Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer follow question . Answer within 25 minutes . I will give you 3 upvote if answer is correct. Do fast Comparative balance sheets for

Answer follow question .Answer within 25 minutes . I will give you 3 upvote if answer is correct. Do fast

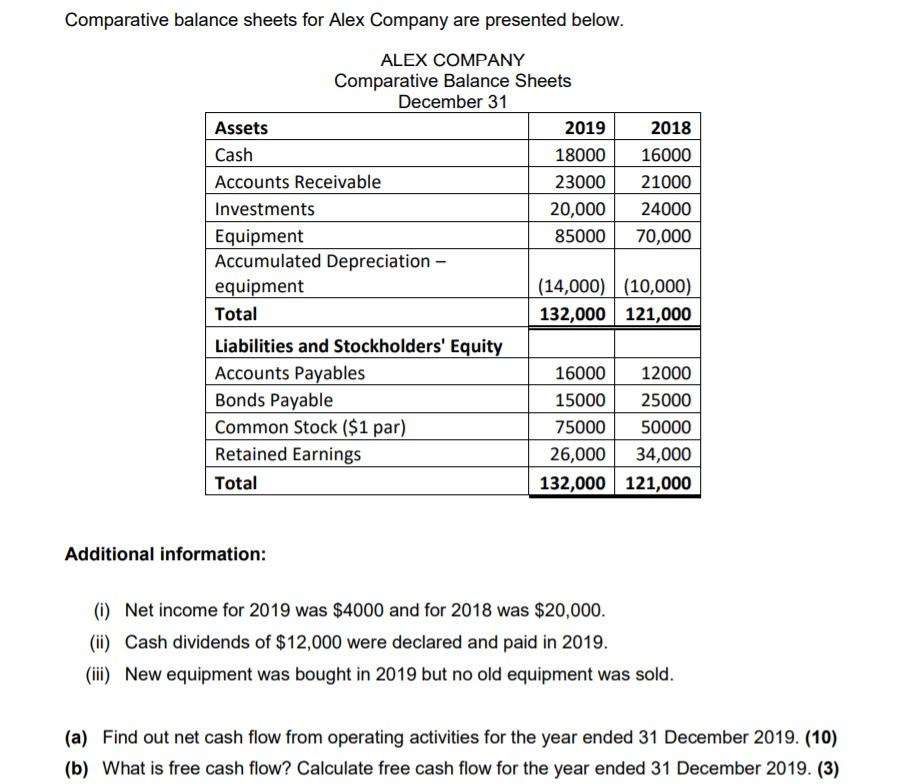

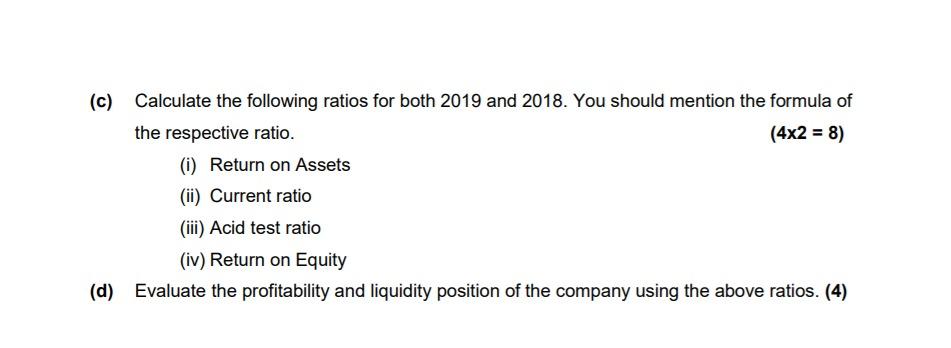

Comparative balance sheets for Alex Company are presented below. ALEX COMPANY Comparative Balance Sheets December 31 Assets 2019 2018 Cash 18000 16000 Accounts Receivable 23000 21000 Investments 20,000 24000 Equipment 85000 70,000 Accumulated Depreciation - equipment (14,000) (10,000) Total 132,000 121,000 Liabilities and Stockholders' Equity Accounts Payables 16000 12000 Bonds Payable 15000 25000 Common Stock ($1 par) 75000 50000 Retained Earnings 26,000 34,000 Total 132,000 121,000 Additional information: (i) Net income for 2019 was $4000 and for 2018 was $20,000. (ii) Cash dividends of $12,000 were declared and paid in 2019. (ii) New equipment was bought in 2019 but no old equipment was sold. (a) Find out net cash flow from operating activities for the year ended 31 December 2019. (10) (b) What is free cash flow? Calculate free cash flow for the year ended 31 December 2019. (3) (c) Calculate the following ratios for both 2019 and 2018. You should mention the formula of the respective ratio. (4x2 = 8) (i) Return on Assets (ii) Current ratio (iii) Acid test ratio (iv) Return on Equity (d) Evaluate the profitability and liquidity position of the company using the above ratios. (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started