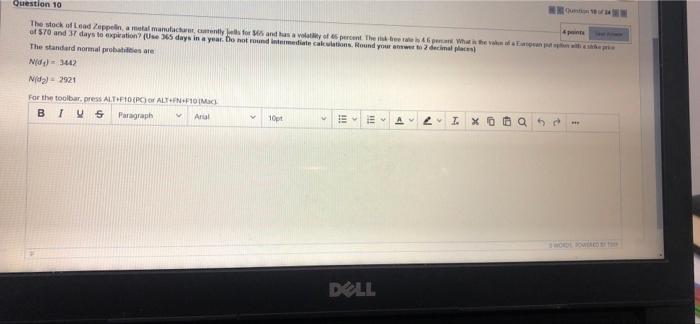

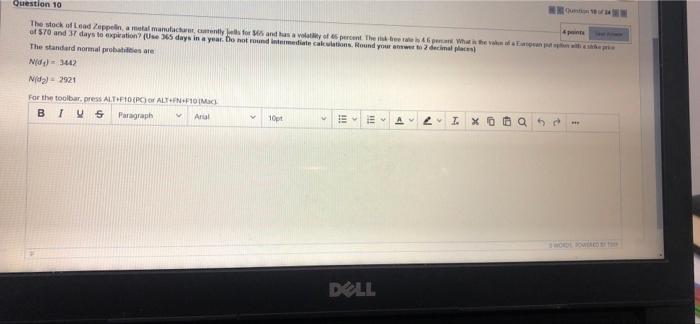

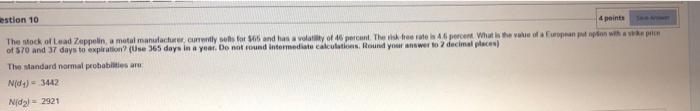

Question 10 The stock of Lead Zeppelin, a metal manufacturer, cuently jells for $65 and has a volatility of 65 percent The risk be rate is 46 pent What is the value of a Espanpop will of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your awer decimal places) points The standard normal probabilities are N(d) 3442 N() 2921 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac) BIVS Paragraph Arial 10pt M EE 52 DELL estion 10 4 points JAW Awar The stock of Lead Zeppelin, a motal manufacturer, currently sells for $65 and has a volatility of 46 percent. The risk-free rate is 4.6 percent What is the value of a European put option with a pr of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places) The standard normal probabilities are N(d) 3442 Nid) = 2921 The stock of Lead Zeppelin, a metal manufacturer, currently sells for $65 and has a volatility of 46 percent. The risk free rate is 46 percent What is the value of a European popion with a d of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to a fecimal places) price The standard normal probabilities are N(d) 3442 N() = 2921 ALT10/BCLO ALTHEN+E10(Mar 1 2 3 4 5 6 70 110 12 13 90 10 A Moving to another question will save this response. Question 10 The stock of Lead Zeppelin, a metal manufacturer, currently sells for $65 and h of $70 and 37 days to expiration? (Use 365 days in a year. Do not round inte The standard normal probabilities are: N(d1) = .3442 N(d2) = 2921 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt 12 13 17 18 24 Question 10 of 24 4 points tly sells for $65 and has a volatility of 46 percent. The risk-free rate is 4.6 percent. What is the value of a European put option with a strike price r. Do not round intermediate calculations. Round your answer to 2 decimal places) *** A 10pt 2I XOQ C !!! 3 !!! > Moving to another question will save this response. Question Question 10 4 points The stock of Lead Zeppelin, a metal manufacturer, currently sells for $65 and has a volatility of 46 percent. The risk-free rate is 4.6 percent. What is the value of a European put option with a s of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places) The standard normal probabilities are. N(d) 3442 N() 2921 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10(Mac) BIUS Paragraph Arial 10pt I *** 27 s 111 > !!!

N X