of 12%. The required rate of return by the equity investors is 14% annually. The expected equity beta of the shares of proxy companies of this project would be 0.9. Expected return from market portfolio is 15%. The consultant considered 2.5% as premium for abnormal risk of the project. The marginal tax rate of the company is 35%. The risk-froo rato is 5%. 3 an Assuming that the cash flows of the proposed project are perfectly correlated, you are required to calculate the expected net present value and standard deviation of net present value of this investment. A B 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started