Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer fast please full question in 2 pictures Using EXCEL attempt the following questions: Question 1: (10 marks) Ross Co., Westerfield, Inc., and Jordan Company

answer fast please full question in 2 pictures

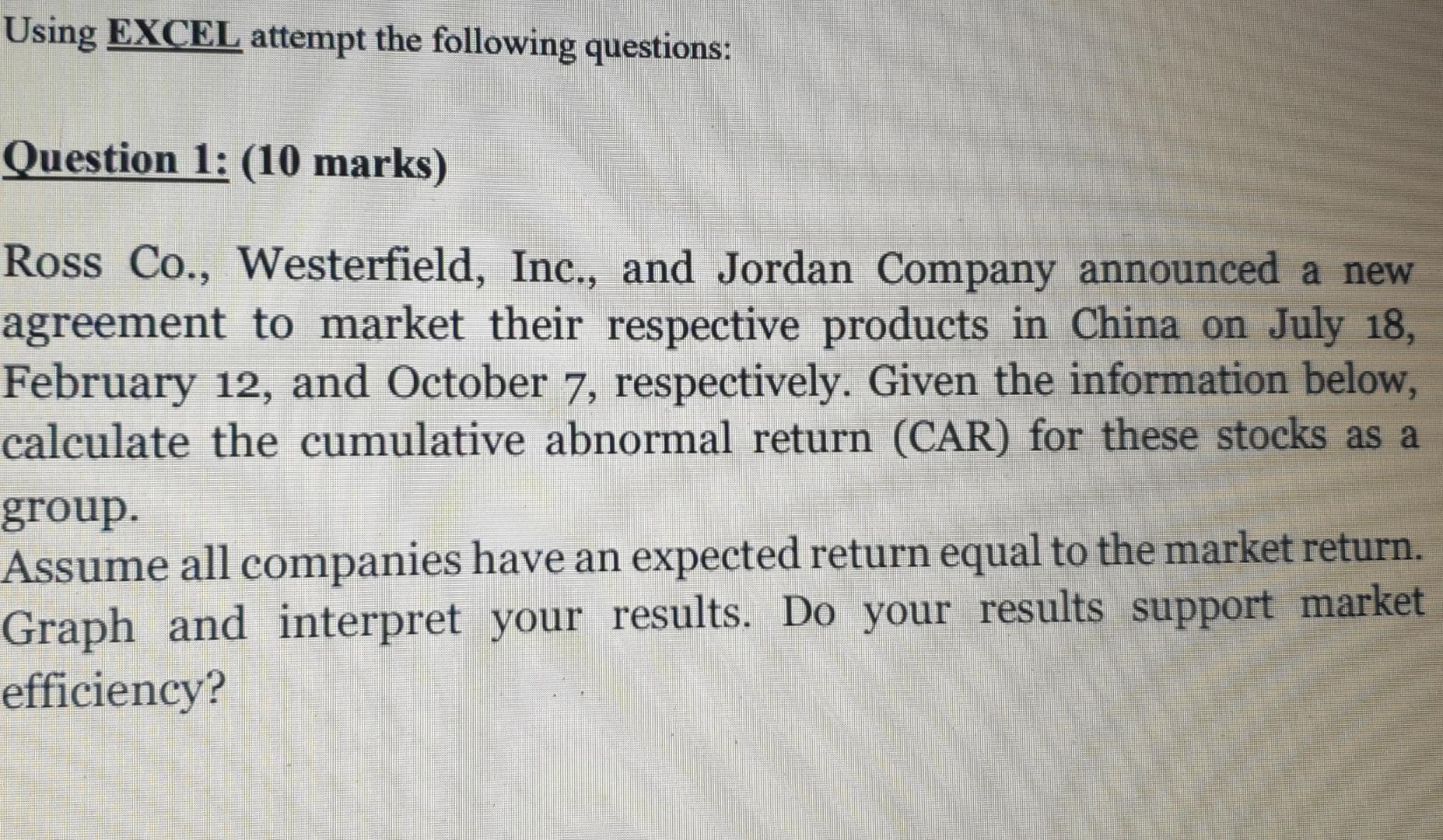

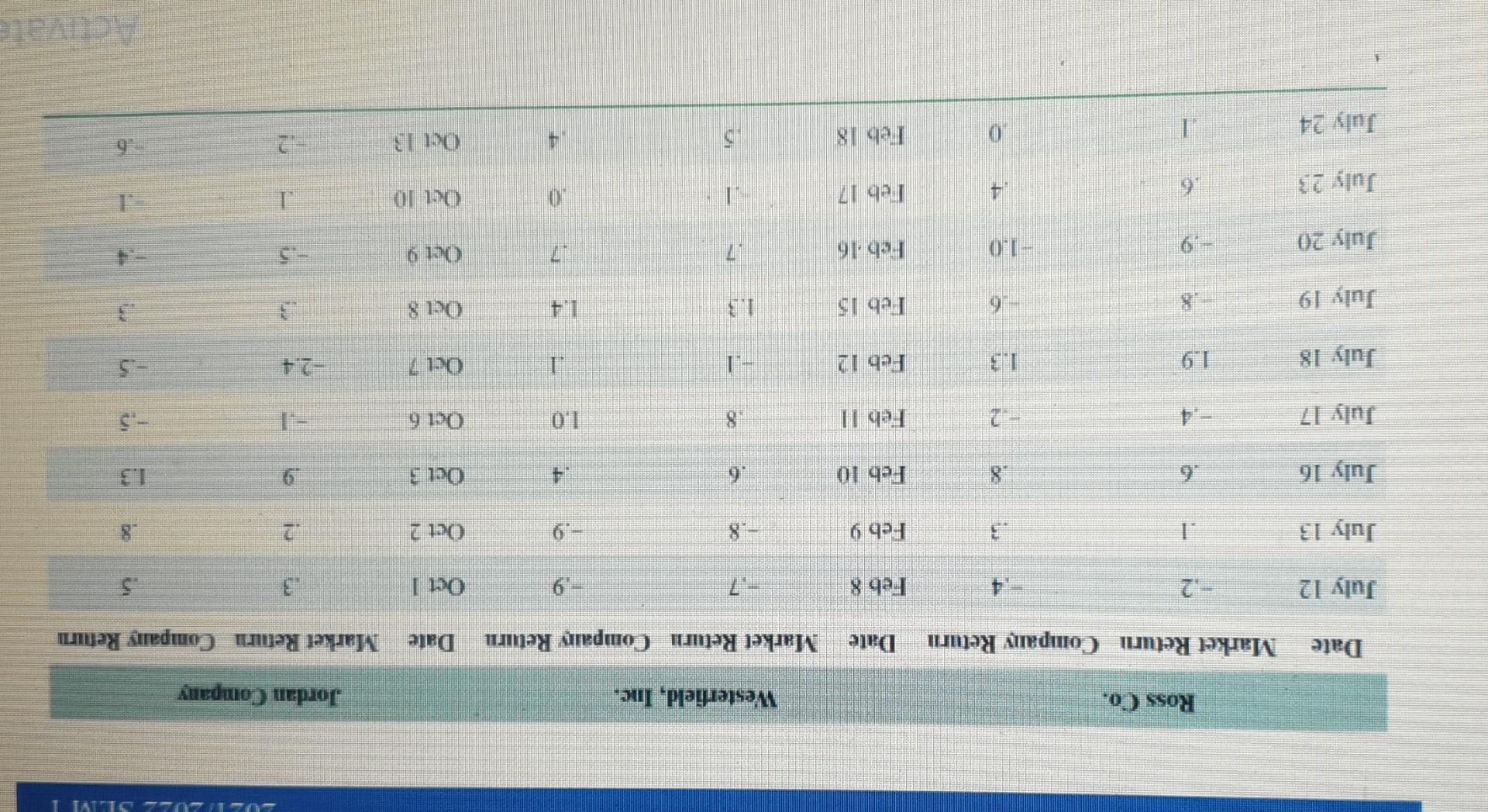

Using EXCEL attempt the following questions: Question 1: (10 marks) Ross Co., Westerfield, Inc., and Jordan Company announced a new agreement to market their respective products in China on July 18, February 12, and October 7, respectively. Given the information below, calculate the cumulative abnormal return (CAR) for these stocks as a group. Assume all companies have an expected return equal to the market return. Graph and interpret your results. Do your results support market efficiency? Ross Co. Westerfield, Inc. Jordan Company Date Market Return Company Return Market Return Company Retur Date Market Returi Company Return July 12 Feb 8 7 9 July 13 1 Feb 9 Oct 2 2 July 16 6 8 Feb 10 6 Oct 6 July 18 Feb 12 Oct 7 July 19 8 Feb 15 Oct & Oct 9 July 20 Teb 17 1 Oct 10 July 23 - Okt 13 Feb 18 2 1 Using EXCEL attempt the following questions: Question 1: (10 marks) Ross Co., Westerfield, Inc., and Jordan Company announced a new agreement to market their respective products in China on July 18, February 12, and October 7, respectively. Given the information below, calculate the cumulative abnormal return (CAR) for these stocks as a group. Assume all companies have an expected return equal to the market return. Graph and interpret your results. Do your results support market efficiency? Ross Co. Westerfield, Inc. Jordan Company Date Market Return Company Return Market Return Company Retur Date Market Returi Company Return July 12 Feb 8 7 9 July 13 1 Feb 9 Oct 2 2 July 16 6 8 Feb 10 6 Oct 6 July 18 Feb 12 Oct 7 July 19 8 Feb 15 Oct & Oct 9 July 20 Teb 17 1 Oct 10 July 23 - Okt 13 Feb 18 2 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started