Continuing Payroll Project: Prevosti Farms and Sugarhouse - EERF (Static) Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees

Continuing Payroll Project: Prevosti Farms and Sugarhouse - EERF (Static)

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff:

| Employee Number | Name and Address | Payroll information |

| A-Mille | Thomas Millen | Hire Date: 2-1-2019 |

| 1022 Forest School Rd | DOB: 12-16-1982 | |

| Woodstock, VT 05001 | Position: Production Manager | |

| 802-478-5055 | PT/FT: FT, exempt | |

| SSN: 031-11-3456 | No. of Exemptions: 4 | |

| 401(k) deduction: 3% | M/S: M | |

| Pay Rate: $35,000/year | ||

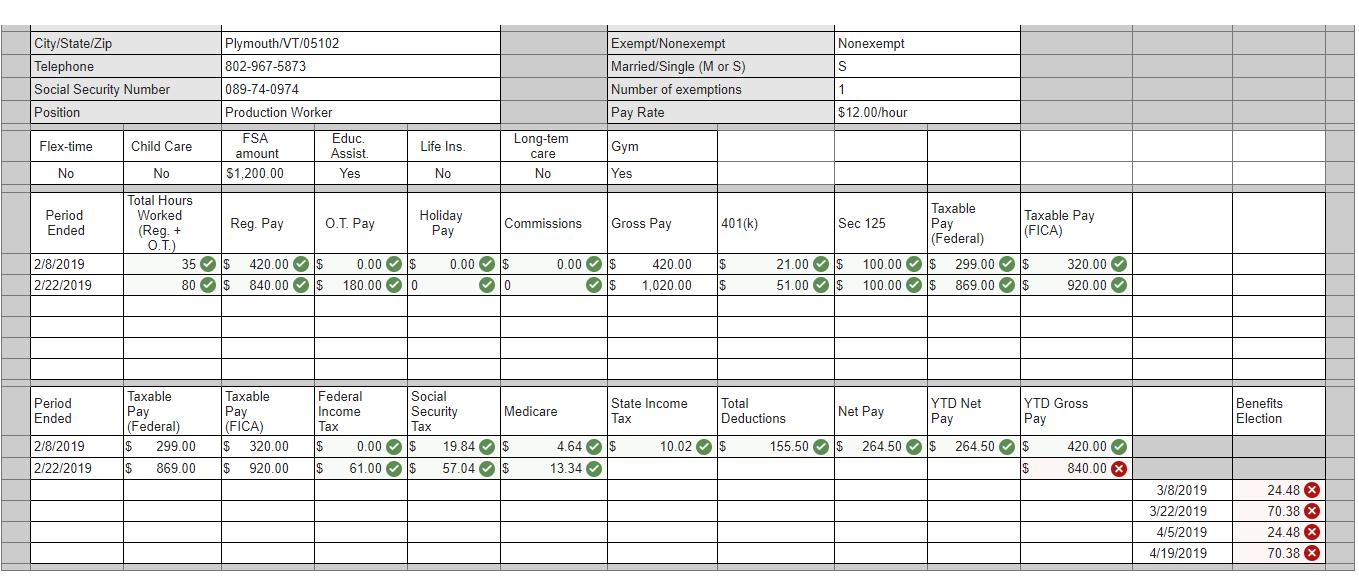

| A-Towle | Avery Towle | Hire Date: 2-1-2019 |

| 4011 Route 100 | DOB: 7-14-1991 | |

| Plymouth, VT 05102 | Position: Production Worker | |

| 802-967-5873 | PT/FT: FT, nonexempt | |

| SSN: 089-74-0974 | No. of Exemptions: 1 | |

| 401(k) deduction: 5% | M/S: S | |

| Pay Rate: $12.00/hour | ||

| A-Long | Charlie Long | Hire Date: 2-1-2019 |

| 242 Benedict Road | DOB: 3-16-1987 | |

| S. Woodstock, VT 05002 | Position: Production Worker | |

| 802-429-3846 | PT/FT: FT, nonexempt | |

| SSN: 056-23-4593 | No. of Exemptions: 2 | |

| 401(k) deduction: 2% | M/S: M | |

| Pay Rate: $12.50/hour | ||

| B-Shang | Mary Shangraw | Hire Date: 2-1-2019 |

| 1901 Main Street #2 | DOB: 8-20-1994 | |

| Bridgewater, VT 05520 | Position: Administrative Assistant | |

| 802-575-5423 | PT/FT: PT, nonexempt | |

| SSN: 075-28-8945 | No. of Exemptions: 1 | |

| 401(k) deduction: 3% | M/S: S | |

| Pay Rate: $11.00/hour | ||

| B-Lewis | Kristen Lewis | Hire Date: 2-1-2019 |

| 840 Daily Hollow Road | DOB: 4-6-1960 | |

| Bridgewater, VT 05523 | Position: Office Manager | |

| 802-390-5572 | PT/FT: FT, exempt | |

| SSN: 076-39-5673 | No. of Exemptions: 3 | |

| 401(k) deduction: 4% | M/S: M | |

| Pay Rate: $32,000/year | ||

| B-Schwa | Joel Schwartz | Hire Date: 2-1-2019 |

| 55 Maple Farm Way | DOB: 5-23-1985 | |

| Woodstock, VT 05534 | Position: Sales | |

| 802-463-9985 | PT/FT: FT, exempt | |

| SSN: 021-34-9876 | No. of Exemptions: 2 | |

| 401(k) deduction: 5% | M/S: M | |

| Pay Rate: $24,000/year base plus 3% Commission on Sales | ||

| B-Prevo | Toni Prevosti | Hire Date: 2-1-2019 |

| 10520 Cox Hill Road | DOB: 9-18-1967 | |

| Bridgewater, VT 05521 | Position: Owner/President | |

| 802-673-2636 | PT/FT: FT, exempt | |

| SSN: 055-22-0443 | No. of Exemptions: 5 | |

| 401(k) deduction: 6% | M/S: M | |

| Pay Rate: $45,000/year | ||

| B-Student | Student Success | Hire Date: 2-1-2019 |

| 1644 Smitten Road | DOB: 1-1-1991 | |

| Woodstock, VT 05001 | Position: Accounting clerk | |

| (555)-555-5555 | PT/FT: FT, nonexempt | |

| SSN: 555-55-5555 | No. of Exemptions: 2 | |

| 401(k) deduction: 2% | M/S: S | |

| Pay Rate: $18.68/hour |

The departments are as follows:

Department A: Agricultural Workers

Department B: Office Workers

Initial pre-tax deductions for each employee are as follows:

| Name | Deduction |

| Thomas Millen | Insurance: $155/paycheck |

| 401(k): 3% of gross pay | |

| Marital Status: Married | |

| Avery Towle | Insurance: $100/paycheck |

| 401(k): 5% of gross pay | |

| Marital Status: Single | |

| Charlie Long | Insurance: $155/paycheck |

| 401(k): 2% of gross pay | |

| Marital Status: Married | |

| Mary Shangraw | Insurance: $100/paycheck |

| 401(k): 3% of gross pay | |

| Marital Status: Single | |

| Kristen Lewis | Insurance: $155/paycheck |

| 401(k): 4% of gross pay | |

| Marital Status: Married | |

| Joel Schwartz | Insurance: $100/paycheck |

| 401(k): 5% of gross pay | |

| Marital Status: Married | |

| Toni Prevosti | Insurance: $155/paycheck |

| 401(k): 6% of gross pay | |

| Marital Status: Married | |

| Student Success | Insurance: $100/paycheck |

| 401(k): 2% of gross pay | |

| Marital Status: Single | |

The first day of work for Prevosti Farms and Sugarhouse for all employees is February 4, 2019. February 8 is the end of the first pay period for Prevosti Farms and Sugarhouse and includes work completed during the week of February 4-8. Using the payroll register, compute the employee gross pay and net pay using 35 hours as the standard workweek for all employees except Mary Shangraw, who works 20 hours per week and receives overtime for any time worked past that point. The other hourly employees receive overtime pay when they work more than 35 hours in one week. Joel Schwartz has made $5,000 in case sales at a 3 percent commission rate during this pay period. Remember that the employees are paid biweekly. Note that the first pay period comprises only one week of work, but the pay frequency for federal income tax purposes is biweekly. Federal withholding tax should be computed using the wage-bracket tables in Appendix C. State withholding tax for Vermont is computed at 3.35 percent of taxable wages (i.e., gross pay less pre-tax deductions).The same deductions are allowed for state as for federal.

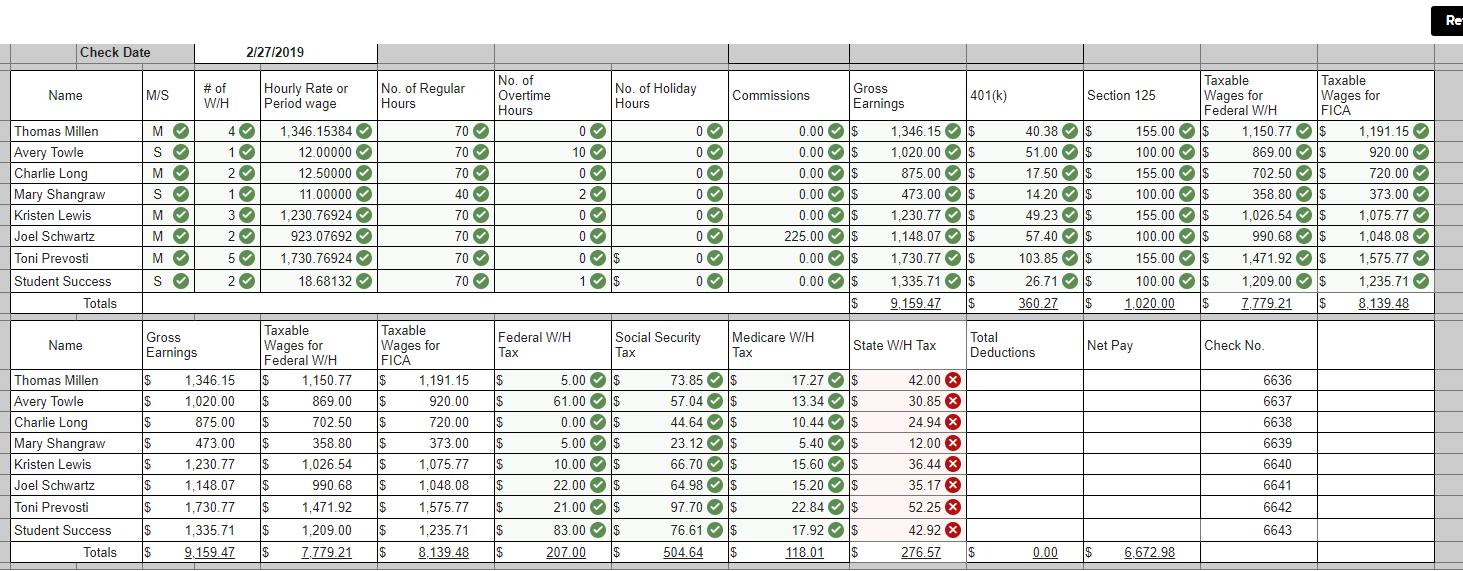

February 22, 2019, is the end of the final pay period for the month. Schwartz has sold $7,500 of product during this pay period at a 3 percent commission. Pay will be disbursed on February 27, 2019, and check numbers will continue from prior payroll.

The hours for the nonexempt employees are as follows:

| Name | Hourly rate | Hours worked 2/4–2/8 | ||||

| Towle | $ | 12.00000 | 35 hours | |||

| Long | $ | 12.50000 | 40 hours | |||

| Shangraw | $ | 11.00000 | 21 hours | |||

| Success (You) | $ | 18.68132 | 35 hours | |||

| Name | Hourly rate | Hours worked | ||||

| Towle | $ | 12.00000 | 80 hours | |||

| Long | $ | 12.50000 | 70 hours | |||

| Shangraw | $ | 11.00000 | 42 hours | |||

| Success (You) | $ | 18.68132 | 71 hours | |||

Required:

Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. The amount per period should be included in the record. As an example, if an employee elected to contribute $1,300 to his or her FSA, the period payroll deduction would be $1,300/26, or $50. Ensure to input an hourly rate for each employee (including those that are salaried) that is rounded to 5 decimal places.

Benefit-related payroll deductions will take effect on the first pay period of March.

| Employee | Flex-Time | Child Care Assistance (under $5,000 annually) | FSA (annual) | Educational Assistance ($4,000 annually) | Life Insurance (at 1% of annual salary value) | Long-Term Care Insurance ($15 per period) | Gym Membership ($15 per month) | |

| Millen | Yes | Yes | $ | 500.00 | No | Yes | No | Yes |

| Towle | No | No | $ | 1,200.00 | Yes | No | No | Yes |

| Long | Yes | Yes | $ | 700.00 | Yes | Yes | No | Yes |

| Shangraw | Yes | No | $ | 200.00 | No | Yes | No | No |

| Lewis | No | No | $ | 1,600.00 | No | Yes | Yes | No |

| Schwartz | No | No | $ | 450.00 | Yes | Yes | No | Yes |

| Prevosti | Yes | No | $ | 900.00 | No | Yes | No | Yes |

| Student | No | No | $ | 300.00 | Yes | No | No | Yes |

Check Date 2/27/2019 No. of # of Name Hourly Rate or M/S W/H Period wage No. of Regular Hours Overtime No. of Holiday Gross Commissions 401(k) Section 125 Hours Hours Earnings Taxable Wages for Federal W/H Taxable Wages for FICA Thomas Millen M 4 1,346.15384 70 0 0 0.00 $ 1,346.15 $ Avery Towle S 1 12.00000 70 10 0 0.00 $ Charlie Long M 2 12.50000 70 0 0 0.00 $ Mary Shangraw S 1 11.00000 40 2 0 Kristen Lewis M 3 1,230.76924 70 0 0 Joel Schwartz M 2 923.07692 70 0 0 0.00 $ 0.00 $ 225.00 $ 1,020.00 $ 875.00 $ 473.00 $ 1,230.77 $ 40.38 $ 51.00 $ 17.50 1$ 14.20 $ 49.23 $ 1,148.07 Toni Prevosti M 5 1,730.76924 70 0 $ 0 0.00 $ 1,730.77 $ Student Success S 2 18.68132 70 1 0.00 $ 1,335.71 Totals $ 9.159.47 57.40 $ 103.85 $ 26.71 $ 360.27 $ 155.00 $ 100.00 $ 155.00 $ 100.00 $ 155.00 $ 100.00 $ 155.00 $ 100.00 $ 1,020.00 $ 1,150.77 $ 869.00 $ 702.50 $ 358.80 $ 1,026.54 $ 990.68 $ 1,471.92 1,209.00 $ 7.779.21 $ 1,191.15 920.00 720.00 373.00 1,075.77 1,048.08 $ 1,575.77 1,235.71 8.139.48 Name Gross Earnings Taxable Wages for Taxable Wages for Federal W/H Tax Social Security Tax Medicare W/H Tax State W/H Tax Total Deductions Net Pay Check No. Federal W/H FICA Thomas Millen 1,346.15 $ 1,150.77 $ 1,191.15 5.00 $ 73.85 $ 17.27 42.00 X 6636 Avery Towle $ 1,020.00 $ 869.00 $ 920.00 $ 61.00 $ 57.04 $ 13.34 $ 30.85 x 6637 Charlie Long $ 875.00 $ Mary Shangraw $ 473.00 $ Kristen Lewis 1,230.77 $ Joel Schwartz $ 1,148.07 $ Toni Prevosti $ 1,730.77 $ 702.50 358.80 1,026.54 $ 990.68 $ 1,471.92 $ $ 720.00 $ 0.00 $ 44.64 $ 10.44 $ 24.94 x 6638 $ 373.00 $ 5.00 $ 23.12 $ 5.40 $ 12.00 x 6639 Student Success $ 1,335.71 $ Totals 9.159.47 $ 1,209.00 $ 7.779.21 $ 1,075.77 1,048.08 $ 1,575.77 $ 1,235.71 $ 8.139.48 10.00 $ 66.70 $ 15.60 $ 36.44 x 6640 22.00 $ 64.98 $ 15.20 $ 35.17 x 6641 21.00 83.00 $ $ 97.70 $ 207.00 76.61 504.64 $ $ 22.84 17.92 $ 118.01 $ $ 52.25 x 6642 42.92 276.57 6643 $ 0.00 $ 6.672.98 Re

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To provide you with a detailed calculation in table form Ill illustrate the calculations for each employee for one pay period eg 282019 We will calcul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started