Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer fastly please answer (a) Explain how interest rate risk can affect a banks' net income and net worth. ( 5 marks) (b) Critically discuss

answer fastly please

answer

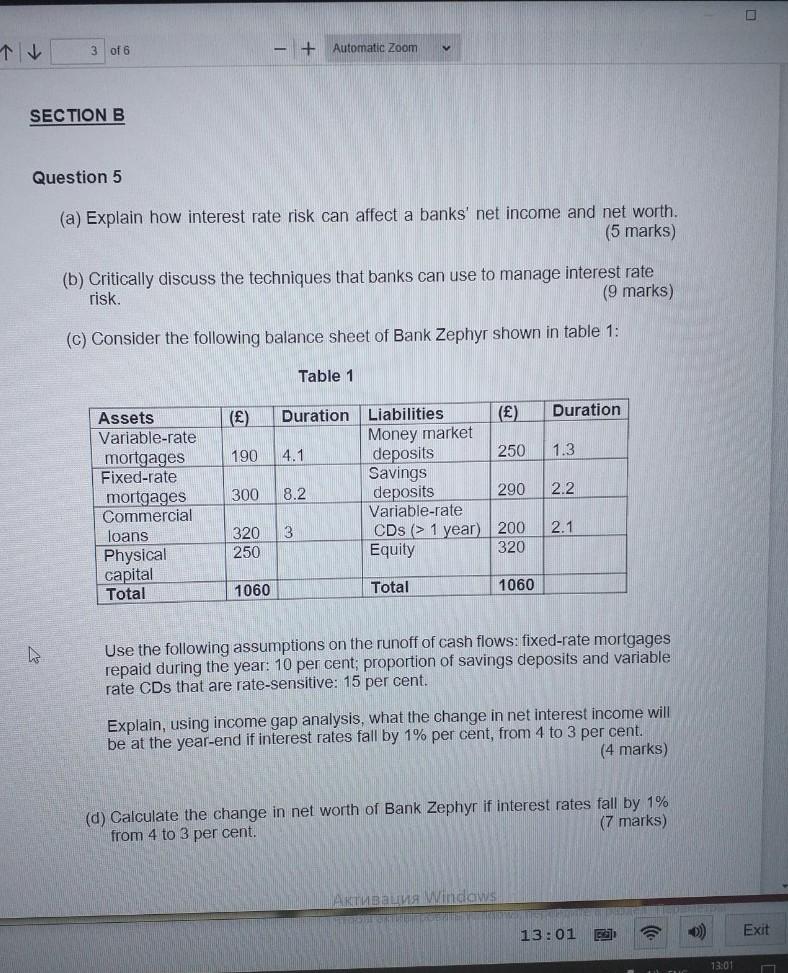

(a) Explain how interest rate risk can affect a banks' net income and net worth. ( 5 marks) (b) Critically discuss the techniques that banks can use to manage interest rate risk. ( 9 marks) (c) Consider the following balance sheet of Bank Zephyr shown in table 1: Table 1 Use the following assumptions on the runoff of cash flows: fixed-rate mortgages repaid during the year: 10 per cent; proportion of savings deposits and variable rate CDs that are rate-sensitive: 15 per cent. Explain, using income gap analysis, what the change in net interest income will be at the year-end if interest rates fall by 1% per cent, from 4 to 3 per cent. (4 marks) (d) Calculate the change in net worth of Bank Zephyr if interest rates fall by 1% from 4 to 3 per cent. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started